|

| By Gavin Magor |

Happy Super Bowl Monday.

Whether Taylor Swift and her Chiefs have repeated with another Lombardi Trophy, or the 49ers have claimed their record-tying sixth Super Bowl in franchise history, history has been made at this point.

And if you are a fan of one of those teams, let me be among the first to congratulate you.

It’s a day many Americans believe should be a holiday, but it’s also a very important day this particular week in the markets because we’ve got some major earnings set to be released, as well as crucial economic data reports.

Let me start with the fact that I see many investors interpreting earnings incorrectly.

There is so much time that goes into financial modeling. I can attest to that because I see how our Weiss Stock Ratings change in correlation to this … but there is one major thing investors seem to overlook: tone.

Sure, I believe that a stock’s Weiss Investment Rating (which has a massive bias toward safety) is very important. But I also believe tone of management and listening to earnings calls is equally important.

We all live busy lives, but for the stocks you are truly passionate about, perhaps those cornerstone stocks in your portfolio, be sure to listen to the earnings call. Listening to management will go a long way.

The numbers are also very important. But our Weiss Investment Stock Ratings tend to do most of the heavy lifting for you.

And that is precisely why I want to use today’s Weiss Ratings Daily to cover some of our recent upgrades, many of which have changed due to recently reported earnings.

We Do the Earnings Heavy Lifting for You

Our models are running around the clock. And the first place investors should go to for their earnings updates is the Weiss Ratings.

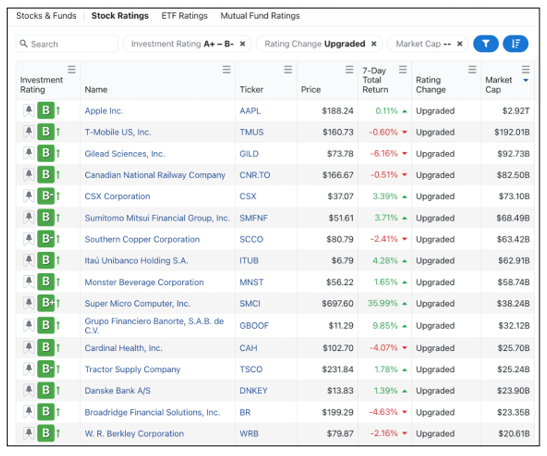

After a few easy filters of Investment Rating “A+” to “B-,” Ratings Change “Upgraded” and sorted by “Market Cap,” here’s what populated:

Whilst there were no “A” upgrades as of late, there were some very notable other names on this list.

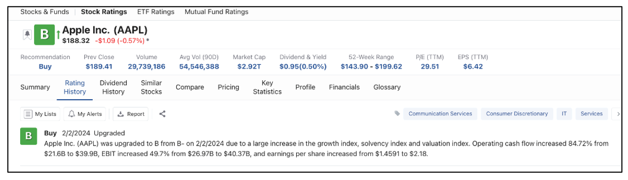

Apple (AAPL) beat on both top and bottom line and was upgraded from a “B” to “B+.” Operating cash flow increased 84%, EBIT increased 49% and EPS increased from $1.46 to $2.18 on a quarter-over-quarter basis.

With the release of the Apple Vision Pro, there is an even newer and greater sense of optimism for the Cupertino giant, which just never seems to miss when it comes to new flashy tech products. If you don’t already own Apple shares, perhaps now is the time to look.

In addition, there are other names on this list that you should take a look at. One of the other top names on this list, Monster Beverage Corporation (MNST),is a name that certainly is in less headlines … but its returns have been stellar over the past decade.

Over the past 10 years, shares are up around a caffeinated buzzing 399%! And very interestingly, since 2005, it is one of the best performing stocks on the entire stock market, a fact many investors may not realize.

Be sure to explore all of our recent upgrades.

But be aware of downgrades too, especially for stocks you currently have in your portfolio.

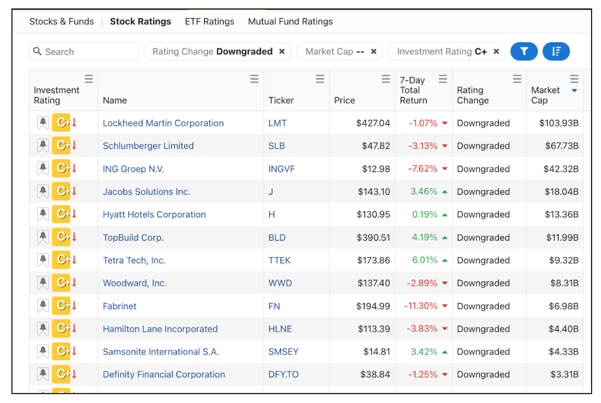

Here are some of our recent downgrades, using the same criteria for filters as above, except we’re looking at names that recently dipped to “C+” from “Buy” territory:

The top name on this list, Lockheed Martin (LMT), did actually beat on EPS and revenue estimates. But our modeling still did not like the numbers enough to keep it within our “Buy” rating territory.

Its fourth quarter earnings were released on Jan. 23. And its rating was subsequently changed on Feb. 2 due to index changes, operating cash flow declining and total capital declining 4.47% from $26.6 billion to $25.47 billion.

If you own LMT, or any of these stocks on this list, be sure to assess this new data.

Here at Weiss Ratings, we are always on top of recent financial changes. Things in the financial world can change just as quickly as ocean seas.

Other major things investors need to remember is that many stocks will be heavily impacted by the Fed’s interest rate decisions this year … and when “cutting” will start.

This week, we’ll get consumer price index (CPI) numbers tomorrow and producer price index (PPI) numbers on Friday … which will be very important numbers for the Fed to gauge that interest rate decision.

Be on the lookout for those. But most importantly, be on the lookout for our investment rating changes.

I’ll see you again next week.

Cheers!

Gavin Magor

P.S. Given how fast new technologies — especially those involving AI — are changing, we should see plenty of ratings movements for major tech companies. There’s something else going on though that would move the needle even more … a $200 trillion “Superproject.” Click here for the full scoop.