Will the Federal Reserve pivot when it comes to raising interest rates?

That’s the big question influencing price action, as indices continue to swing wildly one week before the U.S. midterm elections.

Fortunately, there are ways to avoid getting market whiplash. In this segment, I interview Research Analyst Sam Blumenfeld about sectors with "inelastic demand" and two exchange-traded funds that are outperforming the S&P 500 Index.

You can watch the video here or continue reading for the full transcript.

JB (narration): With the rapid ups and downs as of late, it’s easy to get market whiplash.

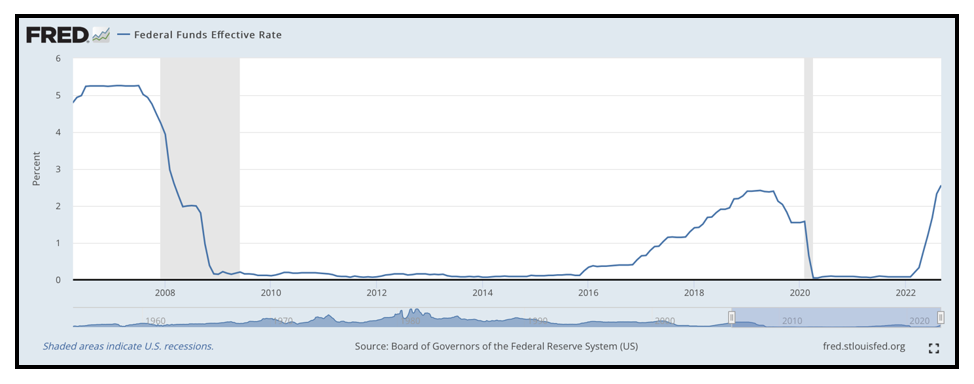

Sam Blumenfeld: The market price action right now is heavily dominated by sentiment surrounding the Federal Reserve, and expectations surrounding whether the U.S. central bank is going to stop hiking rates and continue its aggressive rate hike cycle.

JB: Sam, it’s a question of will the Fed pivot, or won’t it?

SB: Absolutely. You have the United Nations calling for advanced economies to stop hiking rates, while the Fed has come out and said it is not going to until it sees meaningful progress with inflation.

Whether it results in increasing unemployment or stocks falling, the Fed has signaled that its most important priority right now is tackling inflation.

JB (narration): Research Analyst Sam Blumenfeld is focused on investments that are able to endure wild swings.

He works closely on Sean Brodrick’s trading services, Wealth Megatrends and Supercycle Investor.

SB: If you have the Fed continue hiking rates, it will likely drive the U.S. economy into a recession.

Source: FRED.

Click here to see full-sized image.

And in the event of a recession, it helps to position in sectors that have relatively inelastic demand because when consumers are left price-sensitive for goods, demand will stay resilient even when economic conditions worsen.

JB: Overall, investors can find opportunities right now.

SB: Sure. Two sectors that will outperform, or continue outperforming, are consumer staples and healthcare, both of which are down less than half of what the S&P 500 is year to date, which is about 10%.

JB (narration): Sam says there’s anETF in the consumer staples space to consider.

SB: It’s the Consumer Staples Select Sector SPDR Fund (XLP), which holds consumer staples companies by their market cap weighting.

Click here to see full-sized image.

JB (narration): It holds General Mills (GIS), which has a Weiss Safety Rating of “B+,” making it a recommended “Buy.”

In Wealth Megatrends, investors saw a 17% gain in their position with GIS, over just four months.

SB: So, when you have an economy that could be worsening, then it helps to position yourself with companies that produce goods that won’t see their demand falter when economic conditions are more uncertain.

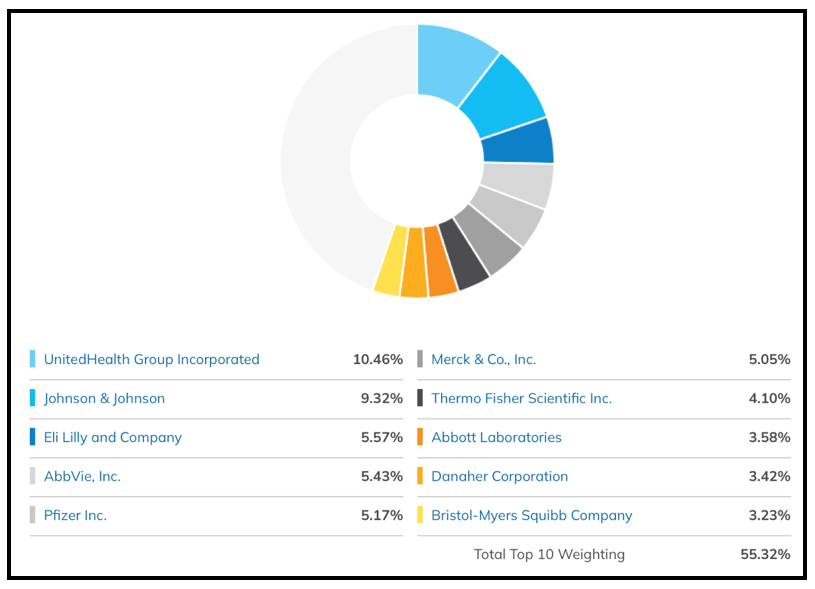

JB (narration): Here’s an ETF in the healthcare space to consider.

SB: It’s the Healthcare Select Sector SPDR Fund (XLV), which offers healthcare exposure through the S&P 500.

Click here to see full-sized image.

JB (narration): If you’re looking for individual stocks in that sector, you can use the Weiss website to guide you.

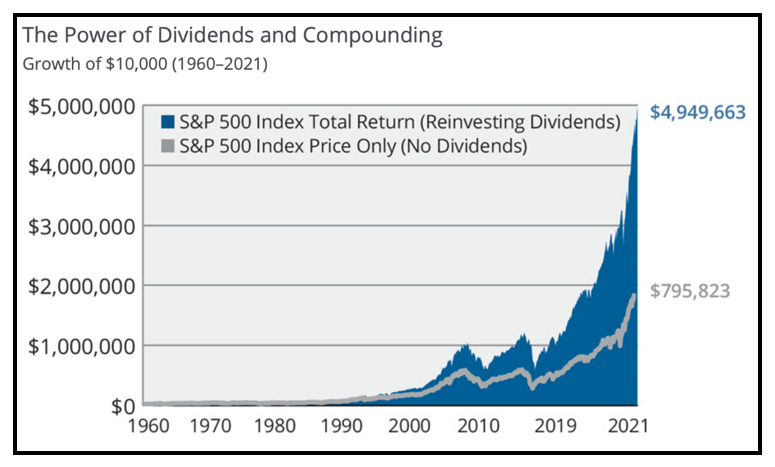

SB: You can drill down and look into the ETF’s top holdings, and from those top holdings you can sort them by potential dividend yield or market cap weighting.

Dividend-payers and dividend-raisers have outperformed over the long term.

When you have a company that’s paying dividends, it’s almost always generating stable cash flows to reward investors.

Source: Hartford Funds.

Click here to see full-sized image.

JB (narration): Rate hikes or not,you can expect market action to intensify after the mid-term elections.

Historically, mid-term election cycles are very bullish for the stock market.

Take a look at the average returns of the S&P 500, over decades:

• Six months after the midterms, the average return is 16.1%.

• One year later, it’s 18.6%.

• And two years later, the average return is about 33.7%.

However, Sam says in this climate nothing is a given.

SB: Historically, a split government has resulted in the best performance over the long term. But obviously, the macroeconomic conditions under those rallies were different, and this is a different period in history.

Past performance is not necessarily indicative of future results.

JB (narration): Proving that time in the market beats timing the market.

JB: Research Analyst Sam Blumenfeld, it’s always a pleasure to speak with you. Thank you so much for your time and insights today.

SB: Thanks, Jessica.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings