|

| By Nilus Mattive |

Earlier this summer, Joe Biden put forth a proposal that would have the federal government cap annual rent increases at 5%.

And I was disappointed to hear Kamala Harris bring that same idea into her larger plan on the topic of home affordability.

Because, as I’ve seen firsthand, rent control simply doesn’t work as well as its supporters think.

What’s worse, it could actually end up creating a bigger affordability issue. It also punishes investors for taking on the risk of operating rental units in the first place.

More on that second point in a minute.

First, lest you label me a heartless capitalist …

How I Got Here

I’m familiar with the plight of poor families who can barely afford to keep up with housing costs.

In fact, my mom’s parents rented the same small two-bedroom apartment in downtown Wilkes-Barre, Pennsylvania, for roughly 70 years.

My grandfather grew up in such poverty that he went to work in the coal mines instead of going to high school. After he got married, he did odd jobs for his landlord — everything from fixing cars to performing electrical and plumbing work.

Rent went up anyway.

Still, I never heard him complain. He knew prices for things go up over time.

He also openly talked about times in the past when he might have been able to buy a house in the neighborhood but just didn’t want to take the risk … especially since he didn’t like the idea of borrowing a large sum from a bank.

My grandparents were Depression-era people, conservative with what little money they had. And they never made the leap to home ownership.

They both died in that small apartment, with not very much to their names.

Meanwhile, I was moving into Manhattan and looking for an apartment of my own.

I had a job with Standard & Poor’s. And although I was making a good salary by Eastern Pennsylvania standards, it was just enough for a decent life in New York City.

My one-bedroom apartment just off Wall Street was available at the market rate of $2,300, with no rent protection going forward. Keep in mind, this was roughly 25 years ago!

Meanwhile, my boss — perhaps 30 years older than me — lived a couple neighborhoods away. He obviously made a lot more than me. He was married, and his wife had a good job, too.

But they’d been in New York for a long time. Their apartment — twice the size of mine — was under rent control.

I don’t know exactly how much he paid, but I would guess it was a third of my rent for double the square footage. He also owned a vacation home outside the city.

So, here we had the newer, lower-income worker paying a fresh market rate and the older, higher-income worker paying a wildly discounted rent.

But that’s still just the beginning

I knew other rent-controlled people who were subletting their apartments — or even charging large amounts of money to let someone move into vacant bedrooms — while the actual property owners received nothing.

I even had a friend who lived in another state almost all year but maintained a rent-controlled NYC apartment as a little getaway (lying about his residency in the process).

This is just a little taste of what I saw, but the big picture was pretty easy to see — rent control largely rewarded people who got there first, regardless of their financial status.

It was easily abused … and it did very little to help newcomers or anyone looking to move from one place to another.

Now, there is no doubt that many landlords do everything in their power to screw over their tenants, especially in a place like New York City.

But from what I saw, rent control didn’t help that situation. It merely discouraged building owners from improving their rent-controlled properties any more than was necessary.

After all, why would an investor shovel money into something that can only deliver a fixed return?

And what if that investor’s own operating costs — anything from needed improvements to tax assessments — increase at a faster rate than rent can go up?

But you don’t have to accept my personal experience or anecdotal evidence.

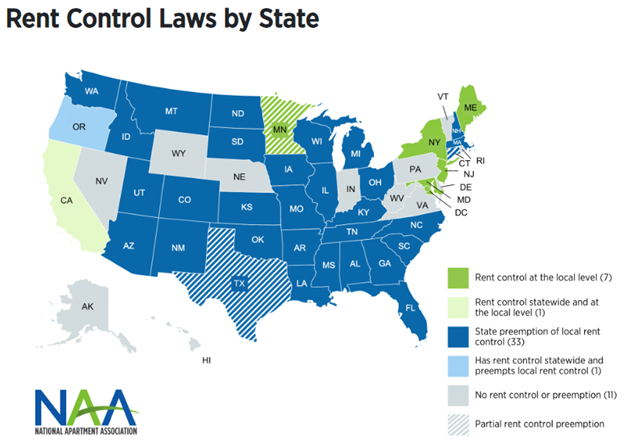

The academic research is pretty decisive that rent control doesn’t work, whether you’re talking about New York or Paris.

A Supply & Demand Problem

An article from Reason highlighted one good example several years ago:

“Brookings Institute Associate Professor of Economics Rebecca Diamond did a recent review of the literature on rent control, finding that ‘Rent control appears to help affordability in the short run for current tenants.

But in the long run decreases affordability, fuels gentrification and creates negative externalities on the surrounding neighborhood.’

The reason is simple and boils down to the law of supply and demand.

While some of the people renting may benefit from rent control by removing some of their risk, it also gives landlords an incentive to alter their supply of rental property.

They have several options based on the circumstances.

First, they may withdraw their properties from the rental market to sell them as condos.

Former George Mason University Chairman of the Department of Economics Donald Boudreaux summed it up nicely in a 2006 letter to the editor of The New York Times:

‘By decreasing the profitability of supplying units occupied by renters, these controls spawn condo conversions and prompt builders to construct fewer rental units and more units for sale to owner-occupiers.

People who can't afford to buy housing are unnecessarily disadvantaged.’

Landlords may also stop investing in maintenance, which, over time, may lead to neighborhoods with many run-down properties.

The bottom line is that rent control never increases the supply of affordable rented housing.”

Now, look, I’m obviously biased.

After many years as a renter myself, I finally started buying properties, and I’ve never looked back.

In fact, I recently converted my garage to a separate legal rental unit.

The last thing I would want is for Washington to cap my future income potential.

After all, I took the risk to buy the property …

I spent all the money to do the conversion …

And I’m the one who will have to deal with property taxes, upkeep and a million other things.

If the government isn’t going to guarantee me against losses, it shouldn’t have any right to cap my profits.

Instead, I can set my asking price. Potential tenants can agree to it or not. And at some point, we will reach something that works for us both.

When the lease is up for renewal, the process starts all over again.

What if the Government Capped Dividends?

What about the fact that Biden’s proposal — the same one adopted by Harris — only applies to corporate landlords that are receiving federal tax breaks?

I would say it still starts us down a very slippery slope.

Moreover, I am actively recommending several real estate investment trusts, or REITs, in Safe Money Report. They are essentially corporate landlords.

In my opinion, the same arguments I just made about my own rental unit apply here as well.

If the government wants to remove tax breaks provided to corporate landlords, I’m fine with that.

But unless they’re willing to protect those landlords — and, by extension, investors — from losses, declining rents and other risks, then they have no place limiting rental rates, profits, dividends or any other related number.

Bottom line: Housing affordability is a complicated issue. And in highly desirable locations with little room for further development, it’s doubly complicated.

However, the government should aim its focus on increasing supply. Especially in cases where government itself is restricting the supply.

We should also consider to what extent the government’s own money printing has created affordability issues in the first place.

It doesn’t matter if you’re talking about apartments, groceries or anything else.

Best wishes,

Nilus Mattive

P.S. Rent isn’t the only thing the federal government wants to take a stronger hand in. To prepare for an even larger threat that’s coming, watch this presentation now.