Did you know that 33 million consumers bought secondhand apparel for the first time in 2020?

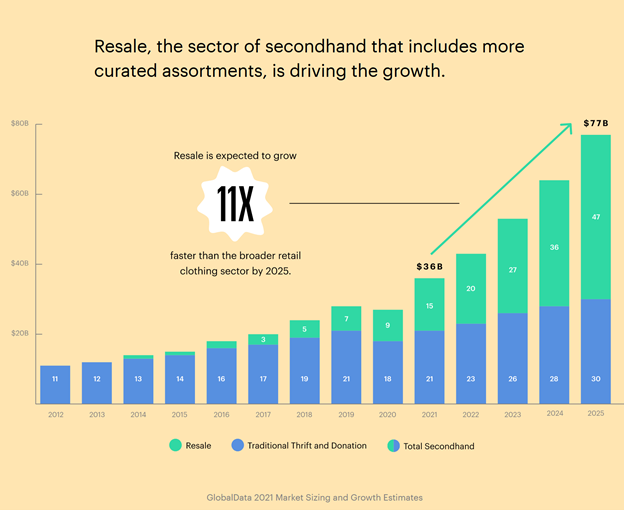

Secondhand clothing continues to gain shares of consumers’ closets across the United States. The clothing resale industry is expected to grow 11 times faster than the broader retail clothing sector ... and it’s expected to double to a whopping $77 billion by 2025.

Check out this graphic from ThredUp’s 2021 Resale Report powered by data from GlobalData:

The report also points out that 76% of people who have never resold clothing are open to trying it ...

And that there are an estimated 9 billion pieces of clothing sitting idly in consumers’ closets.

- In fact, 36 billion pieces of clothing are thrown away each year in the U.S. and 95% of those pieces could be recycled or reused.

This shift has been powered by several changes over the past two years.

During the pandemic, consumers looked to secondhand clothing to save money. But Americans also turned toward this market to make an extra dollar in the tight landscape.

There are numerous apps that make individual and small business reselling easier than ever. And we saw a handful of these companies go public.

It’s become such a lucrative industry that even big-name apparel brands are jumping onboard. Levi Strauss (NYSE: LEVI)’s Secondhand is a recommerce site for previously worn jeans and denim jackets. Anyone can turn in any Levi’s denim item — even if it’s damaged — for a gift card toward a future purchase.

Urban Outfitters (Nasdaq: URBN) launched Nuuly Thrift earlier this year. Via the platform, consumers can buy and sell clothing from any brand … URBN or not. The proceeds can be transferred directly to a bank account or redeemed for Nuuly Cash, which is worth 10% more when spent on Nuuly Thrift or any URBN brand.

- So, why am I telling you to steer clear of this trend that’s clearly set for massive future profits?

First, investors and resellers aren’t the only ones to notice the giant dollar signs.

Major brands are getting envious of these resellers making a profit from their brands. The result is takedown notices under the claim of copyright and trademark infringement.

These takedown procedures are put in place by platforms to help thwart counterfeit products, but now resellers are seeing this being used by greedy brands.

Last month, many sellers on TikTok all received the same email from Shopify (NYSE: SHOP) notifying them that the platform found branded or trademarked goods in their shop. These sellers then had to fill out a form attesting that the products were genuine or risk losing their stores.

I found numerous stories all involving various platforms, brands and resellers that involved a fashion giant trying to block a secondhand item being sold.

According to Yvette Liebesman, a professor of law at Saint Louis University, the first sale doctrine means that once the original owner sells a product, you don’t need their permission to resell it as long as you’re honest about the condition and its provenance.

The truth of the matter is that many small businesses and resellers don’t have the time and money to engage in legal proceedings. In the end, they have to roll with the takedowns and the affect that has on their bottom line.

This legal battle is just beginning.

There are at least two pieces of pending legislation that could significantly alter the resale landscape if passed. This definitely makes me uneasy about putting my money in any of these stocks right now.

But that’s not my only reason to avoid it.

- The second — and biggest — reason is that none of these companies have a decent Weiss Rating.

Poshmark (Nasdaq: POSH) is one of the most widely known businesses in the sector. I’ve been both a customer and seller on the platform. It’s easy to use on both sides of the transaction and what the platform provides makes up for their fee.

When the company went public earlier this year, it had 32 million active users. Of course, this number made investors drool after seeing the potential of the trend. However, shares are down 29% over the past 30 days and 82% year to date.

The stock is currently sitting at a “D-” rating, the same place it was when we started rating it. At the beginning of November, Poshmark was actually on my list of four losers to avoid … and here it is yet again.

ThredUp (Nasdaq: TDUP) was actually founded two years before Poshmark. It’s another platform that allows consumers to buy and sell secondhand apparel, shoes and accessories. The company went public earlier this year on March 26.

I actually found a Forbes article that stated, “Online secondhand marketplace ThredUp made its public debut on Friday, hoping investors will overlook its lack of profits and instead focus on the growing demand for used goods.” That’s an incredibly accurate way to describe both the ThredUp and Poshmark initial price offering (IPO).

ThredUp’s most recent earnings release shows an all-time quarterly revenue high of $63.3 million and a record number of active buyers and orders.

However, the generally accepted accounting principles (GAAP) net loss of $14.7 million wasn’t an improvement over the GAAP net loss of $11 million for the third quarter of 2020. Both losses equal 23% of revenue, meaning the company made more … but in the end, lost more.

Shares are down 17% over the past seven days and down 35% year to date. So it doesn’t look like investors ignored those lackluster earnings after all.

Don’t think that I’m saying you should write off this trend completely. It’s definitely something that I’m going to be following … but I don’t want to lose money in the process.

Best,

Kelly Green