|

| By Gavin Magor |

You might have heard the phrase, “As goes Apple (AAPL), so goes the market.” I guess we’re about to find out how true that may be.

The beginning of February has been a whirlwind. On Feb. 2, as a slew of Big Tech companies reported earnings, the Nasdaq closed the day up 3.25%.

Investors shrugged off revenue misses by Alphabet (GOOGL) and Amazon.com (AMZN), as both stocks rose 7%. They also ignored massive layoffs from those two companies and many others in and outside the tech sector.

Then, about an hour after the market closed, Apple revealed its first earnings miss on top and bottom lines since 2016. The same market that catapulted shares 3% during the day punished AAPL and AMZN — and consequently the Nasdaq — in after-hours trading.

Click here to view full-sized image.

On Friday, Feb. 3, the downward move proved much broader as the labor report showed that jobs surged by 517,000 in January, well above the estimate of 185,000. And the unemployment rate hit a nearly 54-year low of 3.4%.

Big Tech stocks took a beating on fears that additional rake hikes are coming, including a 9.52% hit for Amazon, a high-growth business that is heavily impacted by rate hikes.

You could feel the optimism fade after rising high from the Federal Reserve’s narrative last Wednesday as Fed Chair Powell expectedly announced another quarter-point hike.

Investors seemed to love Powell’s comments that the Fed has made a small dent in inflation and that a soft landing “might be possible.”

Powell also reiterated that the Fed is in no way done hiking rates and definitely will not cut them in 2023. He talked about how the U.S. economy was enjoying “modest growth” and “robust” job gains.

Investors perceived his remarks as dovish, so the S&P 500 rose 1.05% and the Nasdaq 500 added 2% last Wednesday.

To me, those remarks were as hawkish as ever. He mentioned more rate hikes, no cuts, a strong economy and a strong labor market. Am I missing something?

Remember, the goal of the Fed is to bring inflation down to 2% from its current 6.5%, so we’re still a long way away … and a robust economy and labor market only puts more pressure on the Fed to raise rates further. Either investors heard what they didn’t want to hear and are in denial or they’re eternal optimists.

If you’re more confused than ever, I don’t blame you because …

The Stock Market Does

Not Operate Rationally

January ended so strongly that market analysts began debating whether we have hit bottom and reversed into a new 2023 bull market.

Once again, it depends on whom you ask … and what day of the week or month it is. And having a popular CNBC analyst declare that we are in a bull market does not count. His bias may be bullish, but that’s just an opinion.

In my years studying the markets, I have learned that one of the worst things you can do is get overly bearish or bullish and fall into a trap. So please, don’t start doing that now.

So far, sectors that tanked last year are this year’s winners, with the most notable being the tech sector. That’s not all. The S&P has surged past key resistance levels and has fallen below support levels just days later.

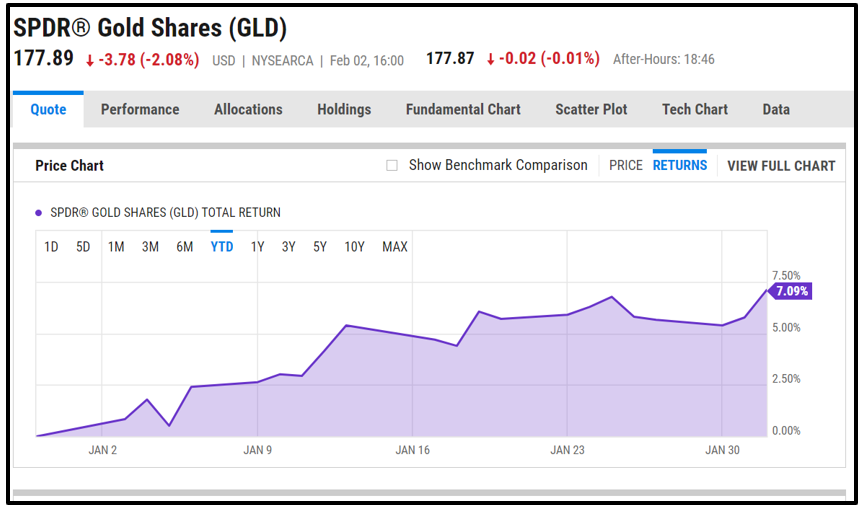

Gold, a traditional haven, is also back up and so far, it’s staying that way; up to $1,866.55 an ounce as of this writing. And Bitcoin (BTC) is up around 40% year to date.

Check out the SPDR Gold Shares (GLD):

Click here to view full-sized image.

Not much of that makes sense to me. That is because a lot of what is happening lacks logic and conviction. But that is how uncertainty manifests itself in the stock market.

Despite what the Fed says about interest rates, or what economic reports unveil about inflation, no one knows what it will ultimately take to fix our market woes.

Remember, they got us here so far. And economists cannot even agree after looking at the same Consumer Price Index figures if inflation has risen or fallen. One person sees light at the end of the tunnel, another perceives it as an out-of-control freight train.

Perceptions, interpretations and emotions do not belong in the same sentence as investing. Yet this is where we find ourselves. And the stock market can be a dangerous place if you engage in any of the three.

My goal is to make sure you don’t get burned. In my All-Weather Portfolio service, we wisely trust the Bull/Bear Timing Model and only invest in highly ranked Weiss Performance Model stocks.

And because the market may be neutral at the moment, I would hate for you to be unnecessarily subjected to the volatility and whipsaw-induced losses that often accompany climates like we have today.

When markets climb like they did in January, it is easy to develop a false sense of security and react in ways you will later regret. The worst thing you can do is chase profits. I understand how hard it is to resist, especially with many of the worst performers in 2022 doing a 180-degree turn this year.

Warranted or not, the market has shifted from value to growth, from risk-off to risk-on, and from fear to greed. With so many unknowns and moving parts in the world today, that can change on a dime.

Bottom line: Regardless of investors’ expectations, speculations or perceptions, the Fed holds most of the cards. And you’ve got to be prepared for whatever hand we’re dealt from Powell and company.

Remember, the Fed’s job is not to make investors happy. Right now, one of their major goals is to rein in inflation. And the tools needed to do the job may cause more pain before relief.

Make sure to keep your guard up. Invest smartly and cautiously. Above all, continue to read your Weiss Ratings Daily for help and guidance in navigating a very challenging and historic investment landscape.

And make sure to keep at least one eye on Apple.

Until next time,

Gavin

P.S. The Fed’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.