|

| By Nilus Mattive |

Stocks … precious metals … real estate … cryptos …

Just about every major investment class under the sun is sitting at or near all-time highs.

In fact, bonds are the only exception.

In that area, it’s the government debt itself that keeps hitting one record high after another.

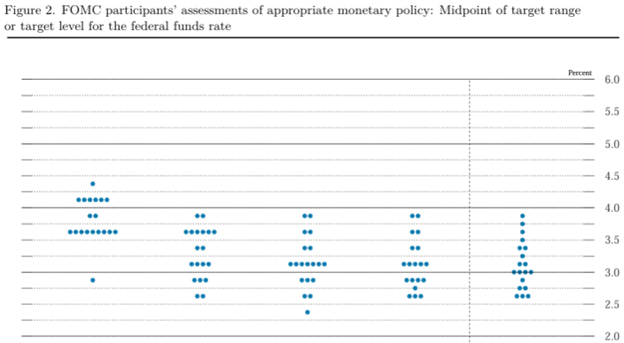

So, sure, both politicians and investors are cheering last week’s interest rate cut by the FOMC.

But I have a different take …

Easy money is a drug, and a very dangerous one at that.

It helps paper over our fiscal problems, and it keeps markets high. However, it’s only a temporary panacea.

- It doesn’t curb government spending …

- It doesn’t force investors to scrutinize what they’re actually buying …

- And it could stoke a still-simmering inflationary fire.

I’ve been following the markets professionally for more than 25 years now. And this has been the consistent pattern over that entire time period.

Even using the government’s own manipulated CPI numbers, something that cost $100 in 2000 now costs $191.

That means our money has lost about half of its value since I got my first job on Wall Street.

And if you go back to the start of the Federal Reserve in 1913, something that was $100 back then currently costs $3,296!

So, the Federal Reserve has done nothing to prevent inflation’s ravaging effects.

In fact, I would say it has fanned the flames … especially since the turn of the millennium.

Along the way, monetary policymakers have also created a series of rolling bubbles and collapses … each one bigger than the last.

Personally, I’d like to abolish the Federal Reserve completely and let financial markets determine all interest rates on their own.

However, in my opinion, the only thing worse than the Federal Reserve we’ve had for the last century would be one that becomes even MORE beholden to individual politicians … which brings us right back to the present.

Simply look at the fact that Stephen Miran — who just got added to the Federal Open Market Committee (FOMC) after taking an unpaid leave as the chair of President Trump’s Economic Council of Advisors — was the lone dissenter last week.

He called for an even bigger half-point cut.

This, despite the fact that inflation remains well above the Fed’s stated target, and asset prices across the board are at unprecedented levels.

With this as the backdrop, I’ll be the first to tell you that markets could keep inflating for months or even years.

But I also know from experience that it could just as quickly end at any given time … and an ensuing crash could be absolutely devastating to anyone who isn’t prepared.

You only need to go back and read some Safe Money Report issues from two decades ago to see how both things are true.

I was working right alongside Dr. Martin Weiss back then, too, and I remember it well.

Headline after headline in the monthly Safe Money Report issues warned about the massive amounts of easy money coursing through the system …

The unsustainability of soaring housing prices …

And all the financial shenanigans taking place behind the scenes.

Yet, prices continued to rise.

Real estate flippers continued to make money hand over fist. And bankers kept laughing all the way to the, um, bank.

Until one day it all stopped!

From October 2007 through March 2009, the Dow lost 54% of its value.

More than 6 million Americans eventually lost their homes.

And at one point, the entire U.S. financial system ground to a halt.

Mainstream media outlets asked the world, “Why didn’t anyone see this coming?” and “How could this have happened?”

Just months earlier, they were telling us stories about all the money being made in real estate!

We could only shake our heads, comfortable in the fact that our publications had been warning readers and preparing them for what seemed like an obvious and inevitable conclusion.

I feel much the same way right now.

Of course, anyone can say “the sky is falling” over and over again.

My goal is to help you continue making money while still staying as safe as possible.

That’s why I always recommend having an adequate cash cushion above all else.

I think you should stay diversified across all the major asset classes, too.

And I suggest having the bulk of your stock portfolio in high-quality, income-producing companies that will do well whether inflation picks up, the economy slows or both things happen at the same time.

It’s also fine to have a small portion of your money in more aggressive plays … as long as you also keep booking outsized profits as they materialize.

Indeed, this is precisely what we just did in Safe Money — closing out two of our more aggressive positions for massive gains of 130% in 17 months and 288% in just under two years.

So, make hay while the sun shines. Just keep plenty in the barn, too.

Best wishes,

Nilus Mattive

P.S. As I said, diversification is key. And part of your money should be in trends that will continue to be unstoppable, no matter what the wider economy does from here.

That’s why you should keep 2 p.m. Eastern open tomorrow afternoon.

That’s when Weiss Ratings will host our Fall 2025 Tech Summit.

The topic is about a small group of stocks that are crushing the SpaceX monopoly … and that are on a glide path to even bigger profits right now.