|

| By Gavin Magor |

Investors have a lot to deal with these days.

They have to make sense of a market that is, in turn, trying to make sense of tons of data.

Everything from earnings to economic reports and the predictably unpredictable market reactions.

Then there are the unpredictably predictable events.

This week, for example, the Federal Reserve meets in Jackson Hole, Wyoming. And the market will twist itself in knots before and after we get a look inside Jerome Powell’s crystal ball.

We know there’s an election coming up. And that there’s always an October surprise. But the October surprises already started to happen in July.

Here at Weiss Ratings, we pride ourselves on being predictably accurate.

Every day, we collect and process all the data we can get our hands on. Over the years, Dr. Martin Weiss has spent over $25 million to keep our ratings running at maximum efficiency.

And he spares no expense when it comes to taking our technology to the next level.

The result: Investors can conveniently come to our website and look for strong investment ideas to help their research.

And much of this data is available for free!

The best part: We want you to take advantage of it!

But we understand there is so much data available to you on our website, you might not know where to start.

In this volatile market, looking at some of the largest stocks could be a smart idea to ride out the turbulence.

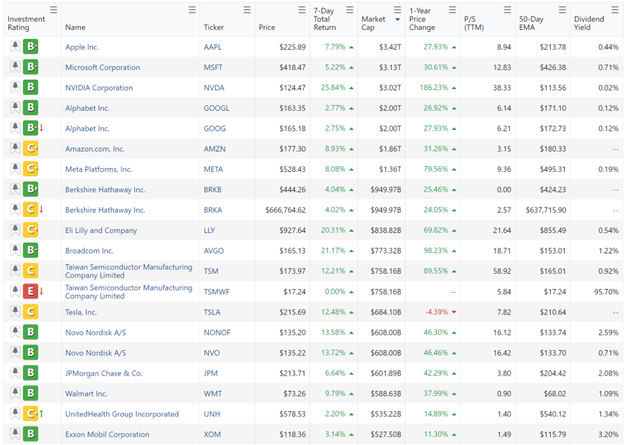

Today, I want to show you Weiss Ratings results for some of the largest stocks in the market sorted by market cap.

I also wanted to see one-year percent change, price-to-sales ratio, 50-day exponential moving average and dividend yield.

Here’s what populated:

In the above image, we can very conveniently see how the market’s largest names are performing, get a sense of valuations from the price-to-sales ratio, get a technical sense though the 50-day exponential moving average and see if they pay a solid dividend.

Ultimately, every investor will have different needs. But for today’s purposes — and to help you fit these incredible tools into your investing picture — let’s break this down a bit more.

Some names, like Nvidia (NVDA), are up massively — nearly 187%. Whilst others, like Tesla (TSLA), are down in the above list.

Tesla is a stock I wouldn’t touch with a 10-foot pole, at least not any time soon.

Not to knock on its cars. But its stock is still very overvalued. And Tesla has a ton more competition in the EV market. It’s not surprising to see it down 3% over the past year.

The P/S ratio compares a company’s stock price to its revenue to see how much investors are willing to pay, or how expensive it is.

NVDA and Taiwan Semi (TSM) appear to be the most expensive names above. But investors are willing to pay those premiums for the growth potential those companies offer thanks to the booming potential of AI.

Next, we have the 50-day EMA. That helps us compare the latest 50 trading days to its current price on the left to see where the price is going.

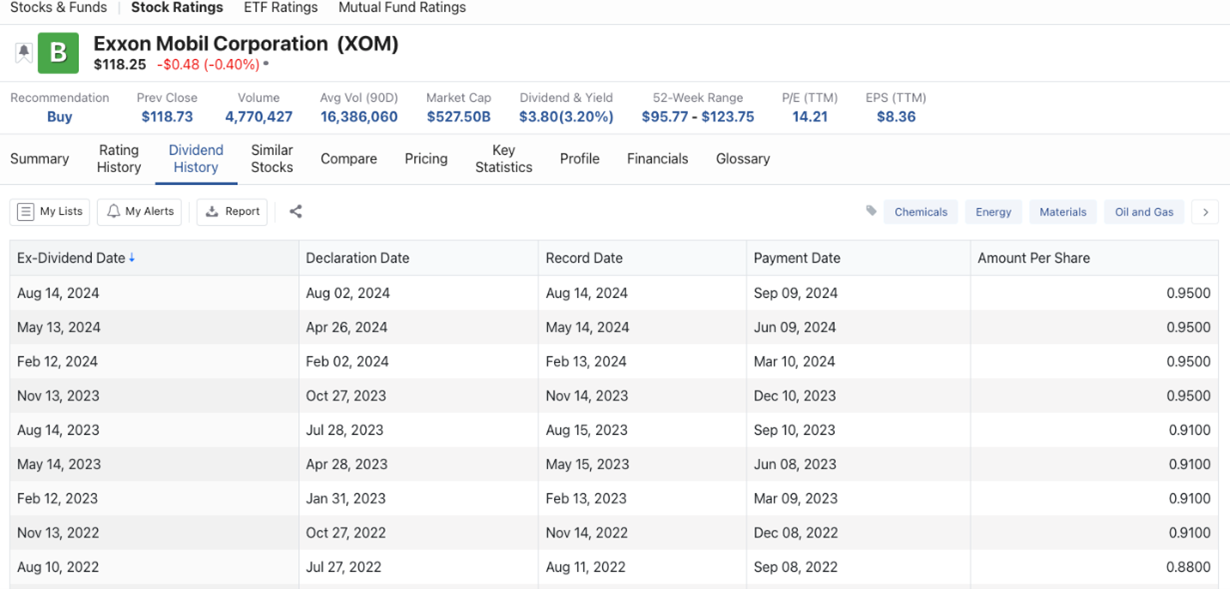

Lastly, we can see the dividend yield. And if you happen to be looking for a stock with a bigger dividend, Exxon Mobil (XOM) may be your top play in the list above.

These are just some of the tools you can use to differentiate potential investments.

I urge you to check out the Weiss Ratings stock screener here and look through the filters for more that suit your needs.

Of course, screening for stocks isn’t the only way to stay nimble in the market.

One of the few areas of investing that we don’t include in our screener is private companies.

These range from small startups to huge privately held companies. They share one attribute, however. Those who gain access to pre-IPO shares can take advantage of these businesses’ highest growth periods.

My colleague and private deal expert Chris Graebe is the expert in this field.

He does use our data — not found in the screener — to help him perform his due diligence. But he’s a master at finding private companies ready to explode.

Elon Musk would probably not like my opinion about Tesla. But he’d hate what Chris is about to share …

He found a company with the potential to disrupt SpaceX’s — Elon’s other major company — near-monopoly in the space industry.

This company is set to release a new technology to deliver satellites to orbit for 92% less than SpaceX and up to 52 times faster.

The company has already locked in partnerships with huge industry names like Lockheed Martin (LMT), Innoveering (a General Electric subsidiary) and the U.S. Air Force.

I would hate any of my readers to miss out on this opportunity. But you can still get information before funding fills.

In Chris’s recent Summer 2024 Private Investment Summit, he shares all the details you need to know.

Stay nimble, find great deals and stick with the Weiss Ratings.

Cheers!

Gavin Magor

with

PJ Amirata