|

| By Jon Markman |

Federal regulators in the United States are stepping up their attack on Alphabet (GOOGL), the parent company to Google.

Microsoft (MSFT) CEO Satya Nadella will testify on Monday in the Department of Justice antitrust case against Google. Nadella is expected to assert that Google’s hold on internet search is impenetrable.

He’s probably correct.

Regulators in the United States and European Union have taken dead aim on large American technology companies. Policymakers believe that these companies are simply too powerful.

So, the regulators are doing something extraordinary; they're abandoning the idea that harm to the consumer should be the gold standard for antitrust. It’s a strange tactic, and it is likely to fail.

Traditional antitrust attacks against companies assert that firms in violation use their monopoly power to limit competition on the way to raising prices paid by consumers. Higher prices — and greater corporate profitability — represent clear harm. It also fits a comfortable narrative that giant greedy corporations want to get one over on the little guy.

Yet Google Search isn’t raising prices. On the contrary, the company has continually offered more — and better — services to consumers for no direct cost.

Google Search is built around an advertising model. Consumers get “free” search in exchange for viewing advertisements. It’s a trade-off most consumers have happily embraced, judging by Google’s lead in the internet search business.

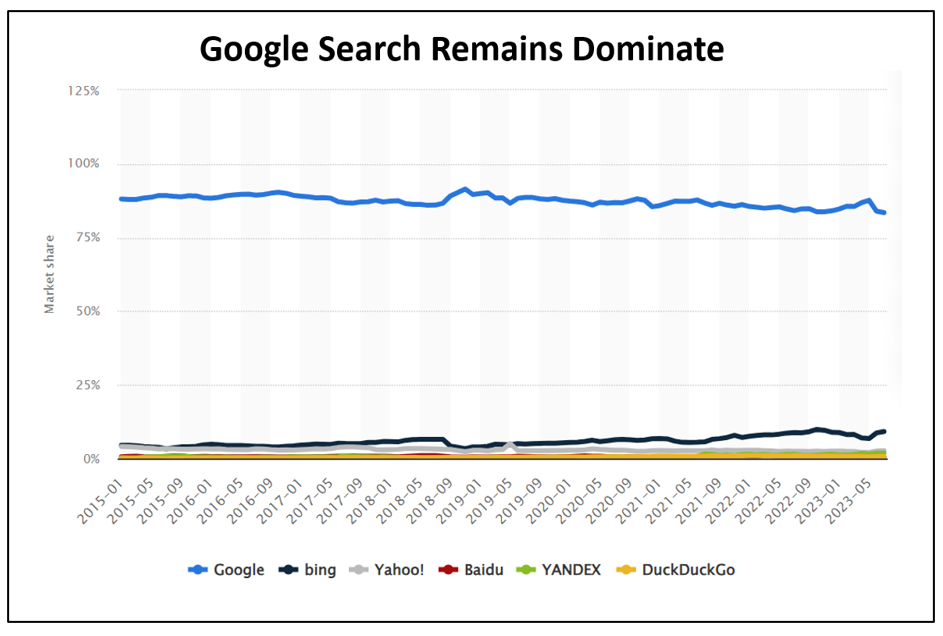

The market share of Google Search on desktops has hovered between 83% and 91% since 2015, according to data kept at Statista.

During the same time frame, data shows that Google’s share of mobile search has remined between 93% and 96%.

Microsoft has been trying since 1998 to break Google’s search stranglehold. That effort has been costly and ineffective. Consumers simply prefer Google.

When Microsoft extended its partnership in January with OpenAI, many investment strategists starting writing the obituary for Google Search. OpenAI developed ChatGPT, an artificial intelligence chatbot that became wildly popular.

ChatGPT launched in December 2022 and reached the 100 million milestone by January, according to a report from Reuters. For perspective, it took Facebook four years and six months to achieve that level of use.

The integration of ChatGPT with Bing, Microsoft’s search business, was supposed to be a game-changer for search. However, Alphabet executives reported in July that sales at Google Search actually increased. This data was confirmed by comScore, a data analytics firm.

What happened to Bing’s market share since integration? It declined by 6% from February through July.

When Nadella testifies on Monday, he’s expected to tell DOJ regulators that Microsoft attempted to negotiate with Apple (AAPL) in 2019 to supplant Google as the paid search provider on iPhones and iPads. Although executives at Microsoft were prepared to bid more than Google for that right — and lose billions on the deal in the process — the offer was rebuffed by leaders at Apple, according to Bloomberg.

Regulators believe this proves unfair practices at Google. That's doubtful.

Apple’s brand is premised on being the best. Consumers believe that Google is the best search engine. Google is to search what Kleenex is to tissue … and what Xerox was to paper copies.

This is the folly of all of the antitrust cases against Big Tech. Clearly, the companies like Apple, Amazon.com (AMZN) and Alphabet are powerful. It’s also true that they have become gatekeepers to our digital lives. Unfortunately, for regulators, this right has been earned by making better products.

Government cases against these tech juggernauts are not going to make much headway. There will be fines, sure. However, these payments will be little more than nuisances.

At a price of $135, Alphabet shares trade at 20.1 times forward earnings and 5.9 times sales. The stock could easily trade to $180 during the next 18 months as the antitrust news fades.

If you somehow haven’t invested with the best, you have an opportunity here.

All the best,

Jon D. Markman

P.S. Giants like Alphabet, of course, are not the only way to play the life-changing technologies we all now take for granted. In fact, I’ve uncovered the best way to play “The Next AI Bonanza,” and it’s not Alphabet. Click here for my new presentation.