|

| By Jurica Dujmovic |

A viral claim gripped the financial markets last week.

There’s an AI bubble that’s 17x larger than the Dot-Com Crash … and 4x the subprime meltdown.

The statistic ricocheted across Bloomberg terminals, tech Twitter and CNBC chyrons over the past few days.

This claim originated with MacroStrategy Partnership, a UK research firm advising institutions managing over $5 trillion.

Those are the kind of numbers that make CFOs sweat, and journalists reach for historical analogies.

But the AI bubble isn't waiting for some future catalyst to pop.

It's deflating right now.

While financial media obsesses over whether we're headed for a 2000-style crash, the bodies are already piling up.

Thousands of AI players are quietly shutting down, slashing valuations and abandoning projects.

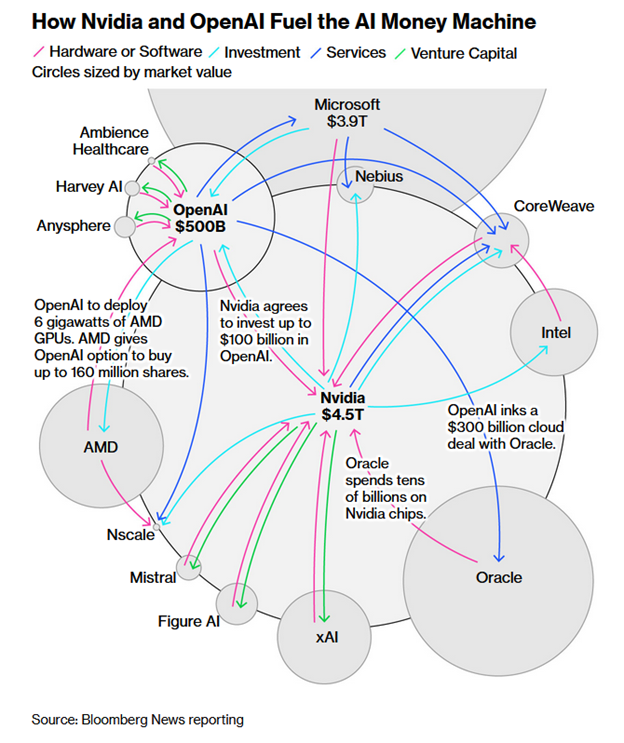

Meanwhile, select AI companies (and their stocks) keep getting bigger. In part, by partnering with each other!

In other words, the AI bubble isn’t one that explodes. It deflates selectively.

Those left standing inside the AI bubble have a real opportunity to reshape the world … and your portfolio.

Inside the Quiet Apocalypse You're Not Seeing … Yet

This isn't 2000. It isn’t even close. And I’ll give you one good reason why … and that’s valuations.

- The price-to-earnings ratio measures how many years of current profits you're paying for upfront when you buy a stock.

- A P/E of 20 means you're betting on 20 years of current earnings to justify today's price.

- The higher the P/E, the more you're banking on explosive future growth.

During the Dot-Com peak, the tech sector’s P/E hit 55+. Cisco's reached triple digits.

Over half of tech companies had no earnings at all. That means their P/E ratios were literally incalculable.

Investors were paying infinite multiples for companies with no path to profitability.

Stocks were valued on "eyeballs" and "mindshare" rather than revenue.

Today?

- The S&P 500 trades at a forward P/E of 23.

- Tech sector average: 30.

- Even Nvidia, at the epicenter of AI mania, carries a trailing P/E of 52.

These are elevated valuations, yes. But they're attached to companies generating massive actual profits.

- Nvidia (NVDA) posted $165 billion in trailing 12-month revenue with a 52% net margin.

- Microsoft's (MSFT) Azure generated over $75 billion in fiscal year 2025 revenue.

These aren't speculative plays burning venture capital.

The Bank for International Settlements analyzed this in September 2024.

It found that, while tech valuations are stretched,

"The profitability and balance sheet strength of today's tech leaders differs markedly from the dot-com era."

Here's where things get interesting:

- Palantir (PLTR) trades at a trailing P/E of 632 and a forward P/E of 215-250. And its price-to-sales ratio exceeds 123.

- OpenAI now carries a $500B private valuation — the world’s most valuable startup. At the same time, it remains unprofitable and projects roughly $12 billion-$20 billion of 2025 revenue (after $4.3 billion in the first half).

That implies roughly a 20x-40× sales multiple on expectations rather than realized revenue.

In other words, we have two things simultaneously:

- Broadly reasonable valuations for profitable giants, and

- Dot-Com-style insanity in select pockets.

In short?

The market isn't uniformly overvalued. It's selectively deranged.

The Crypto AI Route

One alternative to stocks that might still be in an AI bubble is crypto.

Crypto projects rely on the grassroots nature of blockchain technology to make AI accessible to everyone.

Platforms like Render (RNDR), Bittensor (TAO) and others rely on users to lend their liquidity and idle computer processing power.

That, in turn, is used to build and train AI models …

For a fraction of what the largest TradFi firms pay.

Plus, with no need for physical storage or maintenance, these crypto AI projects can keep costs way down.

It’s a solid system. And one that’s self-reinforcing.

In return for their liquidity and GPU, those users get rewards and access to that AI for pennies on the dollar.

This isn’t to say that crypto AI will be insulated when the AI bubble pops.

But it is likely we’ll see a higher survival rate among smaller decentralized AI projects.

How to Make the Best of the Popping AI Bubble

All the stocks we talked about today … Nvidia, Microsoft and Palantir … all have a “Buy” Weiss rating.

The Render token is also rated “Buy” by the Weiss crypto ratings.

Bittensor is rated “Sell.” That doesn’t mean it won’t earn a higher grade in time. But our system currently rates its adoption “Very Weak.”

And if people aren’t adopting and rallying behind a crypto, that makes it riskier to trade.

You can click on any of their tickers above to get up-to-date market data for each.

And to discover how our resident crypto expert Juan Villaverde used AI to make his Crypto Timing Model even more accurate … and why that’s especially useful this “Uptober,” click this link here.

Best,

Jurica Dujmovic

P.S. One AI benefit you don’t want to miss is Juan Villaverde’s upgraded Crypto Timing Model 2.0.

Juan’s timing model was already strong. It pinpointed the start and end of the past three crypto bull cycles with precision.

But the market has grown. So, Juan added AI and fine-tuned his algorithm to account for these changes.

Now, testing shows his model has the power to generate AVERAGE gains of 6,630% for each crypto asset.

To see how it can help your crypto strategy, click here.