|

| By Sean Brodrick |

Last week, the Justice Department took a big step toward rescheduling marijuana, and now the clock is ticking.

Rescheduling will still leave cannabis illegal on a federal level, but it should provide tax benefits to companies that sell pot legally in various states. And that gives investors an opportunity.

There are 38 states where pot is legal for medical purposes. Among those, 24 states have made cannabis legal for recreational use. So, this is a big boon for sellers in those states.

What is “rescheduling,” anyway?

Right now, marijuana is listed as a Schedule I drug, right along with heroin and LSD. That means the government believes it has the highest risk of abuse and has no recognized medical use.

President Biden, the Justice Department and the Drug Enforcement Agency have proposed moving cannabis to Schedule III, the same classification as steroids, testosterone and ketamine.

So, when will rescheduling happen?

First, the White House Office of Management and Budget must review the proposed change. This happens during a 60-day comment period, and the rule change happens 30 days after that.

So, that means marijuana should be rescheduled around Aug. 16.

Coink-idinkly, the Democratic convention is on Aug. 19. If you think that’s a coincidence, you must be smoking something.

68% Support Legalization

68% of adults support legalization, the highest level yet recorded by the polling firm and more than double the roughly 30% who backed legalization in 2000. Team Biden probably wants to make those voters happy.

The legal cannabis industry in the U.S. is worth about $34 billion a year. And yet, most cannabis companies are not profitable. At least part of this is due to the current tax structure.

The part of the tax code that pot companies hate is Section 280E.

Enacted in 1982, it forbids businesses from deducting expenses from their gross income if the business consists of illegal “trafficking” in Schedule I or II controlled substances.

And that means marijuana-related companies end up paying federal taxes on gross profit rather than net income.

Profits Go Up in Smoke

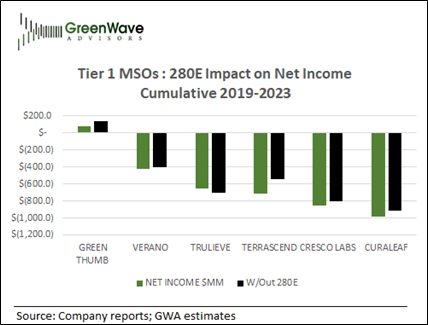

Greenwave Advisors tallied up the impact of the 280E tax law on major U.S. cannabis companies …

None of the U.S. cannabis companies are what you’d consider big, but these are the five biggest: Green Thumb Industries (GTBIF), Verano Holdings (VRNOF), Trulieve Cannabis (TCNNF), Terrascend (TSNDF), Cresco Labs (CRLBF) and Curaleaf Holdings (CURLF).

Of these, only Green Thumb is profitable. In fact, I own it in my personal portfolio for that reason.

Interestingly, Green Thumb would see the lowest impact from a change in the tax code. For companies like Cresco Labs and Curaleaf, it could be a game changer.

Now, it won’t be all roses and clover. When the tax burden is eased, the Federal government will probably add an excise tax. But the tax will probably cost companies less than the current system.

Harvest Some Gains

That’s why cannabis stocks bolted higher when the news of the rescheduling was announced. But pot stocks have since settled down again. That’s good because that’s the opportunity I’m talking about. You can buy these stocks on the cheap.

A smart way to play this would be to buy some cannabis stocks or a cannabis ETF before rescheduling.

We’ll probably see all five of the stocks I just mentioned run up ahead of the event. I’d also recommend booking any profits about a week before the rescheduling should happen.

Wall Street always jumps the gun, so you need to move ahead of Wall Street.

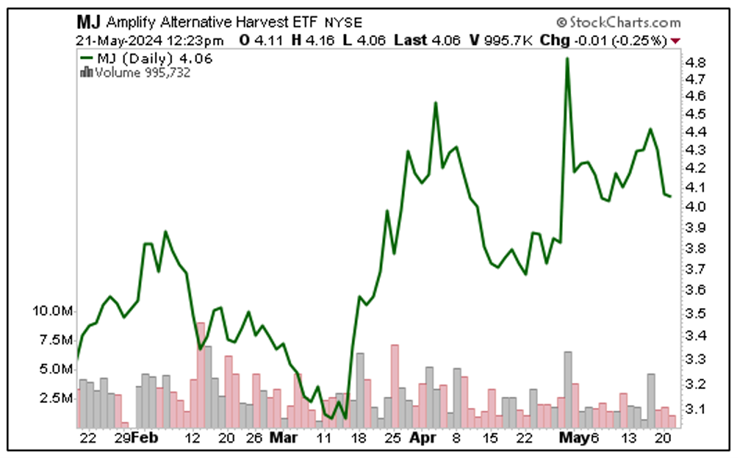

If you prefer to play this through a fund, there are two major U.S. cannabis funds: Amplify Alternative Harvest ETF (MJ) and AdvisorShares Pure U.S. Cannabis ETF (MSOS).

MJ provides exposure to a broader range of companies involved in the global cannabis ecosystem, while MSOS focuses exclusively on U.S. companies engaged in legal cannabis activities.

Since cannabis stocks last bottomed on March 14 — anticipating the news on rescheduling — MSOS is up 16.45%, which is pretty nice compared to the 2.76% gain in the S&P 500 at the same time.

But MJ is up 29.88%. That seems like the better way to go. The fund is pulling back as the first flush of speculative optimism fades. That’s fine, it gives you a better entry price. Again, I expect to see prices start running higher again soon.

The countdown to the rescheduling of cannabis has begun. And you can get a ticket to this party that could put your portfolio deep in the green.

All the best,

Sean

P.S. While there should be profits from the emotional response to rescheduling, it’s often best to take emotions out of investing. If you haven’t seen it yet, Dr. Martin Weiss recently sat for an interview to announce a system that does just that. I urge you to check it out now. It is coming offline tomorrow.