|

| By Sean Brodrick |

It’s becoming evident that the market is pricing in a crisis. But what crisis?

It’s not just fear of recession, though a Fed that stubbornly insists it needs to keep raising rates doesn’t help on that end.

For me, it comes back to banks. The banking crisis isn’t over. Heck, no.

Did you know that:

• More than $900 billion in deposits have flowed out of banks since the Fed began to raise interest rates in March of last year.

• The past two weeks have experienced the largest cut to bank lending in U.S. history.

• We’re also seeing the largest decline in lending to the real estate industry in history.

So, why is money fleeing banks? Because depositors are worried the banks will fail like Silicon Valley Bank did in March. That’s the incident that kicked off this whole banking crisis.

First, depositors reacted by taking deposits from smaller, regional banks. Now, they’re taking from big banks, too.

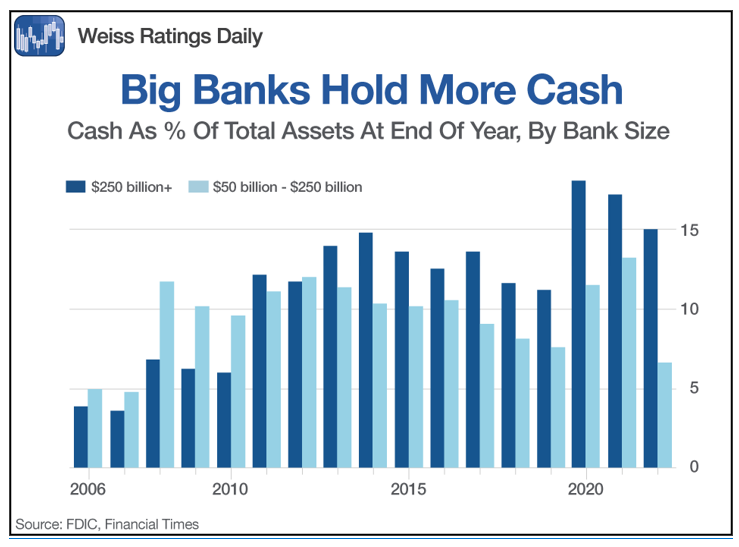

Still, the big banks have more cash on hand to lose, as this chart from the end of the year shows.

Where is the money going? Some of the money is flowing to money market funds.

Assets held in money market funds hit a record $5.2 trillion earlier this month, as savers added more than $300 billion to them in the past three weeks.

That’s the highest quarterly inflow since a peak earlier in the pandemic. And this is a problem for banks. As Axios explains:

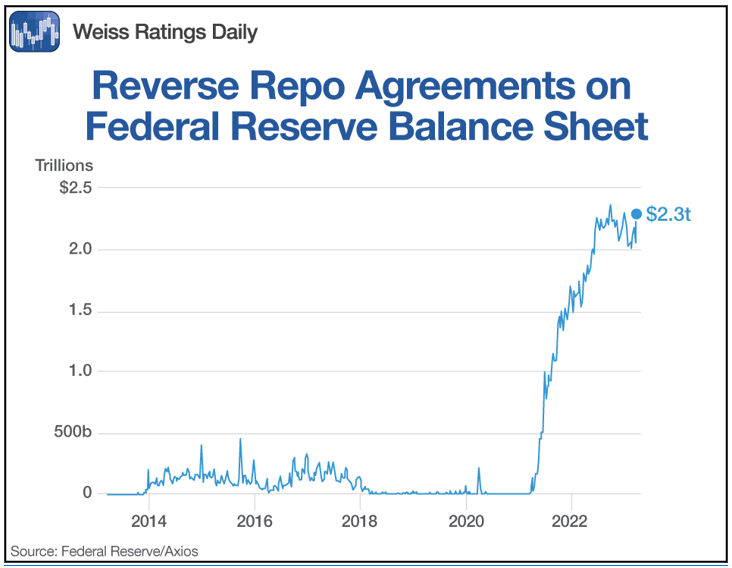

“The ‘overnight reverse repurchase agreement facility’ (ON RRP) enables money market mutual funds to accept vast sums of investors' money and pay their customers higher interest rates than banks typically do.

That's a boon for savers who want high yields on their cash, but is contributing to the destabilization of the banking system, as depositors yank their funds.”

Here’s a chart demonstrating that:

Click here to see full-sized image.

To banks, this is unwelcome competition. They benefit from their unique access to liquidity — and safety — from the Fed. Lightly regulated money market funds are a threat to that and even more so in this jittery moment.

• This week, the Bank Policy Institute, the research arm of the bank-lobbyist-industrial complex, called the repo facility "a black hole for bank deposits."

• The BPI's Greg Baer and Bill Nelson argue that the facility is essentially sucking money out of the banking system that would be put to more productive use for the economy, if it stayed in banks.

• "The facility is subsidizing money market funds as an attractive alternative for uninsured bank depositors," they wrote.

The banks hate when people do this. Banks benefit from their “unique” access to liquidity. This unwelcome competition from money market funds is hoovering up money the banks would love to manage.

It’s a problem for the rest of us, too. Close to $2.3 trillion of all money market funds are parked at the Federal Reserve’s reverse repo facility. Doing that effectively removes the money from circulation.

And it’s going to get worse. The cash at the repo facility garners 4.8% interest. So, it’s likely that more money is going to flow into those “risk-free” deposits.

The bottom line is that smaller, regional banks have less cash to lend. This squeezes the nation’s money supply and economy terribly.

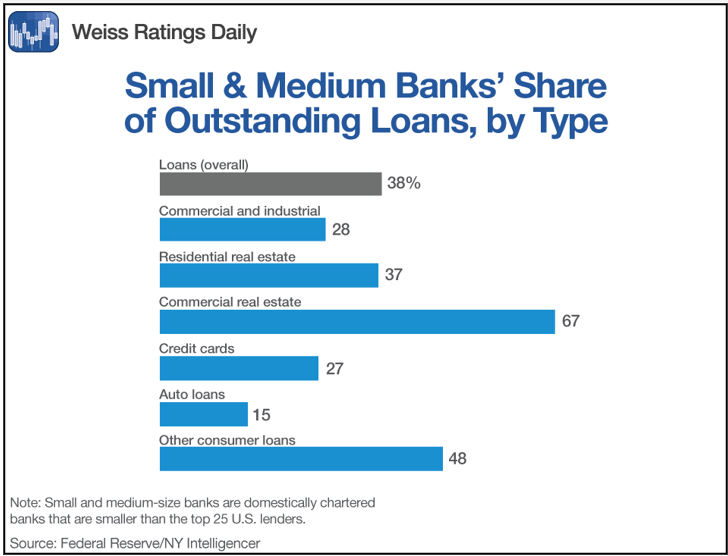

This is a real problem for real estate, as mid-size banks are especially crucial players in the commercial real estate industry. Those smaller banks provide 67% of all loans in commercial real estate.

And commercial real estate is already in crisis, thanks to the pandemic. As of late January, occupancy rates at U.S. offices remained at roughly 50% of their pre-pandemic levels.

So, falling deposits are a problem, loan liquidity is a problem and commercial real estate is a problem.

This is all deflationary. But don’t expect inflation to drop quickly. The effects of this credit tightening will take some time.

In fact, used car prices started rising again in March. Stubborn inflation might push the Fed to raise its benchmark rate even more, which would put even more pressure on banks.

Traders are currently pricing in a 74% chance of the Fed hiking its benchmark rate by 25 basis points on May 3. Is that the end of hikes, with rate cuts around the corner? The market is also pricing in four rate cuts — totalling 100 basis points — through the end of the year.

The Fed seems prepared to call the market’s bluff. And the fate of many banks may be hanging on what happens.

3 Things to Do Right Now

1. Make sure your deposit at any one bank is not more than $250,000. While the FDIC bailed out all depositors at Silicon Valley Bank when it failed, there’s no guarantee it will bail out large accounts if another banking crisis hits.

2. Invest in precious metals and precious metals miners. Gold is a safe harbor in rough financial times. That’s part of the reason why gold has been doing so well recently. It should continue to do so.

3. For more speculative money, consider buying the ProShares Short Financials ETF (SEF). It has an expense ratio of 0.95%, and it should go up as the financials sector of the S&P 500 goes down.

Click here to see full-sized image.

SEF rocketed as financials reeled after Silicon Valley Bank failed. Now, SEF is treading water. It might be forming a “bull flag” pattern.

And as the saying goes, “Flags fly at half-mast.” In other words, SEF could have a lot more upside.

I’d like to be wrong about a potential banking crisis. But if I’m right, you’ll want protection.

Best wishes,

Sean

P.S. I will be speaking at the Las Vegas MoneyShow April 24–26 and sharing my best investment ideas for 2023. Don’t miss out — make your reservations now! I always have a great time in Vegas, and I hope you join me.