|

| By Sean Brodrick |

Just as a Godzilla-sized monster was about to stomp Tokyo, it turned away at the last minute. The Japanese are heaving a sigh of relief.

I’m talking about the debt monster, of course. It’s raging out of control in Japan.

The Japanese may be celebrating too soon, and savvy investors have an opportunity.

What happened: On Friday, yields on Japan's 30-year and 40-year government bonds surged to record highs — 3.2% and 3.675%, respectively — due to weak demand, particularly from traditional buyers like life insurers.

I’ll get to why they’re not buying in a minute.

Importantly, Japan's Ministry of Finance (MOF) recognized the need to act.

So, it signaled a reduction in the issuance of these super-long bonds.

Rather than issue so much long-term debt, Japan is going to take a page out of Uncle Sam’s playbook and issue more short-term debt.

We can see how well that’s worked for America. Still, the news stabilized Japan’s bond market for now.

This is coming to a head as Japan’s bond market undergoes a shift in trend after decades of deflation and yield suppression.

Japanese long-bond yields surged, with the yields on Japan’s 10-year, 30-year and 40-year debt hitting 17-year highs before pulling back this week.

Here’s a monthly chart of Japan’s 10-year yield …

You can see why the Ministry of Finance had to do something.

There are several reasons for the surge: A shift in monetary policy, rising inflation and increasing rate hike expectations are my top three.

There is also an underlying concern among investors that Japan’s debt-to-GDP ratio is becoming unmanageable.

I’ll briefly explain all these …

-

Policy Shift: The BOJ abandoned negative interest rates in March 2024.

This was because inflation was finally consistently above the Bank of Japan’s 2% target.

The BOJ considered this a success. It also wanted to support a weakened yen.

So, it began normalizing monetary policy after years of ultra-loose measures.

-

Inflation: Speaking of inflation, it stayed above the BOJ’s 2% target for over a year, thanks to higher energy costs, the weak yen and stronger domestic demand.

The “success” of inflation quickly came back to bite Japan.

- Wage Growth: Big firms agreed to significant wage increases in the 2025 spring wage negotiations. This adds to inflation fears.

- Currency Pressure: The yen drifted lower since January, bottomed in April, then, confoundingly, started to swoon again in May.

This leads traders to believe the BOJ will be forced to raise rates to stabilize the currency.

The Underlying Problem

Now, let’s talk about the underlying problem: Japan’s staggering government debt-to-GDP ratio.

As of Dec. 2024, Japan's gross government debt stood at 216.2% of nominal gross domestic product (GDP).

This is actually down slightly from the levels reached earlier in the year. But it is very high.

For contrast, the United States, which is catching a lot of flak for its mountains of debt, had a debt-to-GDP ratio of 124.3% at the end of last year.

Germany, meanwhile, has a debt-to-GDP ratio of 62.5%, and the European Union has an average debt-to-GDP ratio of 81%.

A high debt-to-GDP ratio isn't inherently bad. But the higher the debt, the more a government must spend on interest payments.

And as interest rates rise, payments on the debt crowd out funding.

In the U.S., interest payments on the debt are projected to surpass defense spending by 2026.

And Japan’s debt-to-GDP situation is much worse.

The higher the bond yields go, the more interest a country needs to pay on its debt.

This worries investors, who demand higher yields.

That, in turn, creates a debt doom spiral: Higher debt → higher interest rates → higher debt service → more debt.

As the debt doom spiral worsens, credit rating agencies may downgrade sovereign debt.

That, in turn, makes borrowing even more expensive. This is not only for governments, but also for consumers who purchase bonds based on those government yields.

This can trigger a crisis, as we’ve seen in Greece and Argentina in the past.

Now, the worst hasn’t happened yet — and maybe it won’t.

On the other hand, Japan’s debt woes are compounded by an aging population. That increases social security and healthcare expenditures, while at the same time lowers the total workforce and the taxes paid by those aged-out workers.

That leaves Japan between a rock and a monster-stomped hard place.

Will the debt monster eat Tokyo? Can this inflation-fueled creature be stopped? Stay tuned!

The Opportunity

There is an opportunity for savvy investors.

The anguish over rising Japanese yields sent money plowing into the safety of gold.

Now that the problem is “fixed,” gold is pulling back.

Except the problem isn’t fixed. The pullback in gold is only temporary.

And investors could do worse than to buy physical gold or an ETF that tracks physical gold.

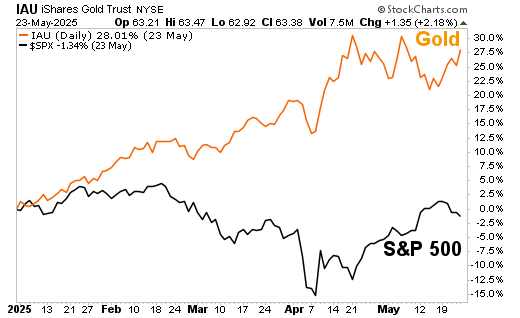

For example, my Resource Trader Members most recently bought the iShares Gold Trust (IAU) on Feb. 3.

They are up 18.9%, far outperforming the S&P 500.

And from the beginning of the year, the outperformance is even more obvious …

We’re holding because I believe there’s much more to come.

The debt monster is coming for Japan — and other indebted nations — and savvy investors will choose golden tickets to get out of harm’s way.

All the best,

Sean

P.S. Gold isn’t the only beneficiary of this evolving landscape.

In fact, Bitcoin just hit a new all-time high. And it continues to gain traction as an alternative asset to play this volatile market.

That’s why we’re putting together a special “Crypto All-Access Summit” on Tuesday, June 3, at 2 p.m. Eastern.

You should receive an email with more information later today. Be sure to check it out and grab your spot while you can.