|

| By Nilus Mattive |

The Federal Reserve cut its target interest rate yet again last week, bringing the Fed Funds rate down to a range of 3.75% to 4%.

That’s the lowest rate in three years.

And the usual people — especially Wall Street speculators and other easy-money addicts — cheered the news.

Responsible savers, retirees and longer-term investors? Not so much.

After all, lowering shorter-term interest rates greatly impacts anyone trying to keep larger amounts of money safe while still earning a somewhat reasonable return.

So once again, the Fed’s easy-money sword has slashed future returns from things like savings accounts, money markets and CDs.

That’s especially problematic at a time when inflation is still running 50% HIGHER than the Fed’s own stated target.

Savers now have even less chance of keeping up with rising prices.

And what’s worse is that lower interest rates are likely to stoke even MORE inflation going forward.

So, the easy-money sword cuts your wealth in two different ways!

This point isn’t completely lost on the Fed, mind you.

One FOMC member — Kansas City Fed President Jeffrey Schmid — actually voted against lowering rates at all.

He said:

“I do not think a 25-basis-point reduction in the policy rate will do much to address stresses in the labor market that more likely than not arise from structural changes in technology and demographics.”

“However, a cut could have longer-lasting effects on inflation if the Fed’s commitment to its 2% inflation objective comes into question.”

However, Stephen Miran, who was the chair of President Trump’s Council of Economic Advisers when he was hand-selected to take a leave of absence and join the Fed, voted for an even BIGGER half-point interest rate cut.

This is only the third time since 1990 that members have dissented in completely different directions.

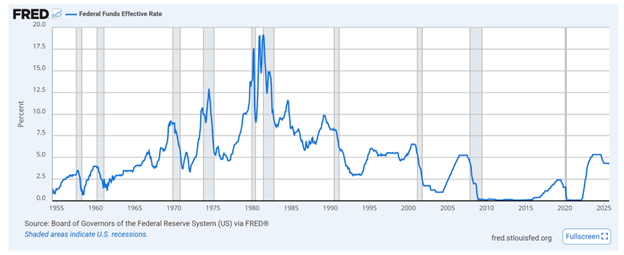

Now, just for a little perspective, here’s a 70-year chart of the Federal Reserve’s target interest rate …

As you can see, interest rates are already low by historical standards.

Prior to the year 2000, rates were typically in the 5% range.

They rarely went much below that between 1970 and 2000, in fact.

And there were even times when rates were two or three times higher than they are right now!

Even including the last 20 years of artificially low interest rates, the Fed funds rate has averaged roughly 4.6% since 1954.

That means the new target range is already about three quarters of a point BELOW the long-term average.

So, there is absolutely no reason that the Fed should have been even more aggressive than it was.

What they did is already bad enough for savers.

It’s especially bad with inflation at, or maybe a bit above, the long-term averages.

And it’s probably bad for the very people celebrating easier money, too.

Because as we’ve seen consistently over the last 25 years, lower interest rates might keep huffing more air into bubbly markets, but they don’t permanently alter gravity.

They just prolong the inevitable and lead to bigger crashes down the line.

So, what should you do about all of this?

How can you stay safe but still earn the type of steady income you want?

First, make sure you’re adequately diversified into a range of different assets.

That way your portfolio can continue to do well no matter what happens in the stock market (or when).

Then, to get big cash payments virtually on demand, strongly consider using the little-known strategy I outline in this video.

You can pretty much get any amount of money you want … on whatever schedule you want … from just about any type of asset you want.

In fact, you don’t even need to own the investment to start getting paid!

I actually just sent out a new recommendation to a small group of readers this past Friday that generated $1,040 from a rather boring blue-chip company that you have definitely heard of.

And if you want in on the next idea I’m sending out this coming Friday, all you have to do is watch my video and follow the instructions at the end.

It’s totally up to you.

But one thing I’ve learned after more than 25 years as a professional investment analyst is that the Federal Reserve is far more likely to bail out its banking buddies on Wall Street than conservative savers and investors on Main Street.

Best wishes,

Nilus Mattive

P.S. That strategy I mentioned is also rather conservative. Which is why we have a 93.8% win-rate going all the way back to January 2020.

We go into much greater detail on the track record in the video.