|

| By Sean Brodrick |

“The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.”

— George Orwell, 1984

If you look at the government’s “benign” inflation data and find it disconnected from prices you’re paying, you’re not alone.

A December Associated Press survey found roughly 9 in 10 adults noticed unusually high prices for groceries and other items.

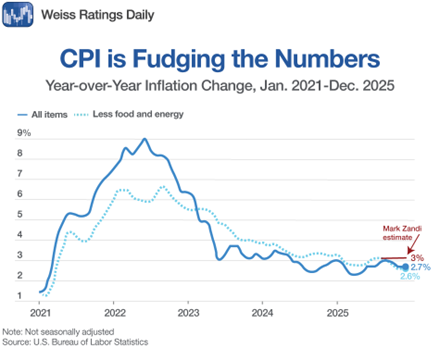

The government’s latest data show consumer inflation running at about 2.7% year over year as of December 2025.

That’s above the target of 2%, but not “too” bad, right?

Except it’s wrong.

We know that because the government admits it is guessing at more than a third of the numbers.

Now, the government has always fudged the numbers a bit.

About 10% of them, because there isn’t timely reporting. But due to the government shutdown last year, the Bureau of Labor Statistics stopped physically collecting data.

Instead, Uncle Sam ASSUMED that prices stayed FLAT for many items.

The assumption soared to 90% during the shutdown and ended the year at 40%.

All this assuming is, as the old saying goes, “making an ass out of ‘u’ and me.”

Here’s a chart of the official inflation data and Mark Zandi’s — Chief Economist at Moody’s Analytics — estimate …

The most significant "fudging" occurs in categories that rely on physical or telephone surveys, such as clothing, services and food items.

So yeah, the inflation at your grocery store IS higher than Uncle Sam will admit.

Why Does This Matter?

It’s likely that inflation will be increasingly underestimated in the future.

And that means the “data” will allow the Federal Reserve to cut interest rates when it shouldn’t.

Remember, the Fed is already under extreme pressure from President Trump to lower interest rates.

This combination of underreported inflation and falling rates can blow up in America’s face.

Students of history know we’ve seen this before.

The Nixon Tapes revealed that President Richard Nixon pressured Federal Reserve Chairman Arthur Burns to keep interest rates low and the money supply high to ensure a booming economy for his 1972 re-election.

Yielding to the pressure, the Fed lowered the federal funds rate from 5% at the start of 1971 to 3.5% by the end of the year, while the money supply (M1) grew at its fastest rate since World War II.

That provided a short-term economic boom, and Nixon won 49 states in the election.

But …

And you know there’s always a “but” on stuff like this …

A Decade of Stagflation

By 1973, shortly after the election, inflation began to spiral out of control.

This led to a decade-long era of stagflation (high inflation, stagnant growth and high unemployment).

You know what did well during this timeframe? Gold!

It rallied about 2,300% during the stagflationary period.

Sure, there’s more to it than that.

And I’ll give you my thoughts on how high gold could rally another time.

My Gold Target ISN’T High Enough

I do believe my long-term target of $6,908 — which I’ve held since October 2024 — is TOO LOW and needs to be adjusted HIGHER.

The debasement trade is in full swing.

Other countries are pursuing de-dollarization.

Long-term, this could be disastrous for America.

So, I’ll crunch the numbers again and get back to you.

That said, I fully expect the White House to pull out all the stops to juice the economy going into the mid-term elections — just like Nixon did.

So, stay long stocks.

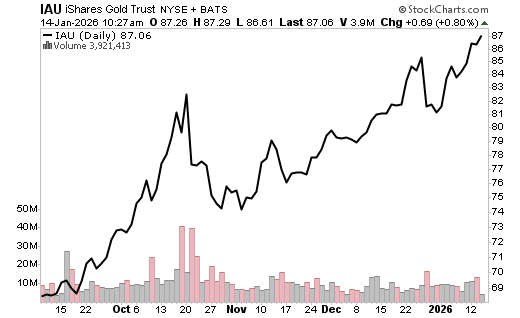

But if you’re not already long gold, consider something like the iShares Gold Trust (IAU), which holds physical gold.

This is just one of many supercycles I’m tracking.

Later today, I will reveal exactly what I’m watching for this year … including three under-the-radar stocks to take advantage.

All the best,

Sean