|

| By Jim Nelson |

Savers and producers are not at war. Neither are the different generations of Americans, despite headlines like this:

And this:

And my favorite:

The goal of most investors is to build their nest eggs to have financial freedom, often in retirement. That, despite tremendous stock market growth during all those years of low interest rates, is just not easy.

And it’s only gotten worse.

With an economic shock every decade, those gains are easily wiped out. Other financial problems arise like unexpected medical bills, job losses and family emergencies.

This isn’t a “boomer vs. millennial” issue. It’s a savings issue.

Worse, when you need it most, it becomes an income issue.

For those lucky enough to actually retire, the total amount needed to comfortably live off of is starting to look unattainable.

An old rule of thumb when planning for retirement is to save enough to live on just 4% of your savings each year. Here’s what that looks like today.

- For $40,000, you need $1 million.

- For $80,000, you need $2 million.

- For $100,000, you need $2.5 million.

I hear you say, “Yeah, but what about the interest earned on the other 96% of your savings?”

That’s no longer good enough.

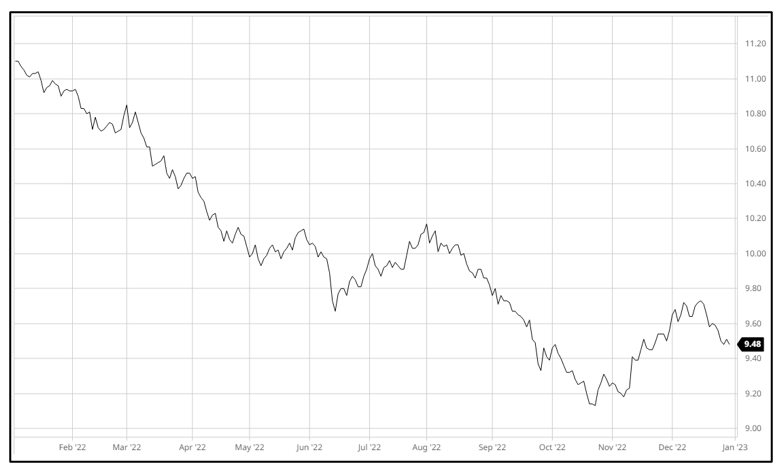

The largest bond fund is the Vanguard Total Bond Market Index Fund (VBMFX). It has nearly $300 billion in total assets, plenty of which are via retirement accounts.

It pays its investors 2.7% in distribution income each year. With inflation coming down over the past year, that should be good enough, right?

Actually, with inflation where it stands today, it isn’t keeping up. Even if the Fed does wrangle the inflation rate back to its 2% target, there’s still the fact that a saver’s investment principal can still be destroyed.

That’s exactly what happened last year to these kinds of investments:

Click here to see full-sized image.

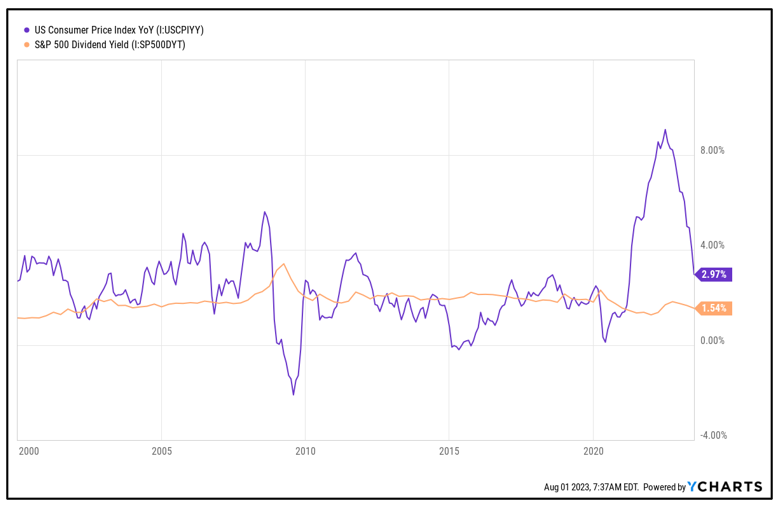

Well, what about dividends? Surely, dividend-paying companies can help offset inflation and help pad the income you receive from your savings.

Well, maybe several decades ago, that was the case. Since the turn of this century, it really hasn’t.

Click here to see full-sized image.

Here, we have the U.S. Consumer Price Index year-over-year change dating back to 2000. Alongside it, we have the dividend yield of the S&P 500 index of stocks.

While they often come close to each other, dividends certainly don’t have long stretches of beating inflation. Most recently, it’s not even been close. Inflation has been winning.

This doesn’t even touch on the fact that workplaces have stopped offering real pension plans … nor the fact that fewer and fewer workers are even eligible for retirement benefits due to the spike in freelance and “gig” jobs.

So, where do we stand today?

According to CBS News, the number of 401(k) accounts with more than $1 million of assets fell 32% last year — to just 299,000.

Think about that. The number of 401(k) accounts — the most popular type of retirement account these days — with $1 million is less than 300,000.

As of earlier this year, there were 48.6 million Americans receiving Social Security retirement benefits. That number is growing even faster since the pandemic … with a 250% spike in new recipients in 2020 and 2021 compared to the previous decade.

If $100,000 in annual income is the goal from retirement savings, these numbers just don’t add up. Even if you can live off of just $40,000 per year in your golden years, you better hope you have one of the 299,000 $1 million accounts.

Unfortunately, Social Security is more than the backstop it was designed to be. Today, it is often the only retirement income left.

That brings me to something even more serious than the generation-bating headlines and feuding between those who have saved and those still saving. This is all about …

The Great Income Emergency

So, bonds aren’t cutting it anymore.

According to Bankrate.com, the average yield on a 5-year CD is just 1.35%, which is actually up as of late.

And dividends by themselves haven’t consistently outpaced inflation, even before the recent spike.

This is the “Great Income Emergency.”

In short, savers just can’t live off their retirement accounts the way they used to. Those nest eggs don’t produce enough income to live respectably in old age like they once had.

Well, what if there is another way to increase income from your portfolio?

What if it not only boosts the income you’d get elsewhere by $200, $500, $1,000 or even more on nearly every weekly trade … but does so with a success rate of 97%?

It exists. And while very few people have ever heard of it, it’s the only solution I see for this emergency. The only way to battle a war on income is with more income.

We recently opened the door to a truly unique income opportunity.

Weiss Founder Dr. Martin Weiss just put together an exclusive presentation to show you this amazing income strategy.

Its goal is simple: Find out how to collect an extra $1,000 in income nearly every week, or about $50,000 per year.

If you, too, see the writing on the wall concerning this “Great Income Emergency,” I urge you to watch this new presentation.

It starts at 2 p.m. Eastern. Click here to catch it live.

Sincerely,

Jim Nelson

Managing Editor

Weiss Ratings Daily