|

| By Karen Riccio |

I don’t have to tell you that stocks have shot up since the recent election.

What’s interesting, though, is the exuberance that comes with indexes blasting through round numbers. Many experts refer to those as psychologically important levels.

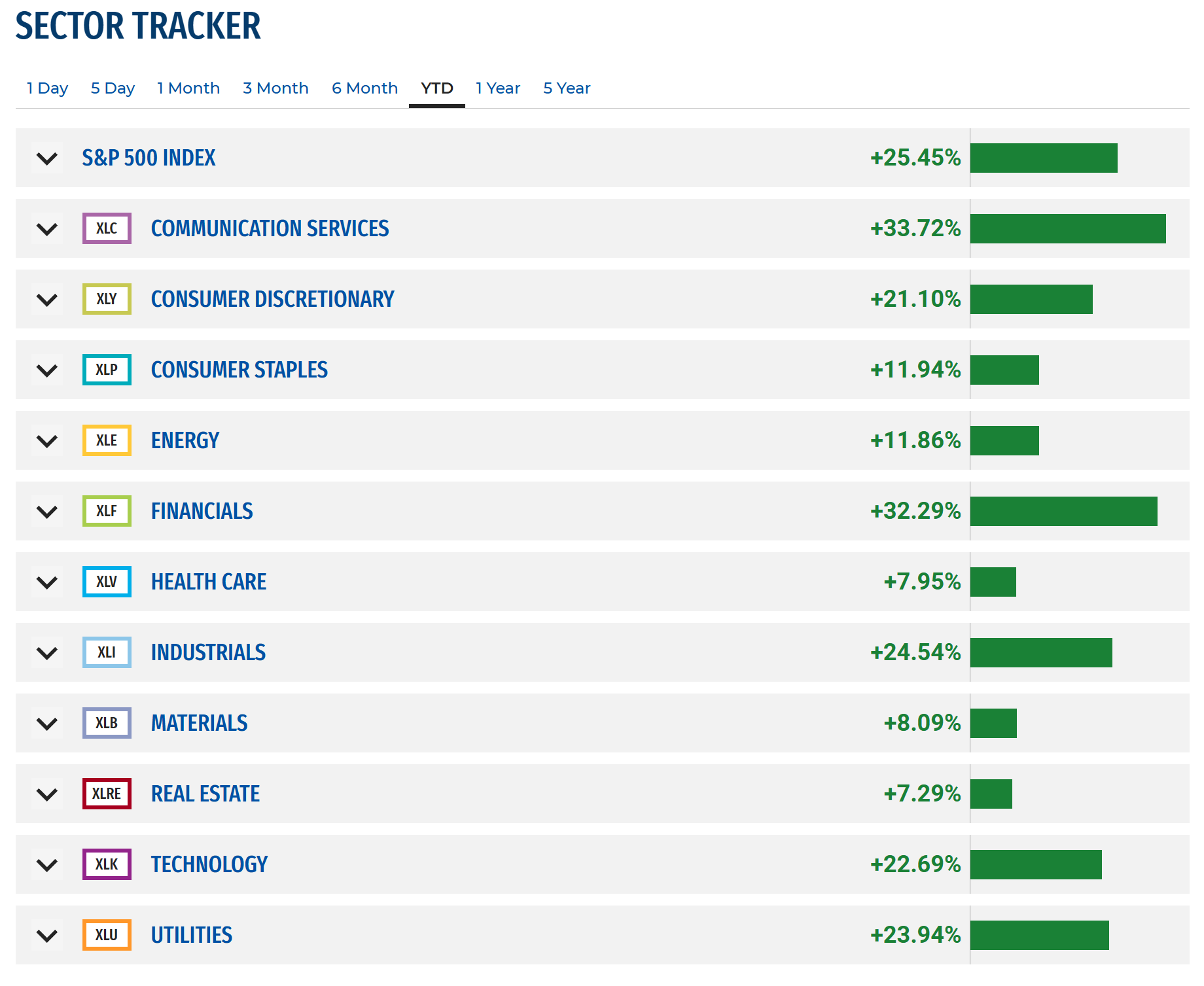

The broad-based S&P 500, for example, now sits right at 6,000. That gives it a current year-to-date gain of 25%.

That’s a lot. The big-cap index is lucky to rise 10% in any single year.

In fact, it’s hard to name one group of investments that hasn’t gone through the roof this year. Every single sector in the S&P 500 is in the green.

Granted, some sectors have done better than others. And these are just year-to-date numbers. We still have six weeks of potential upside.

At the same time, there are still a lot of uncertainties remaining.

We will have a leadership change in the White House and the Senate.

We have ongoing wars in the Middle East and Europe … with threats of unrest in Asia.

Interest-rate policy seems set for right now. But exactly how many cuts, and what size, is still up in the air.

There’s also no love between the incoming U.S. president and the head of the Federal Reserve.

Finally, tariffs, tax policy changes and more are on deck. We could start to see those decisions, and their effects, in the next few months.

We’ll keep you updated on all the latest developments and how to play them, as they unfold.

For now, it’s likely that the broad-market rally has been kind to your portfolio. And now sure looks like a good time to start protecting those gains.

That way, you won’t miss out on more potential upside. But you will be ready for the inevitable ebb that comes after the post-election wave.

Your Own Personal Hedging Strategy

In the past, hedging was complicated. You had to sell short. Or you had to use futures.

In either case, you could expose yourself to unlimited risk.

Today, it’s much simpler because you have access to inverse ETFs. Those are designed to go up when a particular stock index or sector goes down.

The good news: You can buy these inverse ETFs just like any other ETF — through your same brokerage, with the same low commissions and the same flexibility to get in and out as you please.

More good news: You can buy single-leverage ETFs, designed to go up 10% for every 10% decline in the index.

Or you can buy double-leveraged ETFs, designed to go up 20% for every 10% decline. Though, it’s important to be careful with these. More on that in a minute.

For your own purposes, I suggest looking at a series of inverse ETFs that you can use for protection against declines in many major sectors.

Those sectors include real estate, financials, consumer goods, semiconductors, technology, emerging markets and even foreign countries.

This allows you to match your hedges more closely to the sectors or styles you’re heavily concentrated in.

For example, if you have a lot of technology stocks, you could hedge with the ProShares Short QQQ (PSQ).

This fund seeks to produce the inverse results of the Nasdaq-100 Index, which holds many of the world’s most important technology stocks.

If you have a lot of small caps, you could use the ProShares Short Russell2000 (RWM). As its name suggests, it produces inverse gains and losses of the small-cap Russell 2000 Index.

If you have a broadly diversified domestic portfolio, you could use the ProShares Short S&P500 (SH).

And so on.

Now, what about those leveraged inverse funds? After all, getting two or three times the inverse of a crashing index sounds near-perfect, right?

Well, for short periods of time, leveraged ETFs — both those aimed to profit from index gains and losses — can be great for your bottom line.

But it’s when you use these as hedges against the possibility of a decline that it becomes a problem.

You see, they suffer from a phenomenon called …

Leveraged ETF Decay

Here’s how it works …

Since inverse ETFs go up when their corresponding index goes down, the reverse is also true.

If the underlying index goes up, like we’ve seen so far this year almost across the board, the inverse ETF goes down by roughly the same amount.

That’s fine and easy math for single-leveraged ETFs. But when you compound leverage with those declines, it gets trickier.

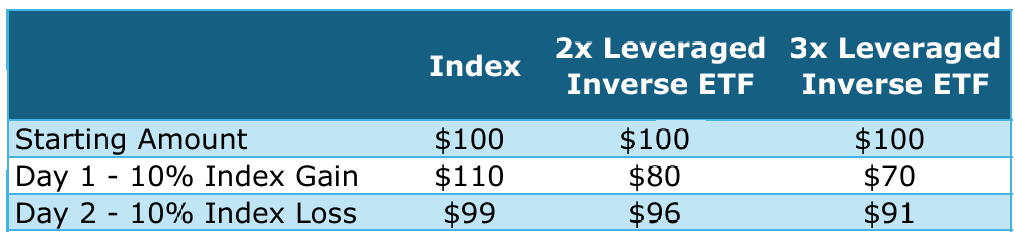

Take this example. Let’s say an index goes up 10% in a day. Its 2x leveraged inverse ETF would then go down 20%.

The next day, the index goes back down 10%. You might expect the ETF to go up 20%, right? Yes, but it might not give you the results you expect.

You see, since the ETF started so much lower after day one, it might have to rise 25% to get back to even the numbers before the first decline.

Here’s how the math works.

As you can see, the longer this kind of up and down market movement lasts, the more ground the leveraged ETFs have to make up just to match the index’s movements.

So, when you put your own personal hedging strategy in place, be sure to consider the time frame you want to keep that hedge active.

Of course, there’s another way to use ETFs — both inverse and not … leveraged and not …

In fact, our resident quant legend Gavin Magor has integrated them into his strategy that has a 100% success rate in the 120 days following every election since 2003.

And guess what? We’re in just such a time frame right now.

He is set to share the details on Tuesday, Nov. 19, at 2 p.m. Eastern at his special “Ride the Post-Election Wave Summit.”

You’ll want to be there. All you have to do is add your name to the list here.

Best,

Karen Riccio