|

| By Sean Brodrick |

It doesn’t surprise me that we’ve seen market prices pull back lately.

Even though earnings estimates for the S&P 500 are rising, most sectors look pricey as hell.

However, there is one investment that looks very attractive, and it could make you Texas-sized money!

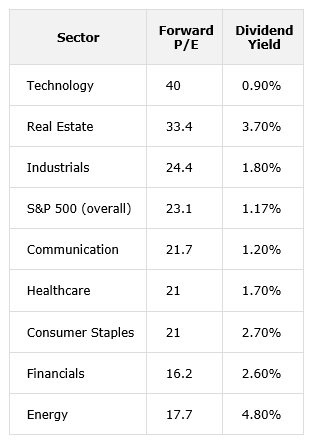

See if you can find it in this table of the different S&P 500 sectors, along with their forward price-to-earnings ratios and dividend yields.

I’m talking about the energy sector.

That might surprise you because energy is the sector everyone loves to hate.

And that’s because energy stocks haven’t gone anywhere in three years.

I believe that’s about to change in a big way.

One reason would be sheer value.

Energy has the second-lowest forward price-to-earnings ratio among the S&P 500 sectors, and the best dividend yield.

In fact, its dividend yield is FOUR TIMES that of the S&P 500, which recently stood at 1.17%.

A Sector That Pumps Money

What’s more, large integrated energy companies are generating record free cash flow due to disciplined capital spending, high operational leverage and resilient oil and gas prices.

This has enabled aggressive dividend growth, buyback programs and enhanced returns to shareholders.

These factors historically support further upside in stock prices.

This gets really interesting because forces are lining up to push oil prices higher.

Oil prices are near the bottom of the range they’ve traded in all year. I don’t believe they will stay this low.

Demand Is Climbing

Let’s start with demand.

Forecasts vary, but the U.S. Energy Information Administration (EIA) expects global oil demand to grow by 1 million barrels per day this year and by 1.1 million bpd in 2026.

OPEC, on the other hand, is a bit more optimistic.

The cartel expects oil demand to grow by 1.3 million bpd in 2025 and by 1.4 million bpd next year.

So, demand is there … and growing.

Drilling Dries Up

Meanwhile, oil companies are cutting back on exploration, which is where we get new oil.

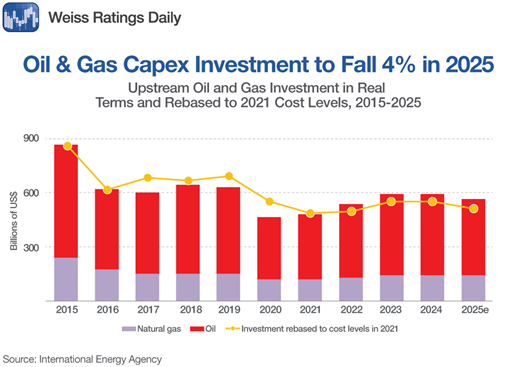

Take a look at this chart, showing how much U.S. oil and gas companies are investing in exploration and production …

Investment in finding and extracting crude oil and natural gas peaked years ago.

Year over year, it’s expected to fall by 4%. But, figuring in inflation, it’s actually a 7% drop.

The less money companies invest in finding oil and gas, the less they’re likely to find.

Over the longer term, years of underinvestment put upward pressure on prices.

Why is this happening? Major producers are maintaining strict capital discipline and prioritizing returns over expansion.

And that supports higher long-term prices and more sustainable profits.

Geopolitics Drives Risk & Prices Higher

Have you seen that, in response to waves of Russian drone and missile attacks, Ukraine is sending drones to blow up Russia’s oil and gas infrastructure?

That is causing problems across Europe, which still depends on Russian oil and distillates, as well as in other countries around the globe.

This adds to ongoing geopolitical risks (Middle East tensions, a potential U.S. invasion of Venezuela, etc.).

So, add geopolitical heat to rising demand and less exploration, and that’s very supportive of oil prices going forward.

How You Can Play It

The best way is to buy individual oil companies that are growing supply while keeping a lid on costs and paying fat dividends.

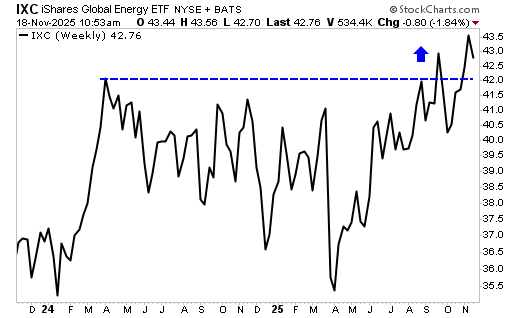

But if you want just to buy an ETF, you can pick up something like the iShares Global Energy ETF (IXC).

The IXC gets a “C+” from Weiss Ratings, has a dividend yield of 3.7%, an expense ratio of just 0.4% and is stuffed with big global oil companies.

You can see the IXC broke out through overhead resistance and seems to be zigzagging higher.

It should go to at least $61, and maybe higher.

You can already find value in oil companies. Now you can drill them for profitable investments, too.

All the best,

Sean

P.S. The other major commodity you should own to close out 2025 is gold.

I’ve written numerous times about the dozens of reasons why the recent rally is just the start.

My price target is $6,900. And I have exactly the companies you’ll want to own to play it.