The Last Time This Happened, I Tracked 96 10,000% Winners

Editor’s note: We’ve been following the massive rally and current holding pattern in Bitcoin for a few weeks now.

And while it’s not a traditional finance asset that’s normally discussed here, the gains already seen — and likely to be seen — definitely should interest us all.

So, we asked our resident crypto expert, Juan Villaverde, what he expects to happen next. He says you can buy BTC and be done with it. Or you can spend significantly less on opportunities with rocket-ride profit potential.

If the second option appeals to you, you’ll want to read this …

|

| By Juan Villaverde |

Bitcoin beelined to $100,000 last week. It’s hesitating there for now.

However, the OG crypto looks like it can go higher. And it can do so in just the next few weeks.

How can I say this with such confidence?

Well, on Sept. 6 — a full two months before Bitcoin’s stunning surge began on Nov. 5 — I told readers:

“The next big cycle turning point, according to my Timing Model, is Tuesday, Nov. 5.

“That’s Election Day in the U.S.

“If the pattern holds, that date could mark a major low in the market … followed by yet another rally.”

Sure enough, Bitcoin started soaring that very day.

It’s now up more than 40%.

And it’s no wonder! Investors are pouring into the No. 1 crypto after its low on Nov. 5.

After Election Day, investors rushed a whopping $1.4 billion into crypto ETFs … in just a single day!

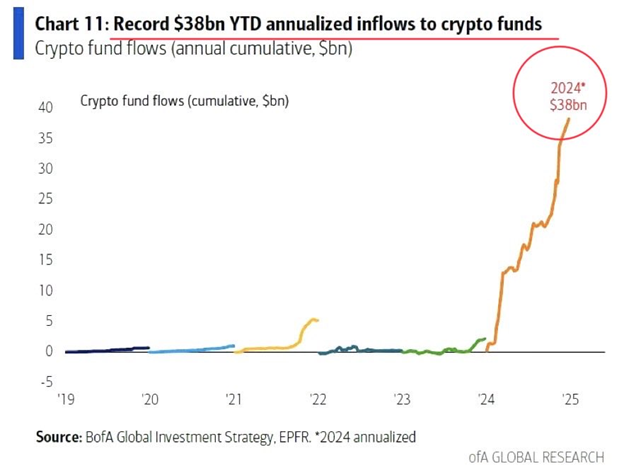

Bank of America says a total of $38 billion poured into these funds so far this year.

And this is only the beginning.

But, while Bitcoin should be a staple in any crypto portfolio, it isn’t where savvy investors will find the outsized returns the crypto market is known for.

That’s because its growth potential is limited.

In fact, I expect BTC to hit $150,000 this cycle.

That’s an incredible jump in price! But it only represents a roughly 1.5x increase from the cycle low on Aug. 6.

But many smaller cryptos are likely to see much larger gains.

During a prior bull market, I counted 96 smaller coins that rose at LEAST 10,000%.

That means investors had the chance to make a minimum of 100x their money … 96 separate times!

That certainly leaves Bitcoin’s anticipated 1.5x growth in the dust.

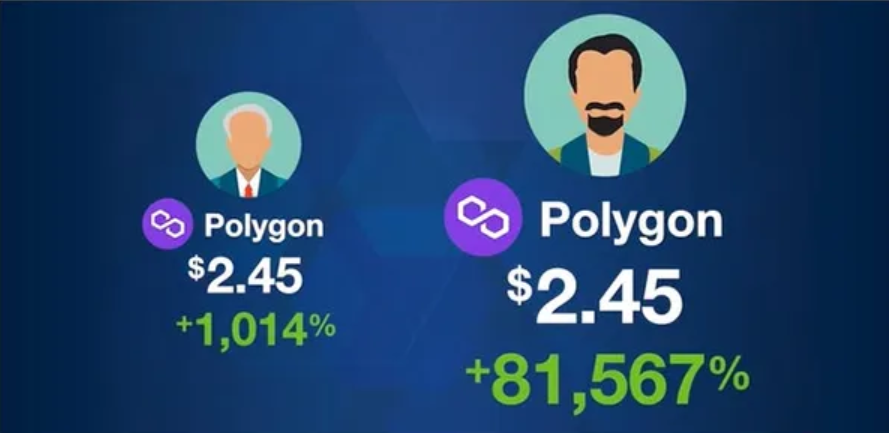

Part of why you can get into such high-growth opportunities is because of how I recommend you buy them. Take Polygon …

If you bought it the day it was first listed on Coinbase, you’d have made a gain of 1,014%. Great, right?

Well, if you bought through my method, that gain would have been 81,567%!

This is now possible again because we are now entering a new phase of the bull market, what I call a Crypto Superboom.

Historically, this has been an explosive part of a crypto cycle. Growth investors unafraid of additional risk exposure can find opportunities for gains that make Bitcoin’s returns look downright sluggish.

And this current cycle holds even more promise than those I’ve observed in the past. That’s because we are seeing an unprecedented combination of four powerful bullish forces.

Together, they could push the market to enter the biggest crypto superboom on record.

It’s why I just joined Dr. Martin Weiss for an emergency crypto briefing to help you prepare for this superboom.

In it, I break down all four of these forces …

How I expect them to play out …

And what sort of opportunities investors should be on the lookout for.

But please take note — there is not much time left to get ahead of this bull market.

That’s why I urge you to watch my latest briefing now.

In it, Dr. Martin Weiss and I cover everything you need to know about this opportunity.

And how you can learn more about the three cryptos I believe have the most potential to outperform.

This video won’t be online long. So, watch it now before you miss your chance.

Best,

Juan Villaverde