|

| By Sean Brodrick |

Bitcoin is up about 30% since the election. But you know what? The BIG Bitcoin rally hasn’t even started yet.

I’m talking about the coming rally powered by massive amounts of buying by governments, big banks and corporations, as Bitcoin becomes a global currency.

Because I’ll tell you this: Donald Trump won the presidential election. But the biggest winner of the election was cryptocurrencies … specifically Bitcoin.

Before the election, Trump pledged to make America "the crypto capital of the planet" and create a “strategic reserve” of Bitcoin.

His campaign accepted donations in cryptocurrency. He courted crypto fans at a Bitcoin conference in Nashville in July. He also launched World Liberty Financial, a new venture with family members to trade cryptocurrencies.

Also, Trump promised to remove the chair of the Securities and Exchange Commission, Gary Gensler, as quickly as possible. Gensler has been leading a U.S. government crackdown on the crypto industry.

By these measures, Bitcoin was the real winner of the election. And since Bitcoin has a fixed supply cap of 21 million, prices can really move.

So, let’s look at the forces potentially powering up Bitcoin’s big move in 2025 …

Force No. 1: Governments

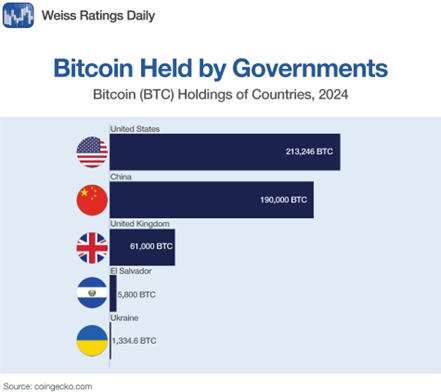

Recently, Bitcoin reserves held by governments account for 2.7% of the total 21 million supply of Bitcoins.

The largest holder is the U.S. government, which has over 210,000 Bitcoins. Here are the biggest government holders …

Germany used to be on that list, with about 50,000 Bitcoins. The Germans sold it all in June and July. In retrospect, that decision should go down as well as the Hindenburg.

There’s a bill already working its way through Congress — the Bitcoin Act of 2024 — which will establish a U.S. Strategic Bitcoin Reserve. It will likely be taken up again next year.

The bill includes a Federal Bitcoin Purchase Program that directs the Secretary of the Treasury to buy up to 200,000 Bitcoins annually for five years.

As the U.S. builds a strategic Bitcoin reserve, we can expect other governments to do the same. And it won’t stop with governments.

Force No. 2: Corporations

Recently, public companies held a combined 305,000 Bitcoins. However, most of these are held by just a few companies.

At its shareholder meeting in December, Microsoft (MSFT), a Magnificent 7 tech firm, is letting investors vote on whether or not Bitcoin should be added to the corporate treasury.

The results of that vote are hard to predict. But if Microsoft says “yes,” expect other big corporations to follow suit.

Force No. 3: Big Banks

Big banks are already dipping their toes into Bitcoin.

Quarterly filings show that Goldman Sachs (GS) and Morgan Stanley (MS) bought more than $600 million in Bitcoin exchange-traded funds in the second quarter.

If the government starts building a strategic Bitcoin reserve … and ESPECIALLY if corporations start building Bitcoin assets, I’d expect big banks to build up their own Bitcoin reserves. And not just ETFs, but actual cryptocurrency.

As more corporations rely on Bitcoin, the big banks will need to own it to facilitate transactions.

And in 2025, I expect these Bitcoin dominoes to fall — the government, corporations and big banks. And that will kick Bitcoin’s climb into overdrive.

My colleague Juan Villaverde, a cryptocurrency expert, says he expects Bitcoin to climb to $100,000 by the end of this year and $125,000 by February 2025. That would be a climb of 42% from recent prices. Wow!

How You Can Play It

You can buy Bitcoin. Or you can buy one of the ETFs that make it easy to get exposure to the leading cryptocurrency.

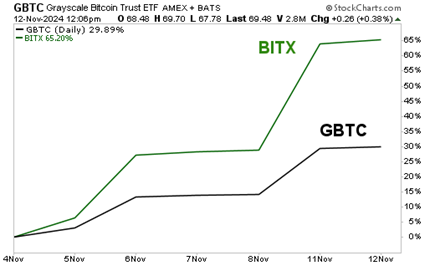

Two examples would be the Grayscale Bitcoin Trust ETF (GBTC) or the 2x Bitcoin Strategy ETF (BITX).

As the names imply, GBTC tracks the percentage change in Bitcoin fairly closely, while BITX is much more speculative, aiming to track twice the daily change in Bitcoin.

You can see that since election day, Grayscale has done well, up nearly 30%. And the leveraged fund has done even better, up a whopping 65.2%.

Remember, investments go up and down. A 2x Bitcoin ETF would not be for the faint of heart.

Bitcoin is set up to have a very good 2025. You might want a piece of that action in your portfolio.

All the best,

Sean

P.S. Bitcoin isn’t the only asset that’s riding the post-election wave right now. As you know, I like several specific commodities right now. But there are certain stocks set to continue riding higher, too.

That’s why another colleague, Gavin Magor, is hosting a special summit next week. He’ll reveal a strategy with a 100% success rate in the 120 days following every election since 2003. Grab your seat here.