|

| By Sean Brodrick |

The broader market has picked itself up from a panic bottom because the banking crisis seems to be solved. For now.

My question is, how do banks fare in the next crisis? And what could the next crisis be?

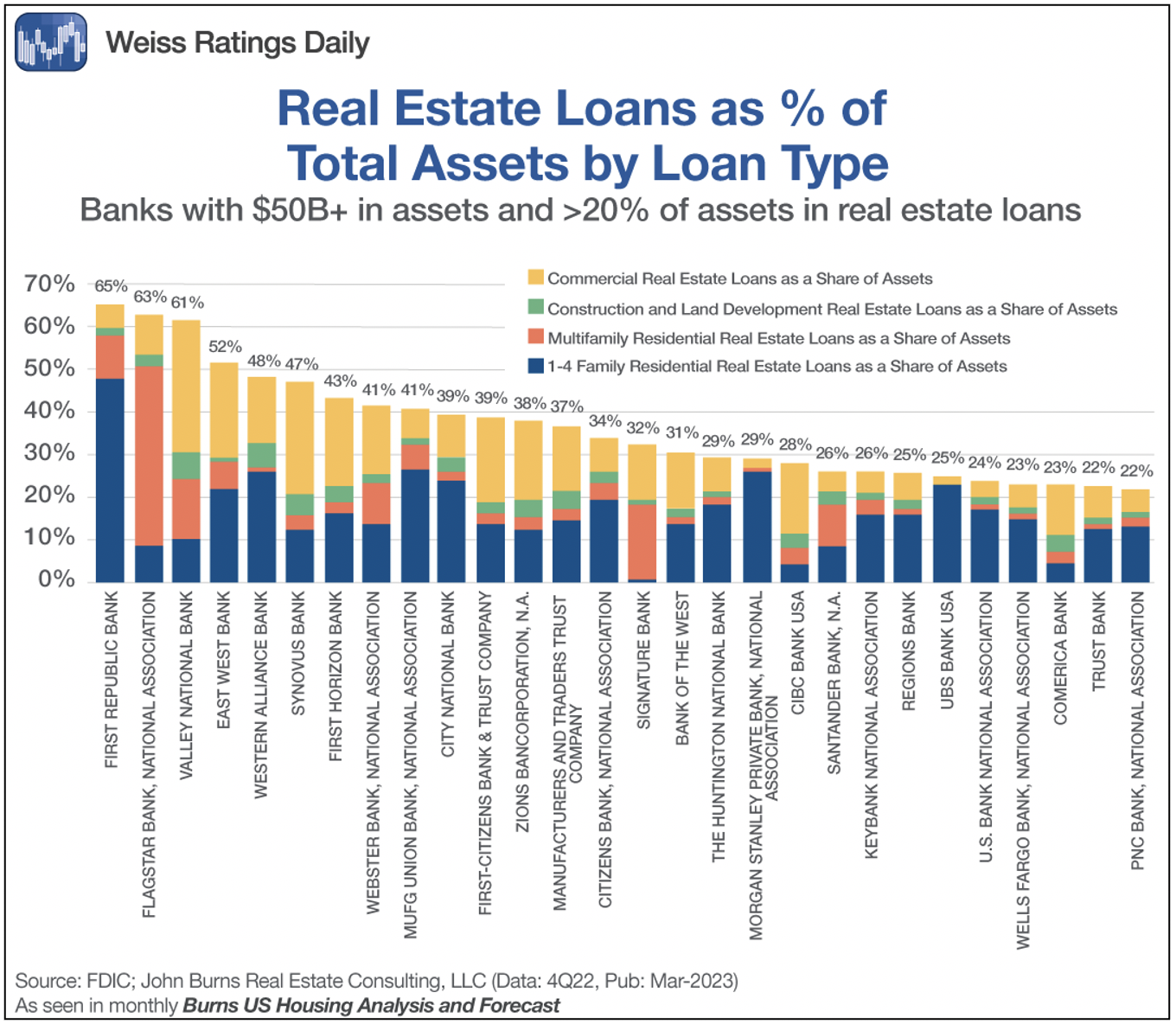

But first, let’s talk about real estate. The hard-pressed regional banks that have been in the news have very large real estate portfolios.

Click here to view full-sized image.

In fact, small- and midsize banks hold 67.2% of all outstanding real estate loans, compared with 37.6% of loans overall. That makes these smaller banks particularly vulnerable to the implosion of a real estate bubble.

Now, with regulators clamping down across the board — barn door, meet a rapidly escaping horse — we’re seeing credit at these small banks tighten up. And yes, that means trouble for anyone wanting a loan. But it potentially means trouble for these banks that have so many real estate loans.

That’s because the loans are on their books as assets. That chart above becomes problematic if those loans go into delinquency, then default.

The good news: The delinquency rate on real estate loans is currently very low at 1.21%, according to the Federal Reserve Economic Data database. During the height of the last real estate crisis, in 2010, the loan delinquency rate hit 10.2%.

Good & Bad News

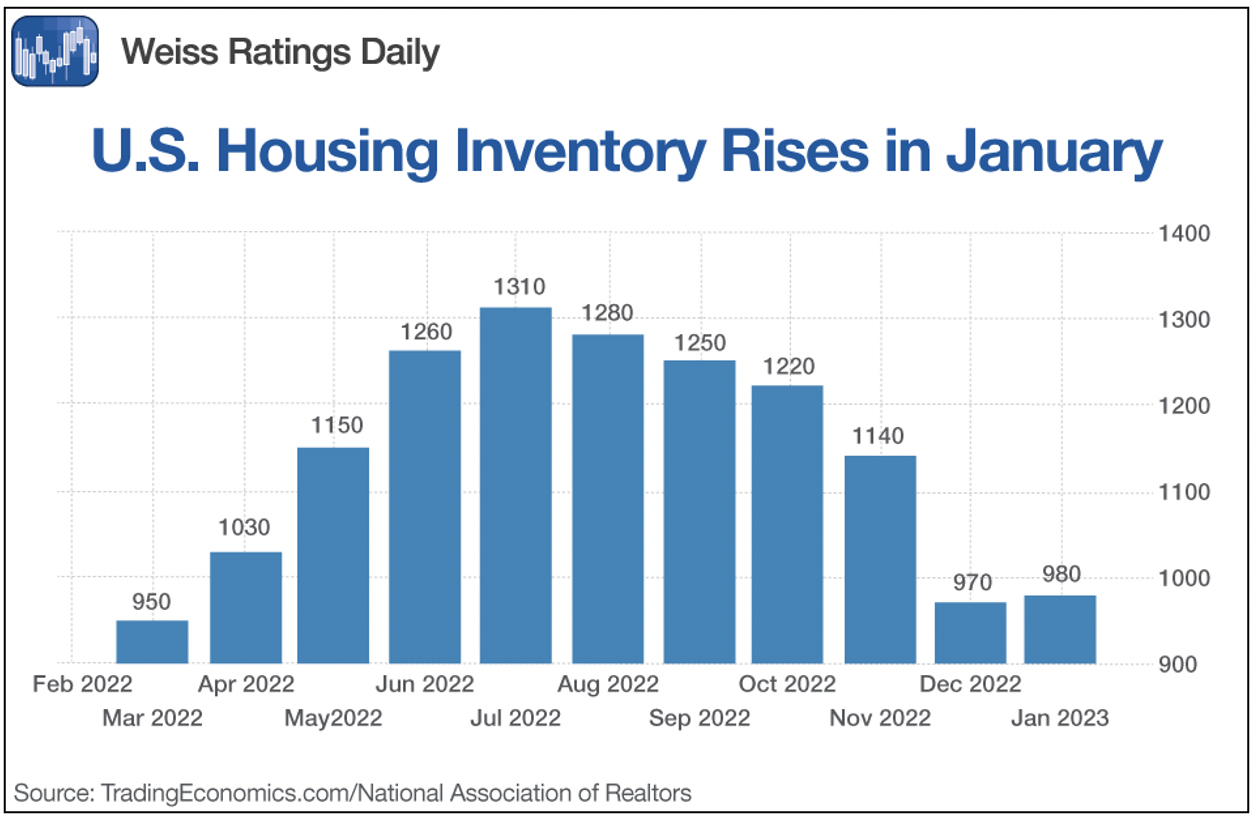

More good news: The number of homes for sale is just under 1 million. Back at the height of the housing market in 2008, it was closer to 4 million. So, there is less inventory.

Click here to view full-sized image.

That is 2.6 months of supply, and a remarkably low level of homes for sale. If you want to be bullish on real estate, that’s the chart for you. If this shortage persists, it’s harder for home prices to crash like they did in 2008.

On the one hand, as you can see from the chart above, the number of homes for sale bottomed in December and is rising. On the other hand, permits to build new homes — both single and multi-family — jumped in February. It was the biggest monthly gain in two years.

What could really go wrong is if investors — squeezed between higher mortgage rates and dropping prices, and seeing more supply about to come on the market — suddenly feel the urge to get out of the market, even if they take a loss.

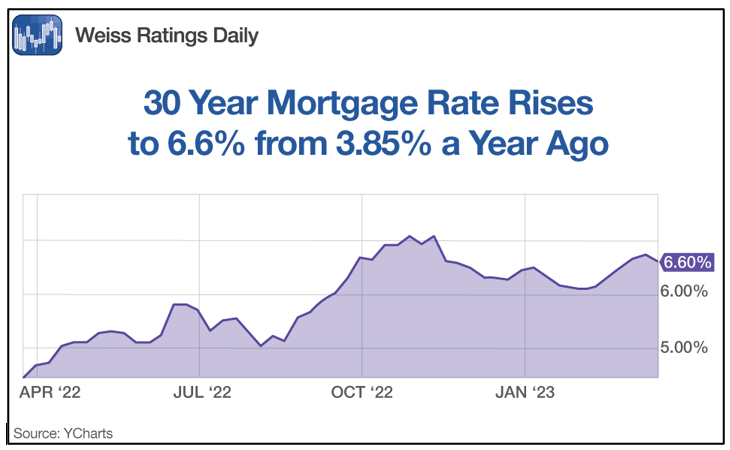

More bad news: Home prices soared during the pandemic, putting many homes at the edge of affordability for home buyers and investors alike. And the rates on 30-year mortgages have soared. While they have eased a little in recent months, mortgage rates are still up 71% in the past year.

Click here to view full-sized image.

The typical monthly mortgage payment for today’s home buyer is at a record high of $2,520. With rates so high, something has to give. And what’s giving is prices.

The latest data, from February, showed the average U.S. home price fell year over year for the first time since 2012, and is down about 4.9% from the peak last summer.

In hard numbers, after peaking at $47.7 trillion in June, the total value of U.S. homes declined by $2.3 trillion.

To be sure, it varies from state to state. In Florida, where I live, home prices are still strong.

But homeowners in California and New York are watching home prices shrink before their eyes. According to a Reuters poll of property analysts, U.S. home prices are expected to fall another 4.5% this year.

When Does a Crisis

Come Home to Roost?

At what point do investors who bought homes with an eye on selling for a higher price start taking a bath? And how long can they keep paying mortgages at rates much higher than a year ago?

So much of the real estate market is a good-news/bad-news situation. For example, existing home sales soared 14.5% month over month in February to end a 12-month streak of declines. That’s good news.

But YoY, sales fell 22.6%. And the average home price slumped, down another 0.2%.

I guess what worries me is the potential for a Minsky moment, which refers to the end stage of a prolonged period of economic prosperity that has encouraged investors to take on excessive risk to the point where lending exceeds what borrowers can pay off.

The combination of inflated prices, sky-high mortgage rates and tightening credit could trigger a Minsky moment in real estate.

And that brings us back to banks. If real estate does nosedive this year, the small- and medium-size banks holding those loans are going to get creamed. Again!

What You Should Do

There are a number of ways to handle this. Having lived through a previous real estate crash, I can tell you what I wish I had done last time.

And that is, I wish I’d taken my available cash and put it into real estate when properties were selling for 30 cents on the dollar. I plan to do that this time.

And the deals can be extraordinary. Here is a real-world example using a condo I own in Tampa: Someone originally bought it for $210,000 near the height of the market in 2006. After the crash, the next buyer picked it up for only $55,000 just four years later. Oh yeah, there are going to be bargains.

To be sure, we will only know property prices have bottomed in the rearview mirror. That’s OK. You don’t have to buy the exact bottom. Close to the bottom will be good enough.

And there are plenty of other good places to invest your money right now. This April 24–26, I will be at the Las Vegas MoneyShow, where I’ll share my best investment ideas for gold, silver, tech and more. I mention this because if you make your reservations now, you can save $50 until April 3 using the coupon code: SPK99. There will be a ton of great speakers and useful investment info in Vegas.

I hope to see you in Vegas. Either way, brace for another potential crisis and more shocks to the banking system. This can be scary, sure. But for smart investors, it’s a real opportunity.

All the best,

Sean