|

| By Nilus Mattive |

The market has what I’m calling a Palantir (PLTR) problem.

It’s this generation’s mania.

This time around, you truly can’t spell mania without “AI.”

You’ve heard me say for a good while now that tech stocks are massively overvalued.

You’ve also seen my predictions that there is big — and possibly imminent — danger that they will drop sharply in value.

But when I start to make comparisons to the late-’90s tech boom, the bulls quickly fire back.

They say that today’s AI leaders are nothing like the fly-by-night internet companies that failed during the Nasdaq collapse.

Their reasoning is simple:

- Companies like Pets.com were not.

Indeed, even Fed Chair Jerome Powell has been making this argument. As he recently told a reporter:

"This [AI boom] is different in the sense that these companies, the companies that are so highly valued, actually have earnings and stuff like that.

“So, you go back to the '90s and the dot-com, they were… these were ideas rather than companies."

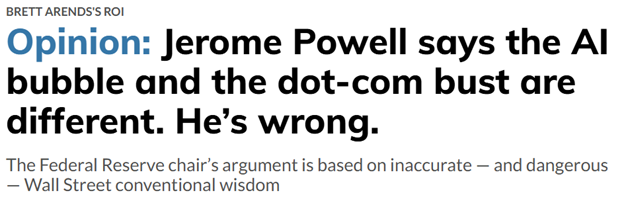

This is selective remembering. And it’s wrong.

A recent MarketWatch opinion piece from Brent Arends essentially echoes everything I’ve been telling you for more than a year now.

Arends perfectly summarizes the reality using data from FactSet:

“The most valuable companies on the Nasdaq at the peak of the bubble, at the end of February 2000, were tech giants Microsoft (MSFT), Cisco Systems (CSCO), Intel (INTC), Sun Microsystems and Texas Instruments (TXN).

“The top 100 on the Nasdaq was dominated by technology companies that were making IT infrastructure, and which had businesses, sales and earnings.

“The cliché of the time was that the dot-com era was like the California gold rush, and the people who were going to make the most money were those selling ‘picks and shovels’ to the prospectors.

“Microsoft, the world's most valuable company at the time with a market value of $465 billion, boasted $22 billion in sales over the previous 12 months, and $8.7 billion in earnings.

“Cisco Systems, No. 2 with a $450 billion market cap, had $15 billion in sales and $2.55 billion in earnings.

“Intel, No. 3 in value at $380 billion, had $29 billion in sales and $7.3 billion in net earnings — and so on.

“Of the top 30 companies on the Nasdaq by value, 23 had had sales of more than $1 billion over the previous 12 months, and 25 had positive earnings.

“The idea that the dot-com bubble was dominated by Pets.com and eToys is just a myth.”

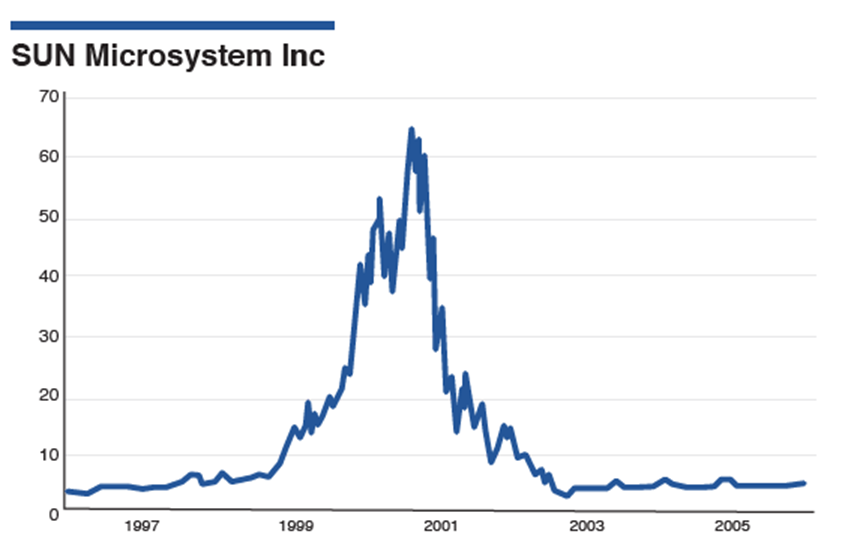

This is precisely why, in September of last year, I told my Safe Money Report readers how even Sun Microsystems’ own CEO, Scott McNealy, tried to tell investors not to pay so much for his company’s stock during the height of the tech bubble.

Predictably, they ignored his warnings.

Predictably, they suffered greatly.

And predictably, millions of investors are doing the same thing all over again today.

In the past, I’ve used Nvidia as a prime example of today’s “profitable picks and shovels” AI darling.

But it’s not even the most extreme case.

Consider Palantir, the AI tech defense software company.

People have made a lot of money with this stock, and that’s great.

But would I buy it right now?

Not a chance.

During Palantir’s third-quarter earnings release last week, the company said profits came in at 21 cents a share on revenue of $1.18 billion.

It also said it expects revenue of roughly $1.3 billion for the fourth quarter. And adjusted operating income should come in between $695 million and $699 million.

All those numbers were better than expected.

But there’s just one problem …

The day of the release, Palantir hit a new all-time high that valued it at about:

- 111x this year’s projected sales …

- 470x trailing 12-month profits … and

- 230x forward earnings estimates.

During the last internet bubble, Scott McNealy said it didn’t make sense to pay 10x his company’s sales.

Yet investors were recently paying 11x MORE THAN THAT for Palantir.

In the financial world, we have a technical term for that type of valuation — stupid.

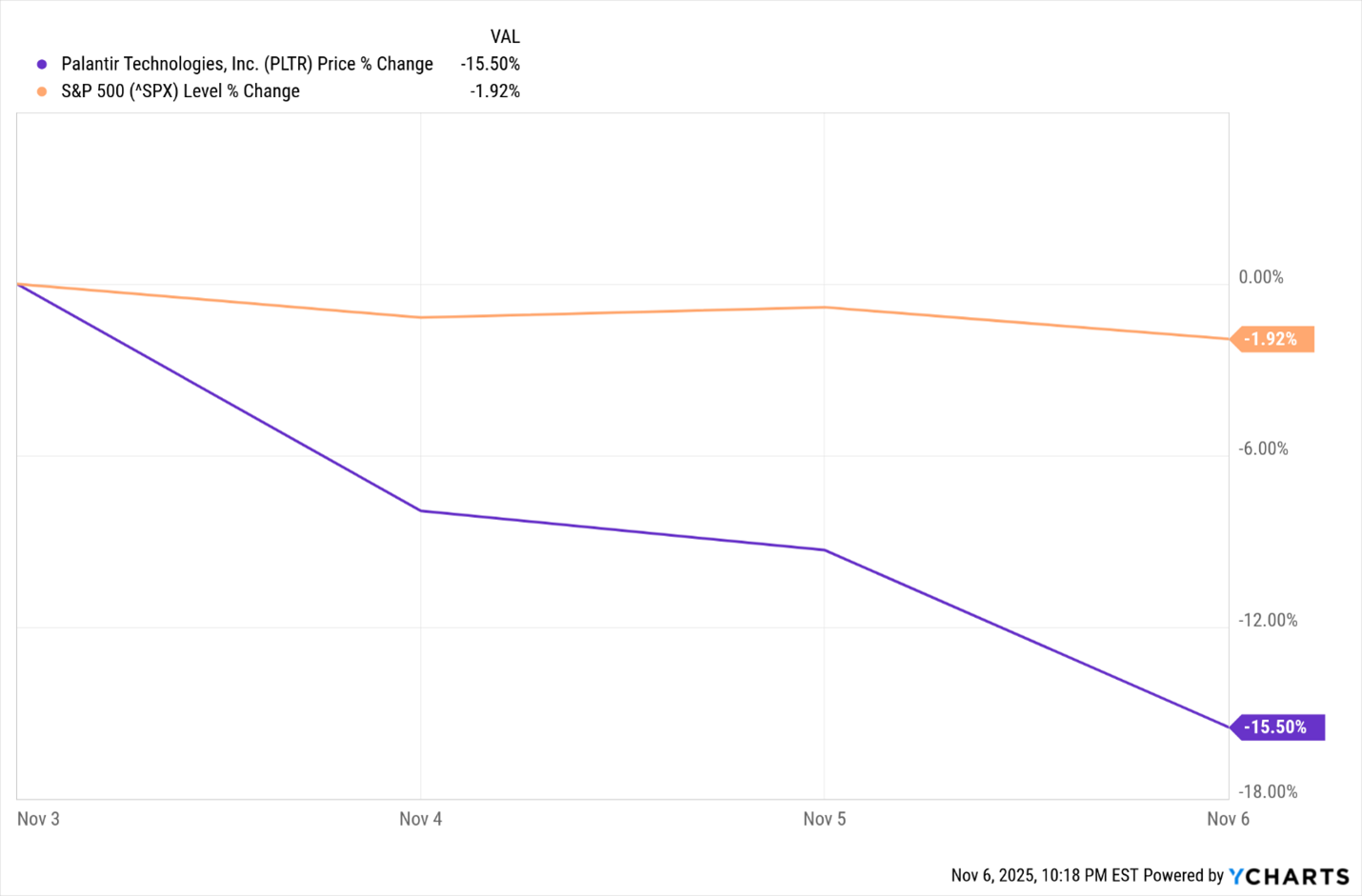

This is why you saw the whole market have a bit of a second thought after the Palantir numbers hit the wires.

Yet it seems like the moment of sanity still hasn’t completely taken hold, and many investors continue to have a “buy the dip” mentality.

This is normal behavior in the waning days of a massive hype-fueled bull market.

But that doesn’t make it safe.

Best wishes,

Nilus Mattive