|

| By Jon Markman |

The unthinkable is happening. Google is being disrupted by a small software startup. Now the search giant finally has a plan to fight back, but it might not matter.

Last week, the chief executive at Alphabet (GOOGL), Google’s parent company, announced that two of its advanced research divisions are merging to build general AI applications.

That’s why investors should buy NVIDIA (NVDA) shares into any weakness. Let me explain.

AI Research Has

Never Been Hotter

OpenAI, the small company behind ChatGPT, is taking the computing world by storm with a next-generation chatbot that appears to behave like a human.

ChatGPT can do everything from writing music, poetry and software code, to carrying out casual conversations about recipes and philosophy. This could be catastrophic to Google’s core business: internet searching.

ChatGPT launched in December and added 1 million active users in its first week. By the end of January, that number swelled to 100 million. For context, this growth, in order of magnitude, is faster than Instagram, TikTok and Google Search, which needed almost one year to reach 100 million users, according to a report from Reuters.

Alphabet’s CEO Sundar Pichai is rightfully concerned.

His plan is to merge Google Brain and DeepMind, its advanced research divisions. While the new subsidiary may lack a creative name, Google DeepMind combines a wealth of real-world AI accomplishments.

Pichai noted last week in his blog post that since 2016, the research teams helped refine Search, YouTube and Gmail and built the computational photography that made Pixel smartphone cameras best-in-class.

The academic triumphs include Transformers, AlphaFold, TensorFlow and JAX, the foundational frameworks that facilitate large language modelling used for general AI system development.

It is undeniable that Google has the intellectual talent and LLM knowhow to fight back against OpenAI. This misses the larger point, though.

This Isn’t a Story

About ChatGPT

AI is a disruptive game-changer.

Research from Lambda Labs shows that ChatGPT could have been created in only 34 days at a cost of a mere $5 million.

Analysts at Lambda figure that 355 years would have been required using traditional methods to train LLMs. Developers at OpenAI blew up the norm. They used 1,023 A100 graphics processing units scaled into a supercomputer. The NVIDIA GPUs used massively parallel designs to bust through the complex math in short order.

This feat of brute force pushed demand for NVIDIA gear through the roof. Two-year-old A100s are now selling on eBay for up to $45,000 apiece. The retail cost is $10,000, if you can find one.

Nvidia reported in November that Microsoft (MSFT) would acquire “tens of thousands” of these GPUs for its Azure cloud computing subsidiary. And a note last week at Business Insider indicated Elon Musk has purchased 10,000 units to bolster an internal AI project at Twitter.

It’s not hard to see where all this is going.

This Is an AI Gold Rush

& NVDA Is Selling the Pickaxes & Shovels

Developers understand it is now possible to build extremely disruptive products with relatively few engineers and little money by using AI.

ChatGPT is only the beginning of what is possible. An entire ecosystem is developing around staking claims and building businesses. And NVIDIA has a monopoly on the shovels and pickaxes.

It’s really an incredible story, with unprecedented upside from here on out.

Nvidia’s AI hardware is running at every major data center in the world, according to CEO Jensen Huang.

Chieftains at Microsoft’s Azure, Amazon Web Services and even Google Cloud are scrambling to buy gear ahead of a new wave of AI development. More importantly, NVIDIA controls the direction of the entire AI stack through the governance of its CUDA open-source software platform.

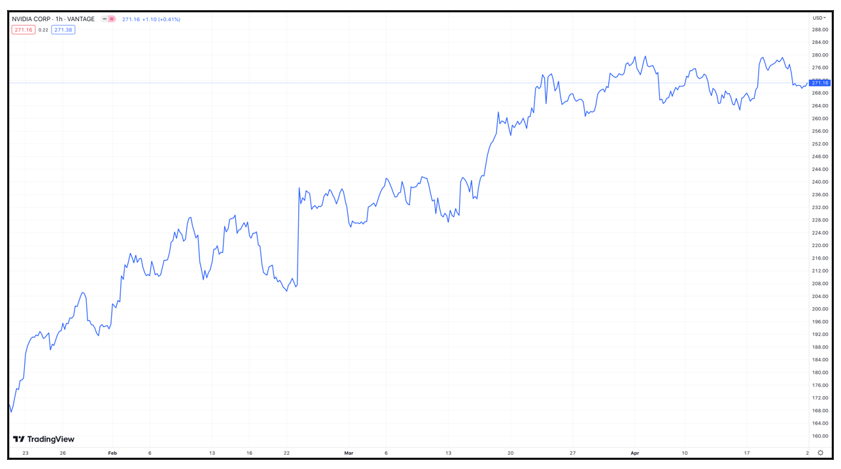

Click here to see full-sized image.

At the time of writing, shares are trading around $271.16. Nvidia stock trades at 44.8x forward earnings and 24.8x sales.

The stock has also run up immensely since October, when it touched $110 amid stories of semiconductor gluts and China sales bans. Since then, a lot has gone its way.

Investors should buy pullbacks to the $245 area.

As always, conduct your own due diligence before entering any trade.

Best wishes,

Jon D. Markman

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being. Starting as soon as July 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions. Investors who want to protect their money should click here for four steps to take now to stay safe and grow their wealth.