|

| By Gavin Magor |

Warren Buffett officially retired one week ago after a 60-year career as CEO of Berkshire Hathaway (BRKB).

And he decided to take his golden watch just in time.

Investing isn’t what it used to be.

At least, how most investors think about the markets is completely different from how they did back in 1965.

After all, a younger Buffett … for as big as his imagination was … might never have foreseen:

- The president of a country with a GDP of $119.8 billion get captured by the U.S. military … and the Dow hit an all-time high.

- The Fed not only become visible … but visibly divided … about interest rates, more than at any time in modern history.

- Gold and silver race higher while the U.S. dollar falls.

Each of these modern-day events are major market-movers.

But no event, no matter how big, should be the most important factor when it comes to investing.

Buffett Stuck to the Basics. You Should, Too

Buffett is a living legacy of how to invest without distractions.

When you buy a stock, you aren’t placing a bet on the Fed or some geopolitical event.

You are buying a sliver of a company.

Whether that business is growing … is priced low or high against its peers … and has a sustainable business model is what you really need to know.

Those factors are FAR more important than any headline in The Wall Street Journal.

Buffett knew that in 1965.

And he still does, from whatever beach I hope he’s relaxing on today.

That’s how he was able to build a $1.1 trillion business of his own. He kept it simple and to the point.

- If a company was cheap, he bought it.

- If no companies were cheap, he bought nothing.

He didn’t trade stocks by predicting the Fed’s next moves.

He mostly bought U.S. stocks and didn’t concern himself about international affairs.

Instead, he looked at the businesses behind the stocks.

That’s exactly what we do here at Weiss Ratings.

And it’s why our latest development is more important than ever with Mr. Buffett out of the game.

Introducing Weiss 3.0

We recently introduced Weiss 3.0 to a select group of members.

It uses our 100 years of data — which comes in at around 10+ terabytes …

Our digitized ratings, proprietary indices, ratings factors and models …

And it adds in a brand-new secret weapon — artificial intelligence.

Now, this is not some AI bot that picks stocks.

Rather, it’s an AI-boosted stock picking system.

One that helps us analyze more than 12,500 U.S.-listed stocks for technical patterns, valuation, balance sheet health and more.

Weiss 3.0 gives us only the best of the best stocks to own in the short term.

It keeps the emotion and headline-driven mania out of our portfolio.

Just like Buffett did $1.1 trillion ago, it finds cheap companies with solid businesses.

Let me give you a fitting example …

The Better COKE

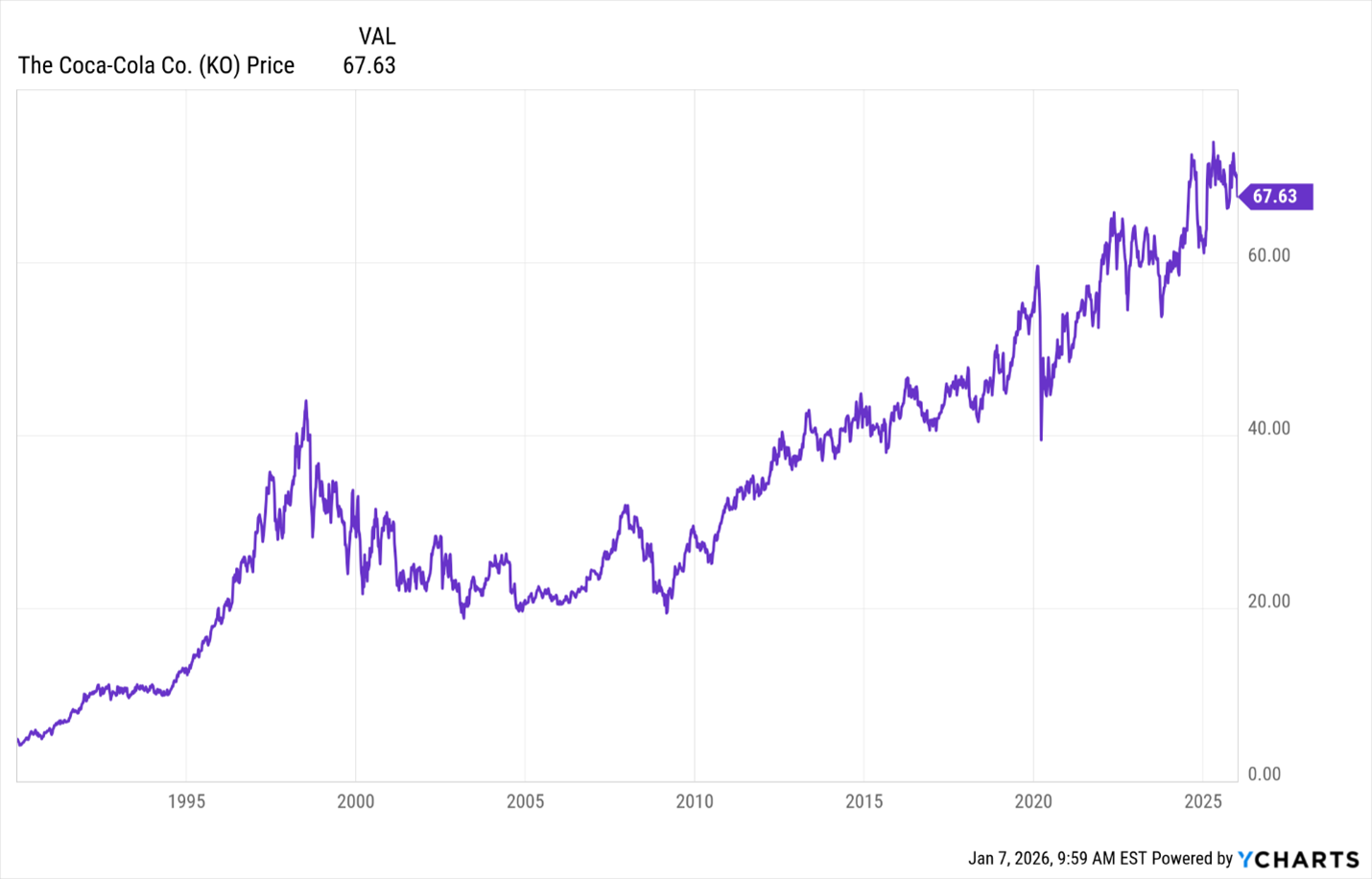

One of Warren Buffett’s greatest investments was in Coca-Cola (KO).

In 1988, he saw that the company exploding with sales growth around the world. He also saw that the stock was cheap and started buying shares.

Today, his Berkshire Hathaway owns some 400 million shares.

How We Caught Our Own Lightning in a COKE Bottle

Weiss 3.0 found something similar with a company that was spun off from the soda giant.

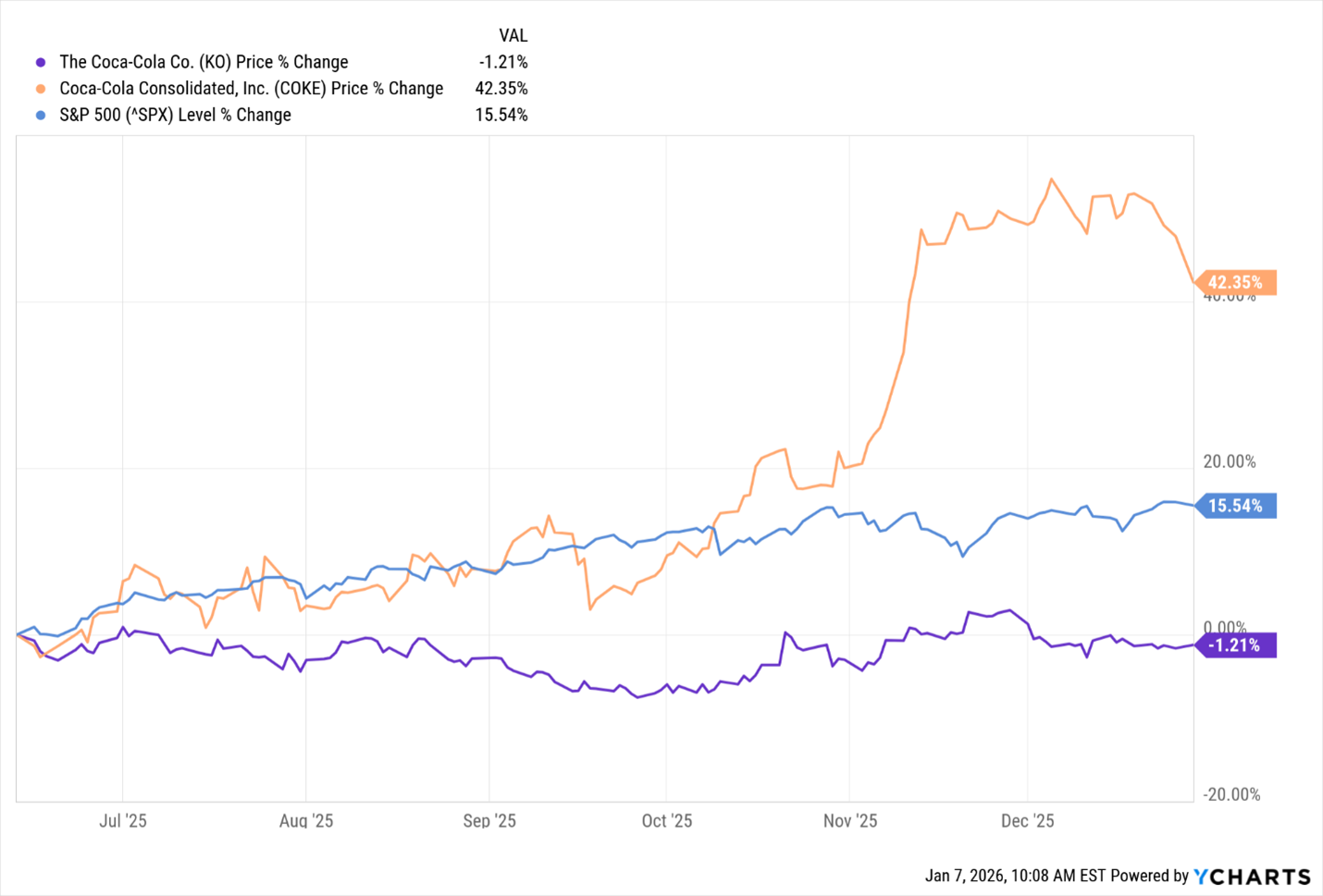

It pinpointed Coca-Cola Consolidated (COKE) last June as a stock worth buying.

COKE is a KO bottler.

Because of its relative size, slightly different business model and focused geographic footprint, Coca-Cola Consolidated offered higher growth and cheaper valuation than its former parent company.

So, I took that — a company most of us would never have discovered by reading any financial media — and recommended COKE shares to my Weiss Ultimate Portfolio readers.

In just six months, they cashed out with a 40.2% gain.

That’s more than double the market’s gain for the entirety of 2025 … in half the time!

COKE is the gold line in the chart above.

You can even see that it smashed its former parent’s performance (KO is the purple line) in that time, too.

What’s more impressive is that it was able to do that as a U.S.-only bottler. In other words …

COKE was able to grow even when international stocks were beating U.S. ones …

When the Fed was divided …

And when the greenback was falling …

All because the numbers and data pointed to that outcome.

And if not for Weiss 3.0, few people would have even known COKE existed.

If you want to see all this in action …

And pull up a spot to see the next COKE before it does the same …

Watch this video as soon as you can.

Cheers!

Gavin

P.S. Our Weiss 3.0 system works round the clock. So it won’t retire to the beach with Buffett. But it will keep alive his “keep it simple” stock-picking approach into perpetuity.

It’s already signaling that our next round of Weiss 3.0 trades is set to arrive first thing Friday morning.

So, be sure to watch our video that unveils how it works before then.