|

| By Sean Brodrick |

I’ve told you how vital uranium is to America’s energy future. However, atomic reactors don’t run on the kind of uranium that comes out of the ground.

Instead, they run on enriched nuclear fuel. And there is a supply squeeze brewing in this market.

It’s a squeeze of epic proportions.

Today, I’ll tell you how you can profit from it.

Civilian light-water atomic reactors run on low-enriched uranium, or LEU. It typically has a uranium-235 enrichment level of around 5%, though it can vary.

Enriching uranium to use in reactors isn’t easy. Very few companies do it.

Much of that enriched fuel comes from Russia, which has some 44% of the world’s uranium enrichment capacity.

Indeed, Russia provides approximately 35% of America’s imported nuclear fuel.

And there is a backlog …

Heck, Brazil recently signed a contract with Russia’s Rosatom. Brazil is supplying the uranium in 2025 and will get back the enriched uranium (4.25%) by December 2027. They will still have to fabricate it into fuel before use.

And as crucial as enriched fuel is now, it will be even more critical in the future.

Nuclear reactors range from the first generation in the 1950s and 1960s to the fourth generation. These are the advanced small modular reactors (SMRs) reactors being developed today.

Those advanced reactors run on high-assay low-enriched uranium (HALEU). HALEU is enriched up to 20%.

The U.S. currently has no SMRs, but there are plans.

- Google is working with Kairos Power to deploy multiple small modular reactors, up to 500 megawatts, starting in 2030.

- Amazon is working with X-Energy to bring five gigawatts of SMRs online by 2039.

- Other SMR projects are being planned across America and the world.

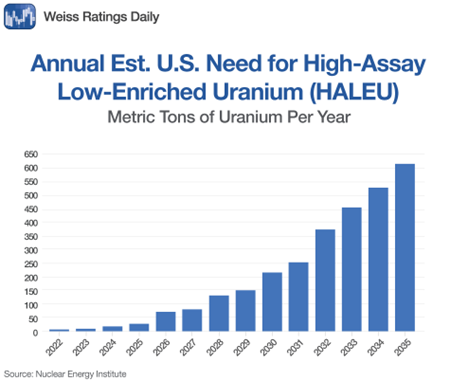

Estimates of how much HALEU fuel will be needed vary. According to the Nuclear Energy Institute, it could be as high as 500 metric tons annually by 2035.

And yet, very little HALEU is currently produced in the U.S. currently. You can see how a supply/demand squeeze is developing.

This squeeze becomes even more critical thanks to a bipartisan ban on imports of Russian nuclear fuel that Congress passed last year, a ban that will be phased in over time.

To be sure, President Trump could reverse that ban. But so far, he hasn’t.

What he has done is advocate for increased reliance upon domestic energy sources, including nuclear.

Department of Energy Secretary Chris Wright underscored Trump’s priority, affirming that as global energy demand escalates, the U.S. must “lead the commercialization of affordable and abundant nuclear energy.”

The Nuclear Fuel Security Act became law as part of the National Defense Authorization Act (NDAA) of 2024.

The act provides $2.7 billion in funding to jumpstart uranium enrichment capacity in America — a critical component of nuclear energy.

Now, companies are racing to make nuclear fuel. The Department of Energy is funding four companies to spearhead large-scale HALEU enrichment capacity in the U.S.

The DOE has already moved forward with an enrichment facility in Piketon, Ohio, which currently produces 100 kilograms of HALEU per year. Production is expected to increase to 900 kilograms in the coming years.

Nuclear power development takes years. But these could be very profitable years for a subset of companies in the nuclear fuel industry — both HALEAU for SMRs and LEU for regular light-water reactors.

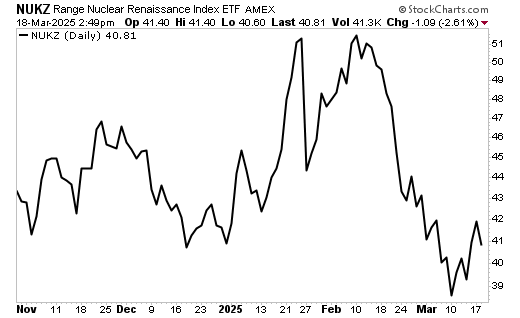

You can find many of those companies in the Range Nuclear Renaissance ETF (NUKZ).

It was just launched last year, so it is currently unrated by Weiss Ratings. It has $212 million in assets, an expense ratio of 0.85% and an average volume of more than 157,000 shares per day.

According to Range ETFs, NUKZ “is designed to provide exposure to companies that are involved in the following segments: advanced reactor, utilities, construction & services and fuel.”

Let’s look at the chart …

You can see that NUKZ sold off hard, like everything else in February.

Now, it is bottoming and bouncing hard.

Sure, it could be volatile. But if you have an eye for the longer term and want to leverage your portfolio to America’s nuclear future, this looks like a good entry point.

The squeeze is coming. Make sure you’re ready.

All the best,

Sean

P.S. If you’d rather invest in one company rather than a basket of them … and you’d also like to be insulated from daily spot market volatility, listen up.

Chris Graebe’s subscribers are gearing up to get first-day access and claim pre-IPO shares in a promising energy startup. Even before VC firms and investment banks!

He’s opening the doors on this deal TOMORROW, Thursday, March 20.

This startup not only owns the largest mineable uranium deposit in the U.S. … but also has plans to process the uranium itself for use in its own reactors.

And the only way to get on the list about it is to watch this video before we take it offline at 11:59 p.m. tonight and follow the instructions at the end.