In 2025, we entered a “New Space Race.”

And in December, we entered a brand-new phase of it.

Space stocks just accelerated from Mach-2 (the speed of sound) to Mach-5 (supersonic speed).

As your gift on this third day of Weissgiving …

I’ll share with you the top 10 space stocks in our Weiss Ratings orbit.

Why Space Stocks Just Blasted Higher

Space is a $613 billion marketplace. But here are three signs that it’s about to get even bigger.

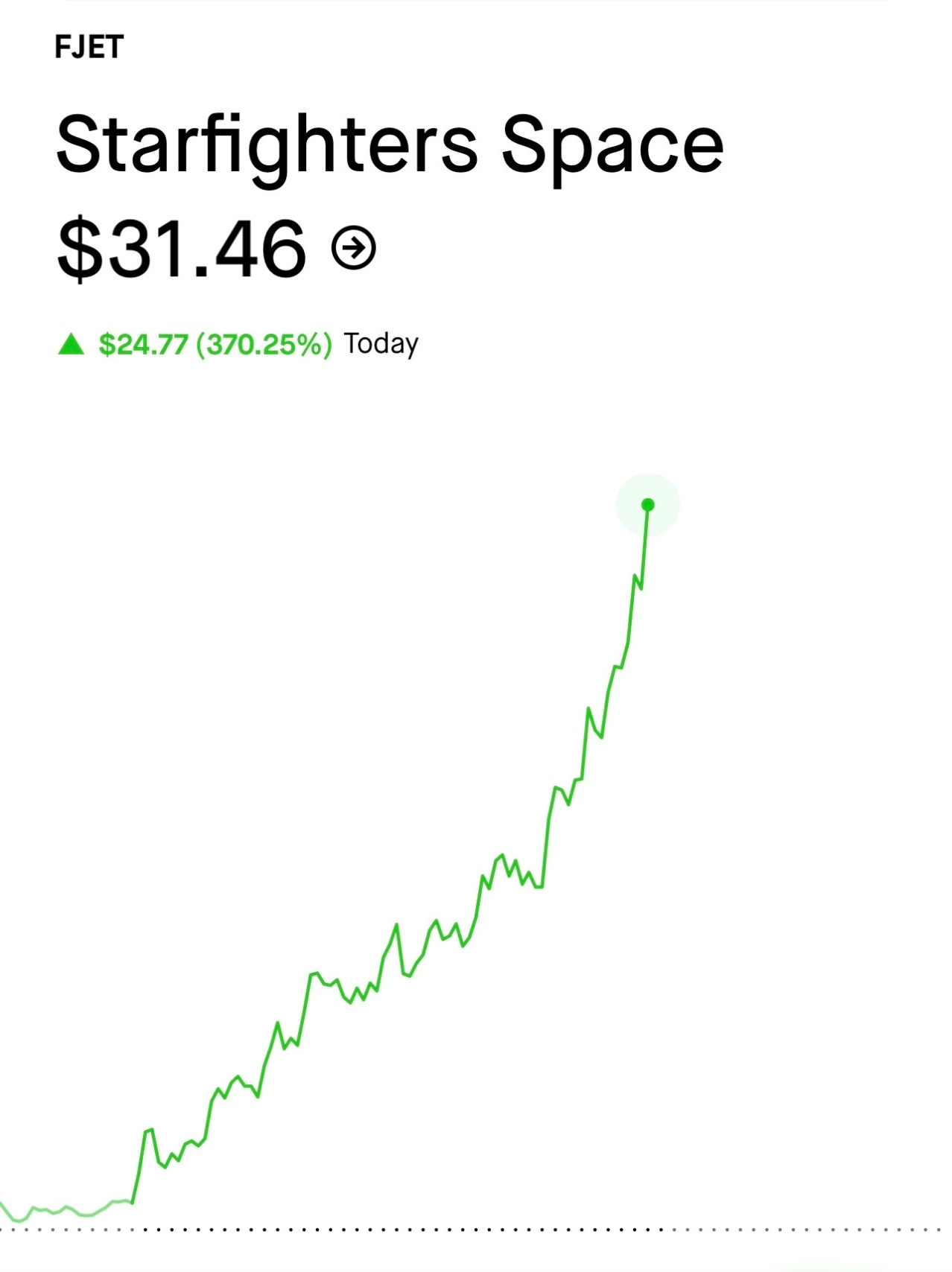

First, a small startup called Starfighters Space (FJET) landed on the NYSE on Thursday, Dec. 18.

FJET opened for trading at $10 last Thursday.

Shares flew to $31.50 on Monday, Dec. 22.

And its market cap briefly surged above $800 million.

My Deal Hunters Alliance subscribers had the chance to take a pre-IPO stake at $3.59 starting in September 2024.

So, some of them had a chance to take as much as an 8x gain.

In just three trading days!

Starfighters’ IPO wasn’t the only big thing to happen last Thursday.

A sonic boom for the space industry — and the stocks that profit from it — just came out of Washington, D.C.

The same day as FJET’s IPO, the White House issued an executive order.

This new EO calls for the U.S. to assert its dominance in the New Space Race.

That includes a 2028 deadline for an “initial” Moon base that leads to a “permanent lunar outpost by 2030” …

A missile defense shield (“Golden Dome”) over America …

And a plan within the next 180 days to secure “U.S. space interest from very low-Earth orbit.”

Low-Earth orbit is exactly where Starfighters … which has a fleet of F-104 jets to put satellites into space … operates.

It does so for just a fraction of what its next-door neighbor at Kennedy Space Center does.

That neighbor, SpaceX, is our third big reason for the coming space boom.

The company recently delivered news that served as rocket fuel for space stocks like Starfighters.

My tech-expert colleague Michael A. Robinson calls SpaceX’s forthcoming IPO the biggest tech story of 2026.

The rumored IPO, if it happens, may not happen until late 2026 at the earliest.

In the meantime, you don’t have to miss any of the fun.

In fact, you can consider any of the top Weiss-rated aerospace and aero-technology stocks in our orbit.

To do that, here’s your next Weissgiving gift …

The top 10 space tech stocks by rating and market cap.

Our ratings and research department gave me this list to share with you.

These space stocks all sport a Weiss “Buy” rating.

But there’s so much more to learn from our ratings than just a letter grade.

We have 10+ terabytes of data to analyze tens of thousands of stocks, ETFs, mutual funds, cryptos, banks and insurers.

To find exactly the kind of stocks you want in your portfolio … or which ones to avoid like the plague …

Our publisher Dallas Brown wants to give you ANOTHER gift today …

A full FREE month of Weiss Ratings Plus.

If there’s one thing I like, it’s making small investments that go up in value quickly.

So I am thrilled to make sure you see his offer.

When you accept this bonus Weissgiving gift, you do two things:

- You get the keys to our premier investment tool that unlocks 100 years’ worth of data … one of the largest financial datasets in the world!

- And you lock in the lowest price we’ll ever offer for Weiss Ratings Plus … for the life of your membership.

Here are all the amazing tools you’ll have access to.

Dallas and the team add new features every month, too.

So, rather than pay $19 a month like everyone else who joins on or after Jan. 1 …

You get access to all these tools, on Dallas, for the month of January.

Then you pay $10 in February … and every month for the life of your membership.

If you agree this is an unbeatable deal, click here right away.

Happy Hunting!

Chris Graebe

Editor

Deal Hunters Alliance

P.S. Mark Gough expects big things next year from a stock that’s set to go “nuclear.”

I follow this tech-adjacent sector closely myself and know one of the players who helped with its IPO.

Mark will send you all the details tomorrow for your fourth Weissgiving gift. Don’t miss it!