|

| By Jim Nelson |

Investors seem to have flipped back into bull mode over the past several days of trading, with the S&P 500 back to near where it began its decline following “Liberation Day.”

They even shrugged off the report from the Commerce Department showing that GDP in the U.S. shrank for the first time since 2022 in Q1.

And while earnings season has been better than expected for many companies, all that action in April has two unique stocks soaring.

Both CME Group (CME) and CBOE Global Markets (CBOE) reported that in Q1 — the same quarter that now shows an economic contraction — they hit all-time high revenues.

That’s important because these two own the largest derivative exchanges. While they overlap a bit, each run options and futures trading.

And that kind of trading has skyrocketed of late. The number of investors adding hedges — in the form of put options or hedged futures — is way up.

Last week, CME reported a 10% increase in revenue during Q1 and record option contract volume.

CBOE, which announced its numbers yesterday, had a similar bump. Sales jumped 15% to a record high. And average daily volume in index options also hit a record high.

Here’s the real kicker — those records came in Q1. That doesn’t even include the panicked rush of hedges in April.

Weiss Ratings gives both a “Buy” rating.

As you can see, CME was recently upgraded, too.

For more details on how to dig into the numbers and data on these two, watch this.

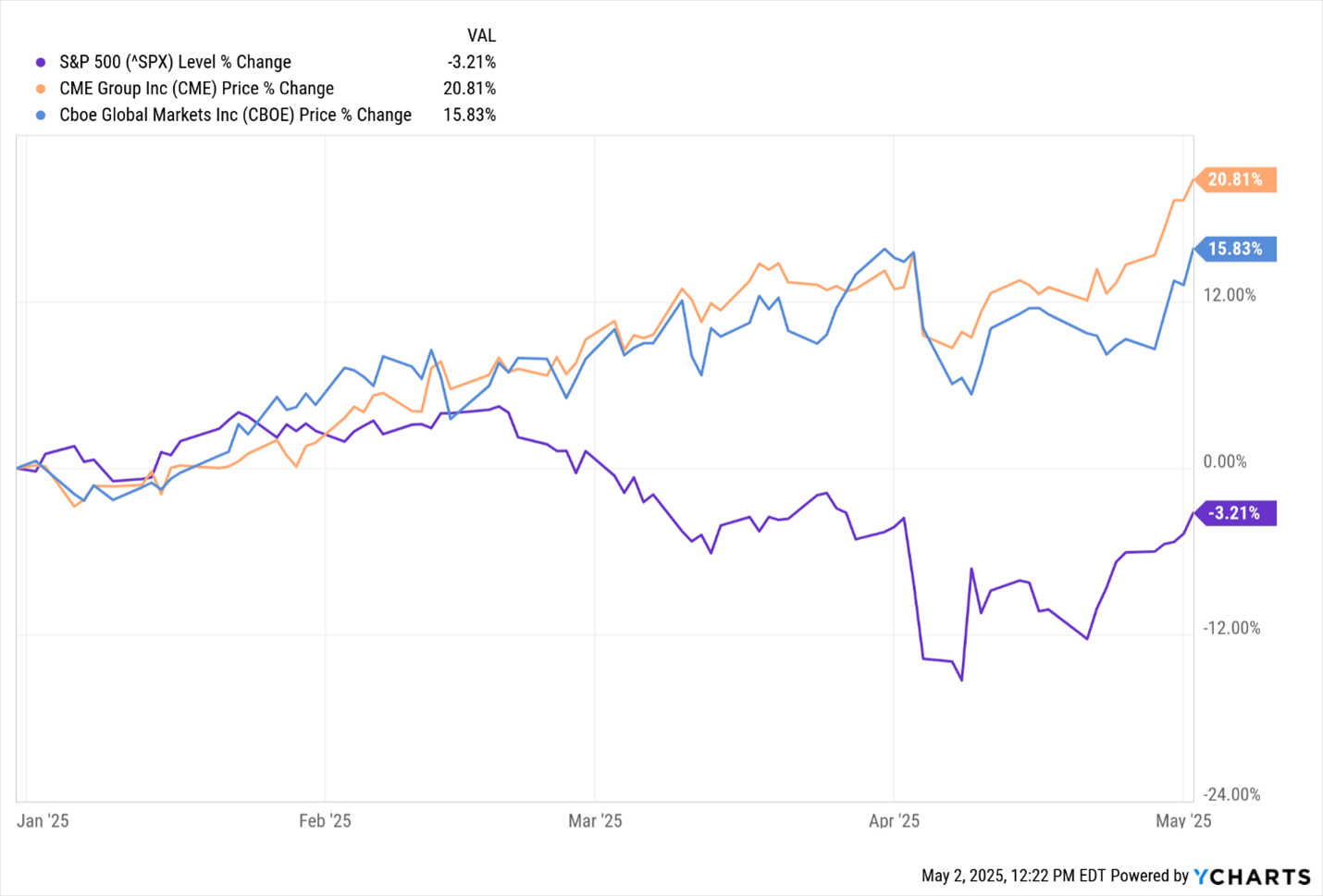

And if it wasn’t clear yet, here’s how the two have performed versus the S&P 500 year to date:

With even more market action in Q2, these trends should continue.

Of course, these aren’t the only trades working out right now. Your experts have plenty of other ways of profiting from this wild market …

How to Pick Stocks Like Your Experts

Editorial Director Dawn Pennington starts you off with a deep dive into how your experts find those profits. And with our newest upgrade, you, too, can research like them.

A Major Private Market Just Opened

Private equity investing used to be locked off for most investors. It has since opened to the likes of you and me. And with this newest announcement, Chris Graebe says even more opportunities are available.

The Secret Reason Central Banks Bet Big on Gold

Gold has retreated from its record $3,500 per ounce price tag. But the longer-term run is nowhere near finished. Resource expert, Sean Brodrick has the full story.

With economic contraction now on our plate, Chris returns with why now is the exact time to consider adding some pre-IPO startups to your portfolio.

Lyft’s Media Move Is No Side Hustle

In our day-to-day lives, we are all inundated with advertising. Michael A. Robinson has a major update to his story on how to lock in long-term profits from it all.

That’s it for this week. Your editors will be at the Weiss Investment Summit next week. But we’ll continue to keep the profit ideas flowing.

Until next time, have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily