|

| By Gavin Magor |

This past week, the S&P 500 notched its highest close (4,283.85) since August 2022.

The index is now up around 7% over the past two months.

We’re still navigating through some very historic circumstances, and next week’s Federal Reserve announcement is perhaps the central banks’ biggest decision since it started raising interest rates.

That said, I believe there’s certainly a lot more to be optimistic about now than there was six months ago.

1 Thing I’m Certain About

You can still find great quality names in the market, and the Weiss Ratings are always here to help.

Remember, our Ratings are free and easily accessible to all.

In recent weeks, I’ve been writing about our Stock Investment Ratings, and will do so again today, but please remember to check out our Banking Ratings, Insurance Ratings, Crypto Ratings and more.

Note: Our Bank Safety Ratings differ from our Stock Investment Ratings for banks. The former is a grade of how safe your bank is, and the latter is a grade of the safety of the bank’s stock.

Speaking of the importance of our Bank Ratings, very recently, my colleague and Weiss Ratings’ Publisher Dallas Brown went on Glenn Beck’s Program to highlight how vital it is to have a ratings system for banks.

In regard to the recent calamity throughout the banking industry, his message was simple: Don’t panic. But you better be cautious.

And isn’t just true for your banking. It’s also true for your insurance companies, the stocks you own and more. And the Weiss Ratings site can help you proceed with that caution.

I highly recommend you listen to the interview:

Now, let’s get to this week’s new ratings and what you need to know about the two companies I have my eye on.

2 New Upgrades

Grabbing My Attention

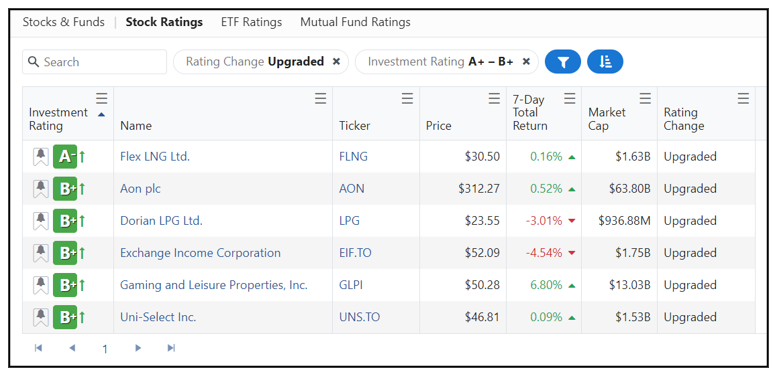

Conveniently browsing the Weiss site, I was able to see this last week’s upgrades, using the filter of “A+” to “B+” territory.

Here’s what I found:

Out of these six stocks, two pop out to me: Flex LNG (FLNG) and Aon (AON).

Until now, Flex LNG had never been rated an “A” or “A-”. The company has projected upward from an “E-” since we began grading back in September of 2019.

The liquified natural gas transporting company has been in “B” territory or better since May 2021 and hasn’t looked back.

It also appears that my colleague Senior Analyst Sean Brodrick was way ahead of this trend, because his Resource Trader Members were able to grab two rounds of double-digit gains on the position last year.

If you have any interest in receiving recommendations from an expert in mining, energy and commodity investments, I strongly encourage you to check out Sean’s fascinating service, Resource Trader.

My favorite thing about FLNG: It’s 9.84% quarterly dividend yield, which equates to $3/share annually at current prices.

The other upgrade, Aon, also has my attention.

The global professional services firm, which offers risk management, insurance brokerage and consulting services, was founded in Chicago, and is now headquartered in the U.K.

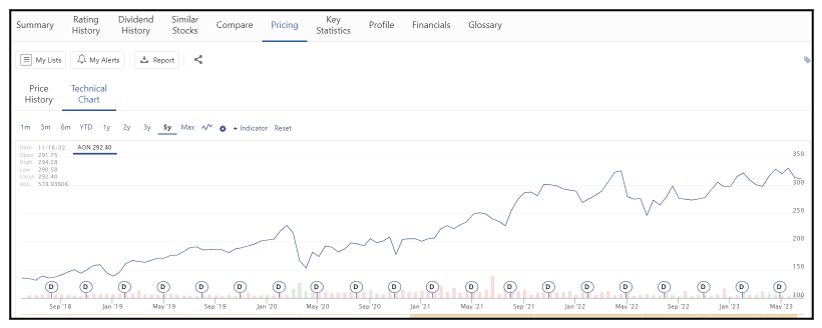

It’s a very large company sporting a $63.8 billion market cap, and by taking a quick glance on the Weiss Ratings site, I can see that it has been in “Buy” territory for the majority of the time we’ve rated it beginning in March 2014, when it debuted with a stellar “A-” rating.

You may also be familiar, if you’ve ever visited Chicago, with the Aon Center, the fourth-tallest building in the city, where the company now has its North American headquarters.

Let’s look at the five-year technical chart:

Click here to see full-sized image.

Over the past five years, shares are up around 199%.

Be sure to always do your own research when picking stocks, but we have some great tools that can help you do just that.

I’m using Aon as another example of how to use our features, but if you’re looking for some financial services exposure in your portfolio, Aon may be a good fit for you.

We hope better market times are right around the corner, but I can assure you that no matter the case, the Weiss Ratings are here, ready, constantly updated and more convenient to use than ever before.

Cheers!

Gavin Magor