|

| By Jim Nelson |

Warren Buffett made a fortune buying companies with low valuations and enormous dividends.

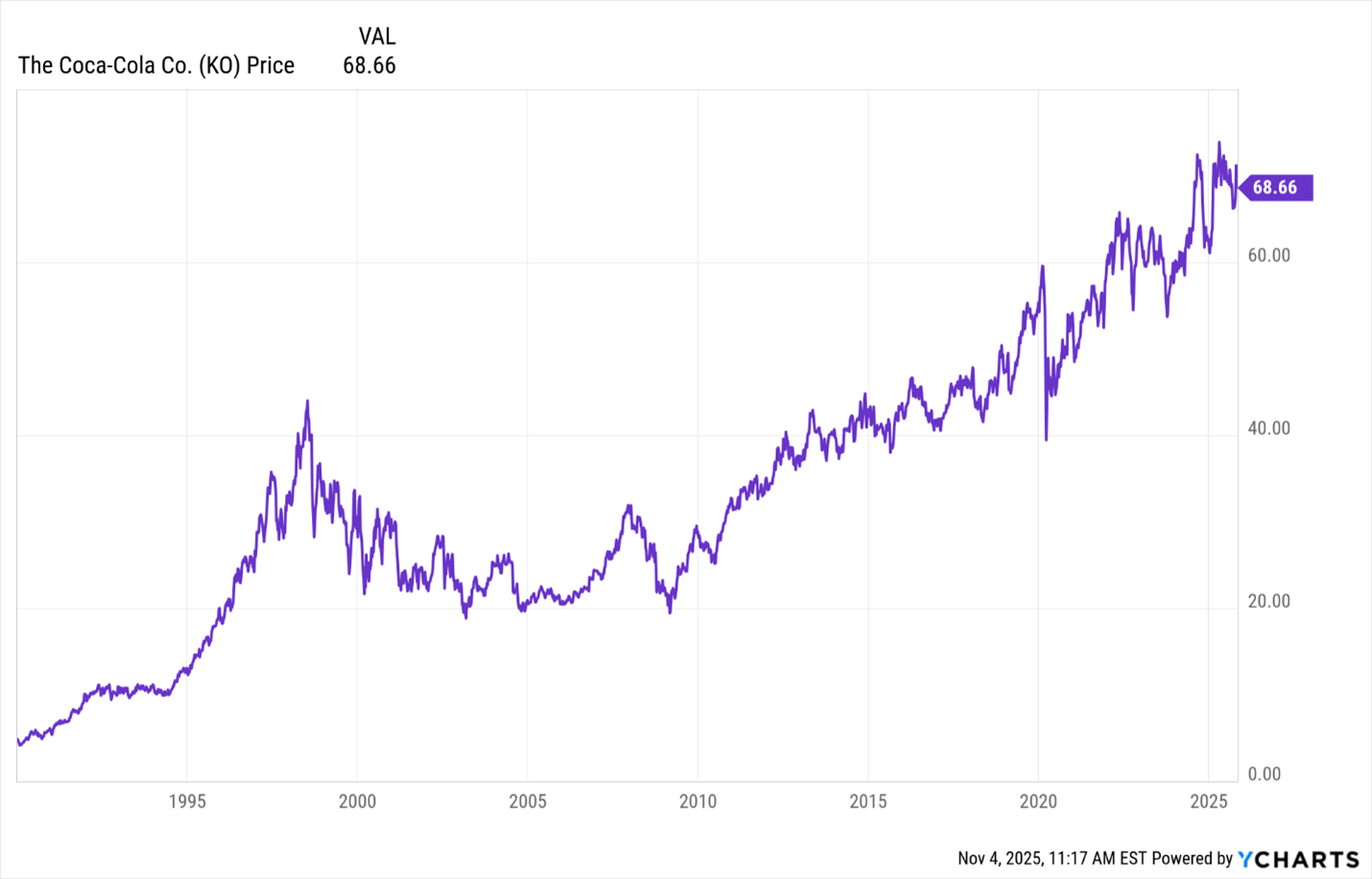

One of his most famous investments of all time is Coca-Cola (KO). He directed his Berkshire Hathaway (BRKB) to start investing in KO back in 1988.

Because of the soda giant’s relentlessly growing dividend, Buffett’s current $1.3 billion stake pays his company $816 million each year.

That means he makes his full investment back roughly every 19 months. Just from the dividends!

KO’s share price appreciation over 40 years doesn’t hurt, either.

But those days seem to be over … on the surface.

While Berkshire is the 10th-largest publicly traded company, it doesn’t pay a dividend.

Neither do the nine larger ones.

At least, nothing to write home about. None pay more than 0.8%.

Compare that to Buffett’s “effective yield” from KO — 62.8%!

Effective yield is calculated based on how much a company pays in annual dividends using your initial investment price.

But even if you had 40 years to replicate Buffett’s KO income stream, good luck finding an investment that pays you back in full every 19 months.

That said, there ARE companies out there that HAVE to pay you to own them.

In fact, there are three types of companies that — unlike mainstream stocks — are forced to pay shareholders an enormous dividend every year.

Today, let’s look at each one and what you should know before buying …

REITs

You’ve no doubt heard of Real Estate Investment Trusts.

Their premise is simple.

Instead of owning individual properties — and dealing with tenants, broken toilets and busted pipes — you can own a portfolio of real estate with just one investment.

Even better, REITs tend to offer large dividends. They are FORCED to pay out at least 90% of their taxable income to shareholders.

That allows them to avoid double taxation — taxed at the corporate level and taxed again on distributions.

One especially income-focused REIT is Realty Income (O). It has a 6% dividend yield and pays shareholders monthly.

One problem with this group, though, is that they are sensitive to changes in interest rates. That can impact their ability to finance new properties with favorable terms.

But they aren’t the only big dividend game in town. So are …

BDCs

Business Development Companies are exactly that: companies that finance developing businesses.

Often, the focus is on startups or other small businesses that need cash to expand.

BDCs will offer structured loans or equity stakes in exchange for that financing.

So, as long as they are picky when it comes to making these deals, BDCs earn incredibly high yields from their deals — often in the double digits.

They come from the “Small Business Investment Incentive Act of 1980.” So, they aren’t going anywhere.

And as part of their special tax structure, they, to, pass on at least 90% of their taxable income to shareholders.

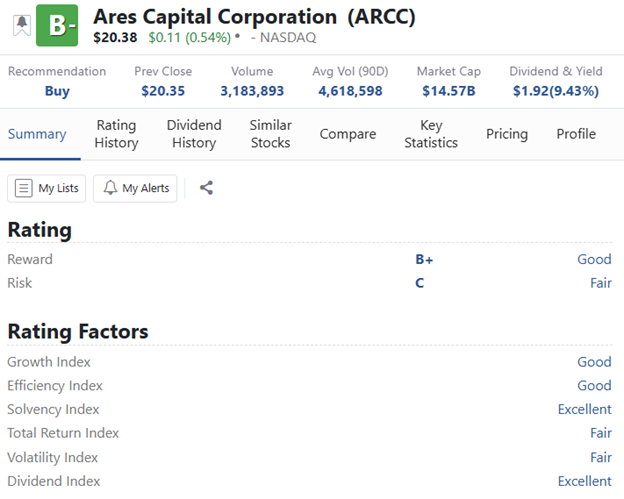

One of the largest BDCs is Ares Capital (ARCC), currently rated a “B-.” It pays a whopping 9.4% dividend.

That fat dividend is attractive. But BDCs are often seen as risky because of the small size of the companies they finance.

If the market takes a downturn, these often go with it.

MLPs

Master Limited Partnerships offer a third category of high-income investment.

These were created in the years following the 1970s gasoline shortages and rationing.

They often pay large distributions to shareholders — called limited partners — because of the kinds of steady businesses they operate.

MLPs typically own assets related to the energy sector. Things like pipelines and storage facilities.

These assets let them lay out long-term contracts with producers.

And their services are always in need — whether the oil is flowing or held up at their facilities waiting for higher prices.

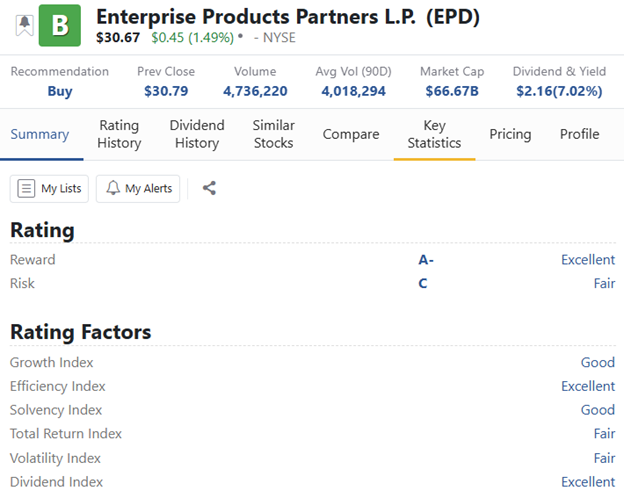

A great example of a MLP is Enterprise Products Partners (EPD).

It has an enormous network of oil and gas pipelines across the U.S. and pays a solid 7% dividend yield.

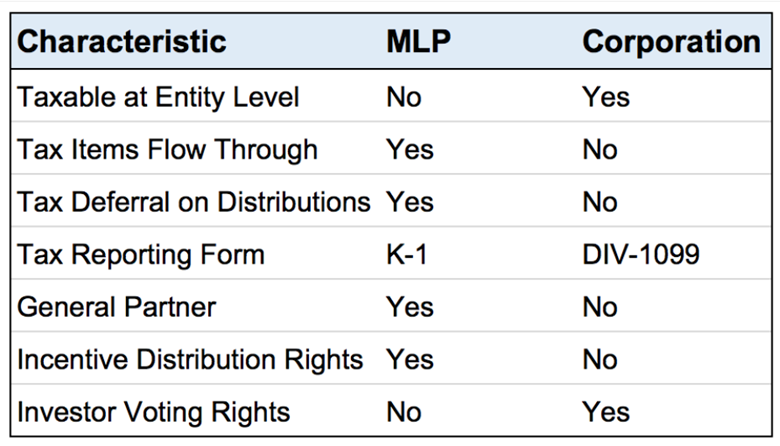

The downside? The IRS makes MLPs complicated to own.

That’s because partners (that could be you) receive payouts made up of “returns of capital.” Not ordinary income.

On the one hand, that allows investors to lower their cost basis and delay taxes until they sell shares.

On the other, it complicates the tax process and can have an inverse effect if held within a tax-advantaged account.

If you are looking for high yields and large investment income like Buffett found in Coke all those years ago, any of these types of companies can serve as great options for you.

But, as you can see, they all have their own problems — interest-rate sensitivity, market risk and tax issues.

There’s a bonus way to find above-average income.

It’s even a strategy that Warren Buffett has used himself in years past.

Unfortunately, today’s your last chance to watch the full presentation where your Weiss analysts lay it out.

So, watch this to the end before midnight.

Cheers!

Jim Nelson