|

| By Gavin Magor |

It’s a tale of two markets, and a large component is due to artificial intelligence.

So far this year, the S&P 500 is up around 15%. But much of that growth is largely attributed to names being driven by AI hype, with the average return of the five largest companies in the S&P — Nvidia (NVDA), Amazon.com (AMZN), Alphabet (GOOGL), Microsoft (MSFT) and Apple (AAPL) — trouncing the rest of the index.

And now, primarily thanks to Nvidia’s very strong Q2 earnings report released on Wednesday, that trend has become turbocharged again.

I expect it to continue.

Wednesday’s report proved this trend is not short-lived. Rather, it’s thriving.

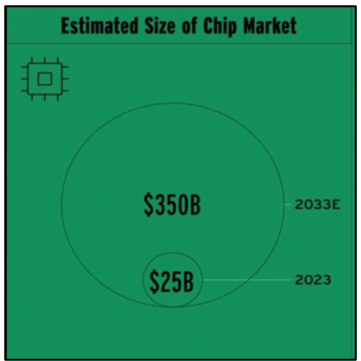

You see, Nvidia is providing the infrastructure required so that AI developers have what they need to make it possible. And the chip market that will be needed is set to balloon over the coming decade, with some estimates as high as $350 billion.

Click here to see full-sized image.

That new market size would be historic, and it may prove to be larger. But as it’s to be expected, there’s still much uncertainty.

It’s important to note that Nvidia isn’t completely vertically integrated, either. It depends on outsourcing its chips to Taiwan Semiconductor Manufacturing (TSM), making Nvidia’s success even more impressive, as this undoubtedly helps boost the company’s profit margins. It designs, then outsource to make its products.

CEO Jensen Huang reported that profit margins on high-end AI equipment are scorching hot. On Wednesday, he said the company earned $6.7 billion during the quarter, up 422%.

First Weiss, Now Wall Street

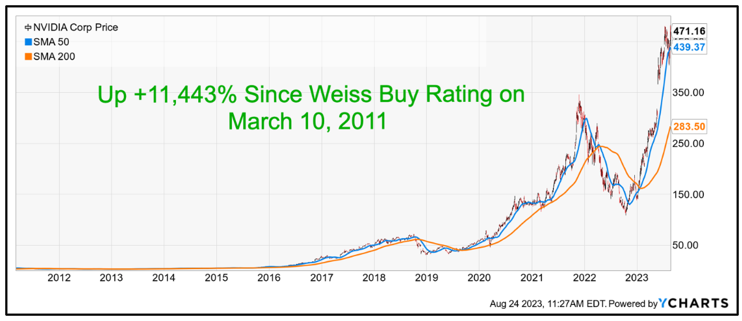

Wall Street finally appears to be catching up to us. Weiss Ratings first rated Nvidia a “Buy” on March 10, 2011. And very interestingly, on a per-share basis, you’d be up a whopping 11,443% if you had acted on that recommendation.

Click here to see full-sized image.

Despite how lofty the company’s valuation is, there still appears to be more room for it to run. I can confirm this by taking a look at the Weiss Ratings stock screener.

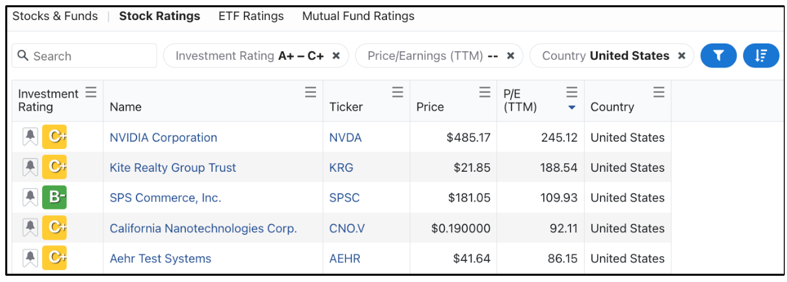

After filtering for companies with a rating of “A” to “C+” that are U.S.-listed stocks, I then filtered by highest P/E ratio. Here’s what I got:

Nvidia, by far, has the highest P/E ratio. Granted, a “C+” is not an “A.” But to be trading at 245 times earnings and still carrying a “C+” rating is highly impressive to me.

Traders are paying a massive premium, and our ratings system believes it is justified.

You can debate the potential size of the AI market, but I unquestionably believe AI will play a larger role in our lives over the next decade.

Similar to how desktop PCs made our lives easier and more connected in the ‘90s (can we please bring back the computer coffee holders?!), I think AI will do the same.

Much like the PC adaptation, it won’t take many jobs. Rather, it will reduce costs for producers and propel the overall economy. In my eyes, the positives far outweigh the negatives for our lives.

My Recommendation to Play the Trend Right Now

I highly encourage you to use our ratings system to help you find strong AI names like Nvidia, but if you want to really take the next step, check out my colleague Jon Markman’s Weiss Technology Portfolio.

Jon is an award-winning investor and even has experience working for one of this year’s top AI winners — Microsoft.

Although he recommended that his members buy Nvidia years ago — and those who followed along are now sitting pretty on 871% gains — he’ll be sending out a trade alert this morning shortly before the opening market bell rings for the first of three game-changing AI plays.

I hope you don’t miss it, but at the very least, I hope you get some more information by checking out this presentation now.

Some AI names are way too risky, but some are going to make early investors a mountain of profits.

Cheers!

Gavin Magor