This Alternative Asset Blasted 40% Higher in Just Weeks

|

| By Nilus Mattive |

For many months now, my guiding principle has been the idea that the Federal Reserve is on a tightrope, with outsized inflation on one side and economic catastrophe on the other.

It’s an almost impossible balancing act that politicians and monetary policymakers created for themselves by continually spending and printing their way out of every single problem, big or small.

Now, the rope isn’t just thin and tight … it’s begun swinging wildly side to side. And it’s hard to imagine Washington regaining its balance before we see a nasty fall.

Where Will

We Land?

Based on decades of past experience, the U.S. government’s massive pile of debt and the latest evidence, it’s clear that inflation will always remain the lesser of two evils for monetary policymakers.

But we could still end up with an economic crash to boot.

And as you know, lawmakers love to use “emergencies” as a way to introduce all types of new controls on everyday citizens and their money!

This is precisely why I’ve been recommending alternative assets to Safe Money Report subscribers.

One of them has already shot up more than 40% in a matter of weeks from me recommending it.

And another — which I just recommended in our most recent issue — surged as much as 29% last year while nearly all other major assets were getting crushed.

More on that in a minute. But first, I want you to understand what’s really happening right now in our financial system …

A Banking Crisis Caused

by Central Bankers

Silvergate. Silicon Valley Bank. Signature Bank.

They were all functioning financial institutions just a few months ago. Now all three are kaput.

Each of their stories was somewhat unique.

But a major factor in all three cases was the simple fact that they couldn’t liquidate their assets fast enough to meet panic-driven bank runs moving at unprecedented rates of speed.

Why not? Because their liquid assets were mostly tied up in Treasurys and mortgages that they bought at much higher prices, before the bond market was decimated by interest rate hikes.

So if you look at the big picture — especially crazy low interest rates followed by crazy rapid hikes — you can see that the Fed, which is supposedly in charge of maintaining stability, is actually a primary source of the instability!

Now, the Fed has the worst of everything:

• Inflation that continues to run at two and a half times its target.

• Rates that are higher than the financial system expected.

• And cracks forming throughout the foundation.

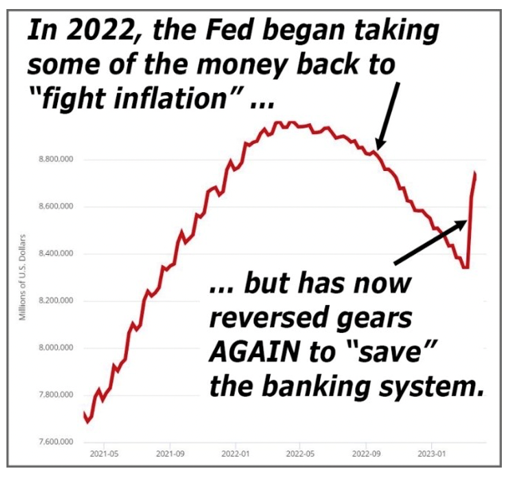

This has left the Fed giving with one hand and taking away with the other.

Sure, they’ve been raising rates over the last year. But the minute those rate hikes started locking up the financial system, the Fed immediately began providing a huge amount of new money to grease the wheels.

Click here to see full-sized image.

That response — officially called the Bank Term Funding Program — put back almost two-thirds of the trillion the Fed had been slowly removing from the world economy over the last year.

Markets Aren’t Stupid

Even as Fed Chair Jay Powell tries to tell everyone that the Fed remains committed to its inflation battle, they can see that monetary policymakers continue to stoke the inflation fire through the back door.

In fact, the smart money is already bracing for impact: the possibility of a hard landing even as prices remain stubbornly high.

Fortunately, Safe Money Report Members are already prepared for the worst-case scenario.

Members have been holding a terrific mix of investments expressly designed for times like:

• Solid dividend stocks with high Weiss Ratings.

• Treasurys.

• Gold and silver.

• Funds that harness volatility through options selling.

• And inverse ETFs that rise when markets fall.

These types of assets and strategies are proven and powerful, which is why they’re precisely what we recommended during the last financial crisis and subsequent market collapse more than a decade ago.

And we will continue to use them as the basis of everything we do going forward, too.

But as I’ve also said recently, it makes sense to layer in additional types of assets and strategies that were NOT available to us the last time around for even more protection and safety.

Just consider my recommendation two months ago to add some Bitcoin (BTC) to the Safe Money Report model portfolio.

Perhaps that seemed crazy at the time. Well, it shot up around 40% in just weeks after the recommendation!

Click here to see full-sized image.

Indeed, the minute the banking crisis began, crypto surged higher, with Bitcoin leading the charge.

I’m not surprised.

Bitcoin was born in the wake of the last financial collapse as an alternate way for people to store and transfer wealth without the vagaries of the traditional financial system.

And as much as the powers that be continually assure that everything is fine, anyone with common sense can see that they’re either stupid or lying (or both).

Prices are surging. Banks are going under. Debts keep rising.

Now, however, crypto provides a different path that more and more people are embracing.

As I said during my initial recommendation, it makes sense to have at least a small allocation to that alternative as both a hedge and a source of outsized profit potential.

Better yet, recent developments have given us access to other alternative assets that were previously the exclusive domain of the ultra-wealthy.

Which is why I just dedicated our most recent issue to another one of those assets … one that I’ve been putting some of my own money into as well.

This asset has been the absolute best way to combat inflation — better than stocks, real estate or even precious metals.

It has also proven to be quite resilient, rising 29% last year even as most other assets and investments were awash in red ink.

The icing on the cake? It exists almost completely outside the traditional financial system!

This is precisely why the wealthy have been using this particular asset to guard and grow their fortunes for centuries while it remained largely out of reach for regular people.

Now, thanks to a little-known law and an innovative new investing platform, that has finally changed.

It wouldn’t be fair to paying readers to go into any more detail here. But if you’re interested in joining them, you can do so here.

But the larger point is that you are no longer limited to traditional investments like stocks, bonds and cash.

In fact, the more you go beyond them, the better your chances of getting extra safety and better overall returns.

Best wishes,

Nilus