|

| By Sean Brodrick |

On Tuesday, gold made a new closing high, its highest daily close in history. That follows an all-time monthly high in January and a yearly all-time high at the end of 2024.

Now, TV’s talking heads are saying that the move in gold was just reactive to global uncertainty and that it should be done. To which I reply, “Dude, you ain’t seen nothin’ yet.”

I’ve pounded the table about gold for quite some time. I sent my subscribers gold reports, the Resource Trader portfolio is bristling with great miners and I plan to give them more. Why? Because this gold rally is the real deal.

So how do I know?

Time is short, and I’ve previously covered some major forces driving gold, with examples here and here.

So, I’ll give you three new reasons, plus a way you can play the coming gold-plated rally.

Mystery Buyer Is Very Bullish

According to a note from TD Securities, a “mystery buyer” in Asia is one of the reasons gold did so well last year. And now, that mystery buyer is back.

TD Securities says the mystery buyer is a small and influential group of Asian buyers with deep pockets. These unnamed buyers respond to weakness in Asian currencies by buying gold.

Speaking of currencies, did you know one way countries can respond to higher tariffs is by weakening their currencies, thus dulling the effect of higher taxes on exports?

With tariff threats rising, that would seem to indicate the mystery buyer will keep stacking.

And speaking of tariffs …

Trumping the Dollar

President Trump has quickly gotten into tariff and/or trade disputes with Colombia, Mexico, Canada, China and the European Union. He has his reasons. One of the side effects is a weaker U.S. dollar.

You might think higher tariffs would boost the dollar because tariffs make foreign goods more expensive to import. That typically leads to a decrease in buying goods made abroad. Less foreign currency is needed to buy those products, so the dollar gets stronger, right?

And that DID boost the dollar, short term. But after bolting higher on Monday, the dollar slid and closed lower. Tuesday, the dollar kept sliding.

What Trump’s mercurial tariff actions do longer term is paint the U.S. as an unstable partner. When Trump threatened Canada and Mexico with new, higher tariffs, he ripped up trade agreements he signed in his first term.

This makes our trading partners look for alternatives.

Now, the European Union is fast-tracking a new trade agreement with Mexico, after signing similar deals with four of South America’s biggest economies.

Canada is reaching out to its trading partners in Latin America as well.

The tariffs are one reason why they are rushing these deals through, worried about what Trump might do next.

That may be one of the reasons why the U.S. dollar is dropping now.

Here’s a fun fact: Gold is priced in dollars. The two sit at opposite ends of what I like to call “The Seesaw of Pain.” When one goes up, the other gets hurt.

Now, it’s the greenback’s turn to feel the pain, and gold is making gains.

Fear of Recession

I don’t think a recession is likely. Wall Street is worrying about it anyway, and fear of recession is growing worldwide.

Part of this is concern that reciprocal tariff hikes will kick global economic growth in the teeth. But there are other reasons.

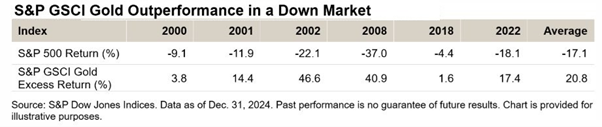

What does well when the market goes down? You get one guess, and it better start with “G”. This chart from S&P shows why …

History shows us that gold tends to go up when the stock market goes down.

My theory is at least some of the gold buying we’re seeing is investors around the globe bracing for recession.

Many investors are seriously underinvested in gold. Just a small change in that could send prices sky-high.

How You Can Play This

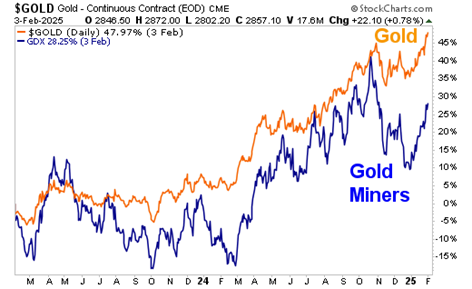

Gold has been zigzagging higher for quite a while. Here’s a performance chart of gold versus the VanEck Gold Miners ETF (GDX), over the past two years.

You can see that gold miners tracked the rally in gold pretty closely until October of last year. That’s when inflation worries sent gold miner shares plunging, while gold kept trucking higher.

Inflation is a problem for miners because as wages and fuel prices increase, the margins on each ounce get tighter. But inflation subsided, and the gold price increased, making profit margins widen.

Finally, in December, gold miners started to wake up … and play catch up.

There’s still a long way for gold miners to go. Especially if, as I strongly believe, gold is going first to $3,000 an ounce, then above $6,000 an ounce!

Here’s a final fun fact I recently picked up from analyst Garrett Goggin: Even though gold is at a new high, gold miners are trading at just 6.2 times free cash flow — a historic low.

By this measure, gold miners are a screaming bargain.

So, consider picking up the GDX or drilling down and buying individual miners if you don’t own enough already.

In a gold bull market, you’ll feel like you can never own enough miners.

Gold has a long, long way to go.

All the best,

Sean

P.S. While Trump is threatening tariffs with one hand, he’s making alliances with the other. Yesterday, my colleague, Michael A. Robinson held a summit about the most important of these alliances. You can still watch it here.