This Startup Protects the Internet of Things from Hackers

|

| By Chris Graebe |

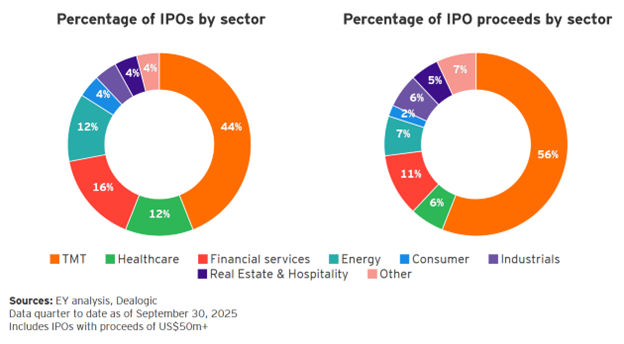

2025 is ending on a strong note for IPO investors.

A whopping 314 companies have gone public in 2025 in the U.S. as of late November.

That’s nearly one per day!

Globally, there have been another 194 IPOs.

And many more pre-IPO companies continue to raise capital.

Including this one that’s about to open its doors to the crowd.

Frankly, the startup-investing train shows no signs of slowing down.

Dozens of companies are planning to go public in 2026 and 2027.

Where Are the Best Places to Find Pre-IPO Plays?

One simple strategy: Follow where stock investors are pouring in capital.

Earnings season revealed that the AI spending trend is alive and well.

Investors continue to push for AI stocks, from chipmakers to software and hardware players.

But there’s a related part of the market that remains off the radar.

Yet, it looks attractive, whether Pre-IPO or IPO: cybersecurity.

Cybersecurity is a necessary business. And the business model is solid.

Companies don’t just sell a piece of software off a shelf these days. They create bespoke services … and those can generate substantial recurring revenue.

That means high profit margins — and high-growth opportunities — for the right cybersecurity players.

It’s exactly the kind of business where a small investment can grow substantially over time.

One pre-IPO cybersecurity player is catching my attention now.

Keep an Eye on Armis Ahead of a Future IPO

One pre-IPO player that has my eye is Armis.

Founded in 2016, Armis provides total cyber risk from ground to cloud for critical infrastructure.

The company just raised $435 million at a valuation of $6.1 billion.

Armis has a three-year plan to hit $1 billion in annual recurring revenue — and they’re currently at $300 million.

What makes Armis worth a watch here? They’re comprehensive in their cybersecurity coverage.

Armis focuses on protecting the entire attack surface and managing cyber risk exposure in real time, covering everything from ground to cloud.

The company specializes in seeing and securing all types of assets.

It’s not just traditional IT devices, but also Internet of Things (IoT), OT (operational technology), medical devices (IoMT) and both managed and unmanaged devices.

That’s huge. Remember, hackers are looking for a way in.

They don’t care if it’s from your computer, your smartphone, your watch.

Soon, they could even figure out a way to hack a self-driving car — or a pacemaker.

Armis assumes, reasonably, that all devices need to be protected — especially in an age of rising connectivity.

Armis provides an agentless cybersecurity platform that identifies, monitors and protects managed, unmanaged and IoT devices across enterprise environments.

This approach means they can discover and protect assets without requiring software installation on every device.

That’s particularly important for IoT and OT devices where agents can't be installed.

Rather than just point-in-time security, Armis positions itself around continuous cyber exposure management — understanding and managing risk across the entire asset ecosystem in real time.

Their CEO notes that organizations are embracing a unified, exposure-based approach to security, which represents a shift from traditional reactive security models.

In short — it’s no longer enough to be informed when someone is trying to break a firewall — the threat needs to be met immediately and warded off, even before a human can interact.

Currently Armis has worked with over 40% of the Fortune 100, including seven of the Fortune 10.

Armis has been on a hot streak with internal growth. It is also expanding capabilities through acquisitions in cloud, AI and operational technology security.

That includes the recent purchase of CTCI for AI-powered threat hunting to provide early warning capabilities before attacks occur.

Armis is preparing for an IPO targeted for 2026-27 and will be an IPO to watch.

If You Can’t Wait

Back in May, I highlighted the opportunity in Cyber Crucible — a Pittsburgh-based company that works to prevent ransomware attacks outright.

Cyber Crucible is a smaller player than Armis, with just over $2 million in software sales in 2024.

But it’s in the final days of their raise on WeFunder.

While cybersecurity hasn’t gotten the attention of AI software or chipmakers, it’s a crucial component of modern life.

Spending will only increase, whether to stop ransomware or protect IoT devices.

And there are plenty of attractive IPOs coming up in 2026, even after a banner year.

Stay tuned — it’s an exciting time for pre-IPO opportunities.

Happy Hunting!

Chris Graebe

P.S. In fact, I will share the name of the most exciting pre-IPO opportunity I have found with my Deal Hunters Alliance readers this week.

You can get the details on how to join them if you watch this video to the end.