|

| By Dawn Pennington |

Last month, Jeff Bezos said AI technology is “real” …

It’s “going to change every industry” … and

It’s in an “industrial bubble.” One that would soon reveal the real winners and shake out the rest.

Many talking heads, however, missed the word “industrial.”

And suddenly, “bubble trouble” became synonymous with AI’s potential demise.

This week, your resident tech expert, Michael A. Robinson, was invited to the Schwab Network to answer the question:

“Is the AI bubble busted, or was it never really real to begin with?”

There, he was happy to dispel that myth!

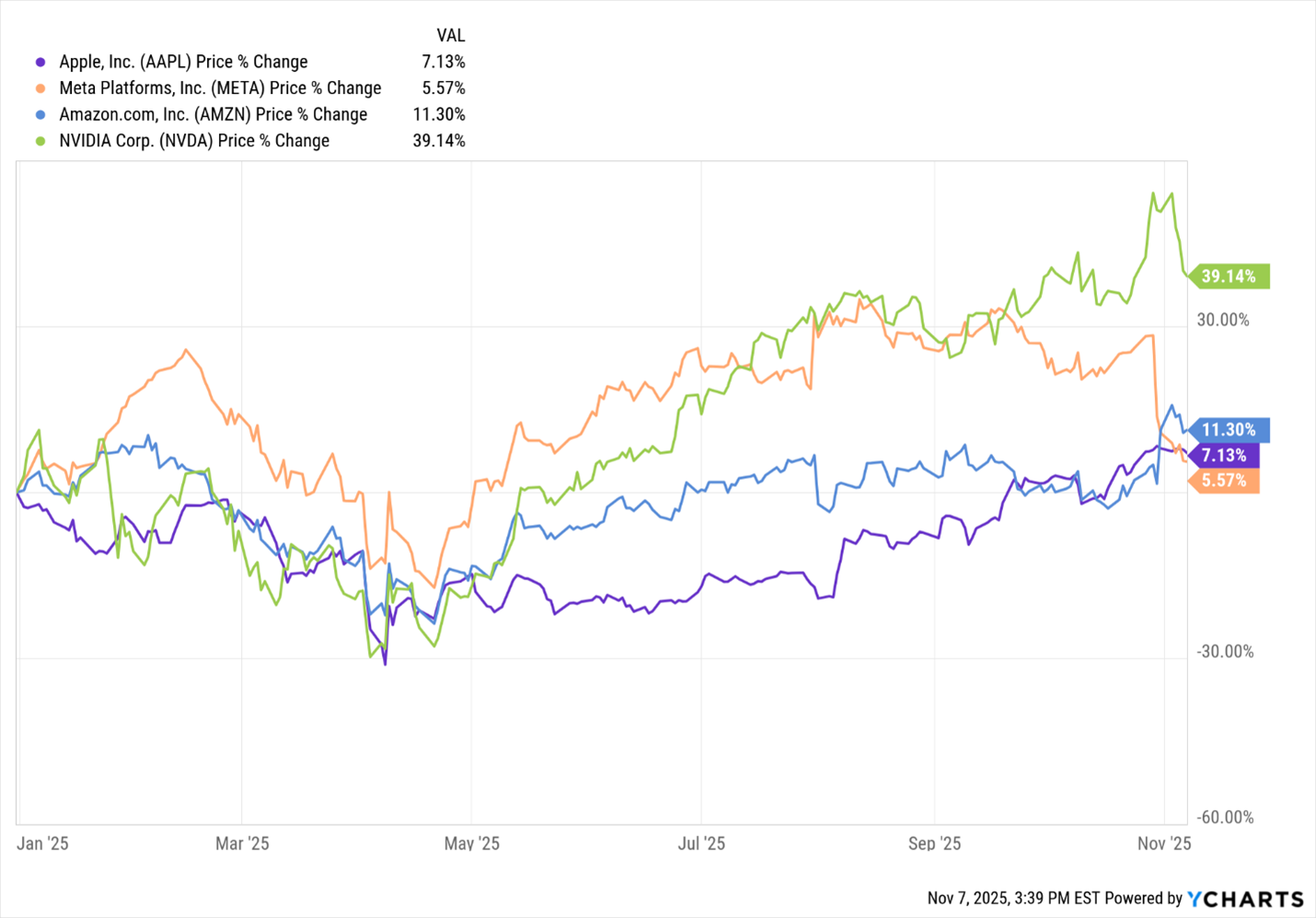

In fact, Michael said the recent series of solid earnings from the Magnificent 7 is proof that Q3 was a “myth-buster quarter.”

It’s no surprise that Bezos’ Amazon (AMZN) got an AI-generated boost to its bottom line.

Its AI shopping assistant, Rufus, is responsible for some $10 billion in annual sales.

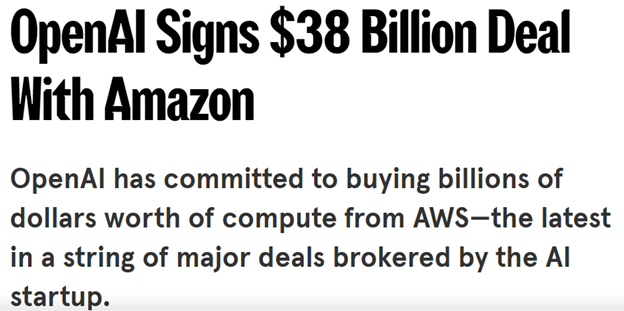

And some of those profits are going toward a $38 billion cloud deal that Amazon just inked with OpenAI.

In the Yahoo! Finance article we quoted earlier, Bezos had this to say about winners and losers in the AI world:

“When people get very excited, as they are today, about artificial intelligence, for example … every experiment gets funded, every company gets funded.

“The good ideas and the bad ideas. And investors have a hard time in the middle of this excitement, distinguishing between the good ideas and bad ideas.”

OpenAI is using Amazon Web Services infrastructure to train its models. So knows all about funding ideas.

So does Mark Zuckerberg.

During Meta Platforms’ (META) earnings report, he said the company is set to spend some $72 billion on AI infrastructure in the coming year.

Meanwhile, Apple (AAPL) did something wise when it comes to AI …

Nothing!

As Michael said in his Schwab segment, Apple CEO Tim Cook knows other companies can do AI better right now.

And he lets them spend “gobs of money” on developing it!

Sticking to its knitting, as Michael calls it, might just make Apple the big winner of the quarter.

As Michael pointed out during our weekly analyst call on Wednesday, Apple is not going to win the AI race anytime soon.

No one would argue that just about every chatbot in the world is smarter than Siri.

Meanwhile, Apple is smart at getting customers to spend money.

And it delivers top-notch service through the life cycle of their (in many cases, multiple) devices.

As for the biggest stock gainer this year among the Mag-7 brethren … none is more synonymous with AI than Nvidia (NVDA).

We don’t have its results yet, as Nvidia’s the only Mag-7 that didn’t report in October.

But when Jensen Huang’s company announces earnings after the closing bell on Wednesday, Nov. 19, Michael has high expectations.

He’s particularly interested in how big the backlog is for its Blackwell chips. If that demand is big, it could get even bigger. And that could translate directly to the share price.

Michael recently called Blackwell “the Force Multiplier Chip”:

“Nvidia’s next-gen monster (is) the Blackwell GPU.

“One chip delivers up to 20 petaFLOPS — the compute power of 100,000-200,000 iPhones.

“Stack those iPhones one on top of the other, and you’d have to climb from the ground to the top of the Empire State Building to match just one of Nvidia next-gen chip.

“That’s the force multiplier effect.”

He wrote that right here in Weiss Ratings Daily back in August.

Your analysts always aim to give you fresh ideas, analysis and actionable picks in your daily issues.

Here are the ones they sent your way over the past week:

The Earnings Double I Found While Traveling With AI

This week, Michael penned an ode to Chad, his nickname for ChatGPT. Chad guided him and his wife, Tracy, to some amazing 30th-anniversary adventures. And it led him to the company whose physical presence plays a key role in the rise of AI.

These Companies HAVE to Pay You to Own Them

It’s a low-yield world, and The Fed Just Stole More Money from Savers.

But there are not one, not two, but THREE types of companies that … unlike mainstream stocks … are forced to pay shareholders an enormous dividend every year.

Click on the link for three tickers that can get your heart or, at least, your account racing.

The Anti-Hallucination Machine

This week, Chris Graebe asks the question, “What if someone built an AI that never hallucinated? One didn’t need teraflops of cloud compute or billions in fine-tuning?” One startup team full of smart humans seeks to answer those questions and more.

AI Boom Could Usher in Employment Doom

AI is keeping America’s economy alive — but it might be killing the jobs that once sustained it. AI is driving a massive wealth effect via tech-stock prices, not wage gains. So, Sean Brodrick has a pick for you to make some profits in case of a rAIny day.

To your health and wealth,

Dawn Pennington

Editorial Director