|

| By Sean Brodrick |

Gold and silver hit new highs on Monday, just as the U.S. dollar suffered its largest single-day drop since late December.

Both precious metals continued their climb yesterday.

Investors aren’t just buying gold just because they think it’s a good investment.

They are voting.

Their vote is a no-confidence motion in the U.S. Federal Reserve's independence.

It’s one of those rare moments when politics, money and markets collide.

Not just collide, but do it so violently that prices start screaming messages policymakers can’t ignore.

For decades, the U.S. dollar has enjoyed one enormous privilege …

And that’s trust.

- Trust that the Fed would act as a neutral umpire.

- Trust that data, not political pressure, would guide interest rates.

- Trust that no president could bend the central bank to his will.

That trust is now being tested. And the precious metals market is reacting exactly the way you would expect when that trust starts to crack.

What Happened?

The Justice Department served the Federal Reserve and its chair, Jerome Powell, with grand jury subpoenas tied to his June 2025 congressional testimony over the $2.5 billion renovation of the Fed’s headquarters.

On paper, this is about marble, elevators, and cost overruns — roughly $700 million above initial estimates.

In reality, everyone on Wall Street understands this is a power play by President Trump.

For months, the President has bluntly stated that he wants deeper rate cuts. Much deeper. He wants …

- Lower mortgage rates.

- Higher economic growth.

- Cheaper financing for Washington’s ballooning deficits.

Powell is one of the few people in D.C. who dares to tell Trump “no.”

He’s held the line on slashing rates, warning openly about reigniting 1970s-style inflation.

So, President Trump has called for Powell’s resignation on multiple occasions.

But the Fed chair can only be removed “for cause.”

Now, Attorney General Pam Bondi and U.S. Attorney Jeanine Pirro are pushing an investigation into construction costs.

With the White House sending subpoenas, it appears the Justice Department is looking to put a Fed chair under personal legal threat.

If Powell resigns, or is removed before his term expires in May 2026, the administration gains control of the Fed’s agenda.

Powell’s Defiance

Powell’s response was extraordinary. In a rare video statement, he made clear he will not resign.

He also called the investigation a “pretext” — a deliberate attempt to intimidate the Fed into changing monetary policy.

Powell is warning markets, Congress and foreign governments that the world’s most important central bank is now a political battlefield.

Here’s the key point:

If the Fed loses independence, the dollar loses credibility.

Once credibility goes, the debasement trade goes vertical.

That is the belief that the U.S. dollar will lose its purchasing power due to excessive government spending and the rapid expansion of the money supply.

It’s also poison for a reserve currency.

Think of it this way …

For decades, the dollar’s value rested on one simple assumption …

That the Fed would do what was necessary to defend it, even when it was politically painful.

The moment investors believe legal pressure rather than economic data is forcing rate cuts, that assumption collapses.

And that turns gold and silver into voting machines.

The metals do not answer to presidents, attorneys general, or Congress. Importantly, they cannot be printed to solve political problems.

That’s why gold ripped through $4,600 on Monday … and the dollar dipped.

That’s the “Sell America” trade starting to stir beneath the surface.

Gold & the Dollar

This is not a retail trading phenomenon.

Central banks — particularly across BRICS and non-aligned nations — have been dumping dollars and hoarding gold at a pace that would have seemed unthinkable a decade ago.

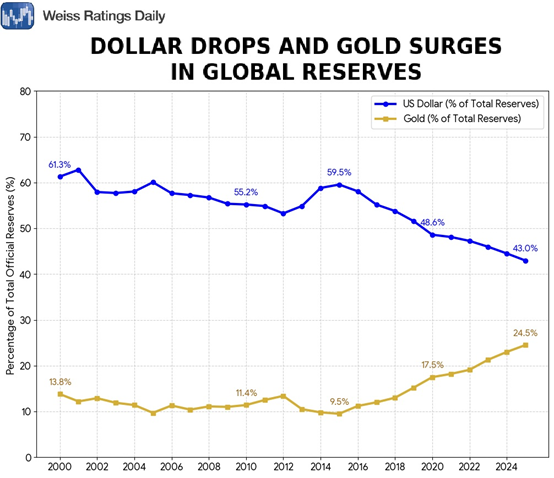

As shown in the chart below, the U.S. dollar’s share of global reserves has declined from 61.3% in 2000 to 43% in 2025.

Meanwhile, gold's share of global reserves began climbing in 2015, reaching 24.5% last year.

Gold has not passed the dollar as a share of reserves … YET!

But considering what’s happening, what do you think central bankers are doing now?

I’d bet they’re backing up the truck on gold. Not because they’re speculating. They are de-risking.

Gold is the only reserve asset with no counterparty risk and no political strings attached. As the legal and political pressure on the Fed intensifies, that appeal only grows stronger.

We’re still in the early stages. Based on recent developments, this referendum has only just begun.

President Trump is playing with dynamite by threatening the Fed.

He might not get the result he wants.

But gold bugs could see the price of the yellow metal surpass their dreams.

All the best,

Sean Brodrick

P.S. Gold ran up 2% in the past two days. As I hinted above, I uncovered a way to help investors make 469 times more than just owning gold.