|

| By Gavin Magor |

Banks are in the news again — this time for being the picture of health in the Fed’s eyes.

Mine, however, are a little crossed after putting the recently released stress test results for banks under the Weiss Ratings ultra-focused microscope.

In fact, my research team and I agreed it raised quite a few questions and yellow flags about the test’s relevancy and validity.

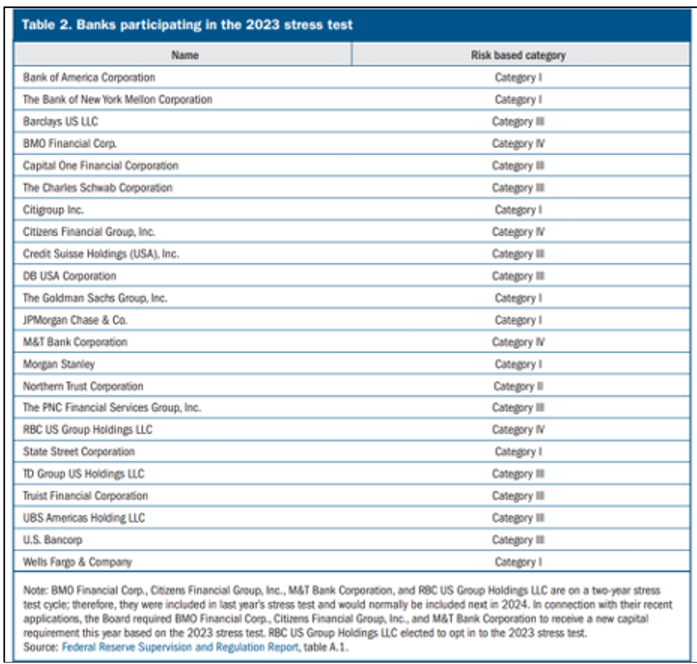

The annual test, instituted after the Great Financial Crisis in 2008 in an attempt to identify high-risk banks, changes each year. The most recent one examined 23 U.S. banks with assets of more than $250 billion.

The test would determine if they could weather a hypothetical severe recession while conducting business as usual. Here’s a list of the 23 banks that were tested this year:

Each bank had to be able to maintain minimum capital levels and continue providing credit under specific economic circumstances: surging unemployment (10% rate), as well as declining commercial real estate and housing values of 40% and 38%, respectively.

And guess what? Every bank subjected to the test passed with flying colors. Meaning, the group could absorb more than $540 billion in losses and continue to operate normally under pressure.

Unfortunately, though, because the Fed created the test based on 2022 data and prior to 2023 data, the reasons behind the failures of three regional banks (or the lessons learned from them) weren’t even considered.

That means because the 2020 bank stress test underestimated the fallout of the pandemic, providing a not-so-accurate health report, this year’s version could quite possibly be the most important one ever released by the Fed.

But I’m very leery about taking the results at face value, and you should be, too.

Here’s why …

The Brutally Honest Truth Behind Banking

I’ll use Silicon Valley Bank, the first major bank to fail this year, to explain why I’m skeptical and why you should still keep your guard up.

One of the most important gauges of a bank’s health is its adjusted Tier-1 capital ratio distributions. This metric determines if a bank holds enough capital to prevent insolvency.

Under the Dodd-Frank Act, a bank is considered "well capitalized" if it has a Tier-1 ratio of 6%. At Weiss, following the stricter Basel III guidelines, we use 8% as our barometer. SVB only had an adjusted ratio of equity capital to total assets of 5.8% as of Dec. 31, 2022.

The Fed’s stress test, however, assessed whether banks would stay above the required 4.5% minimum capital ratio during the hypothetical downturn.

First off, I view 4.5% to be a very low threshold; and second, it’s overlooking deposits. All the Fed cares about are the current reserves in these Tier-1 banks and if they can absorb the losses while maintaining minimum requirements.

That paints a partial and rosy picture that doesn’t reflect reality. As in the case of SVB, we live in a digital age where bank runs can happen almost instantaneously through mobile depositing.

Another major reason SVB faltered was because it owned too many “hold-to-maturity” assets — like long-term U.S. Treasury bonds — and couldn’t cover the losses.

Now, it’s completely fine to hold bonds to maturity; it’s an extremely common practice in banking. Doing so is usually safe because their value is measured at acquisition cost, even if they lose value.

The only time that can spell trouble is when a bank is forced to sell them prior to maturity to cover losses — like in the case with SVB, a bloody awful situation that happened due to poor management.

And as long as interest rates continue to rise, holding too many unrealized losses on the books could bring down any bank, regardless of size. Like many banks, the 23 involved in the test started this year with large unrealized losses because the market value of their securities fell as interest rates rose in 2022.

So, the fact that this year’s stress test actually assumes rates will decline in a hypothetical recession test isn’t up to date with current market predictions regarding rates. Neither is the Fed’s assessment that the market value of U.S. Treasurys will rise and unrealized losses will fall, when most analysts expect two more hikes before year end.

Just last week at the European Central Bank Forum, Federal Reserve Chair Jerome Powell claimed that he wouldn’t take the idea of multiple consecutive interest rate hikes off the table.

The assumption of lower rates also creates a fallacy by the Fed that real estate — commercial and residential — will reestablish uptrends; credit will loosen; and loan defaults will become a thing of the past.

To add to the illusion of health, only banks subject to Category I or II standards or firms that opted into the stress test, are required to include unrealized gains and losses on securities in the calculation of capital.

Category III and IV firms are not required to include them. So, some banks reported unrealized losses and some didn’t.

My main point, and one that I hope you at least consider, is that I’m just not buying the stellar health report for the banking industry.

We’ve still got offenders of risk management, and they’re playing Russian Roulette with your money.

Keep in mind that banks with more than $700 billion in assets have placed nearly 68% of their bond portfolios in hold-to-maturity assets, more than double from three years ago.

And with increased regulations because of the recent failures, as well as tighter international standards likely to boost capital requirements for the country’s largest banks, that in no way means smooth sailing for the industry.

With the Weiss Bank Ratings, you can find out if your bank is riding positive or negative waves. Just type in your bank’s name, and its rating will pop up along with key metrics like liquidity, stability and asset quality, among others.

Be sure to explore, and continue to stay up to date.

Cheers!

Gavin Magor

P.S. AI stocks have taken the market by storm. But, is this the right time to buy? We’ll try to help clear the fog around AI investing TODAY at 2 p.m. Eastern at our Artificial Intelligence Town Hall. Click here to claim your seat for this free event.