|

| By Gavin Magor |

It’s like walking on a tight rope with no end in sight.

Of course, I’m talking about the Federal Reserve’s battle against historically high inflation, and their interest rate-cutting decision.

Currently, rates are in the 5.25% to 5.5% range and have been there since July 2023. The last time the Federal Reserve held rates this high for so long was directly before the Great Recession in 2007.

History never repeats itself, but sometimes it rhymes. And I expect market volatility later this year, given the uncertainty.

Last week’s news of a hotter-than-expected consumer price index (CPI) report only restoked concerns about when rate cuts will take place.

The CPI, which is a measure of goods and services prices across the economy, increased 3.5% from March 2023.

The once widely assumed June 2024 interest rate cut is now highly unlikely. And this has a major impact on a lot of facets of the economy, especially stocks.

Among many things, as interest rates rise and fall, it has a major impact on how stocks are valued.

That’s why now is an especially crucial time to be following the Weiss Stock Ratings.

And one great way to combat future lower yields, and increased portfolio performance in general, is by seeking additional dividend income.

This research can easily be done on our Stock Ratings page, and I highly encourage all investors to utilize our resources.

Dominating Dividends

When searching for strong dividend paying names, I always go to the Weiss Stock Ratings page.

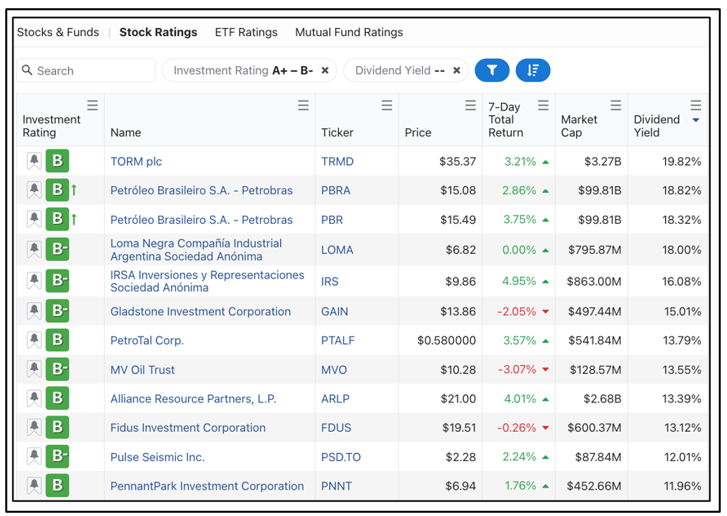

I then filter for “Buy”-rated names, which are within our “A” to “B-” range for stocks. This means these stocks have been put under rigorous tests for safety and stability, with good prospects for outperforming the market.

After that, I easily sort these stocks by “Dividend Yield.”

Here are the top 12 stocks that populated after my recent search:

Generally, a good dividend yield is anywhere in the 5% to 10% range. But we’re seeing even higher yields in the above list. And when you combine those big yields with the green “Buy” rating toward the left, these names should have your attention.

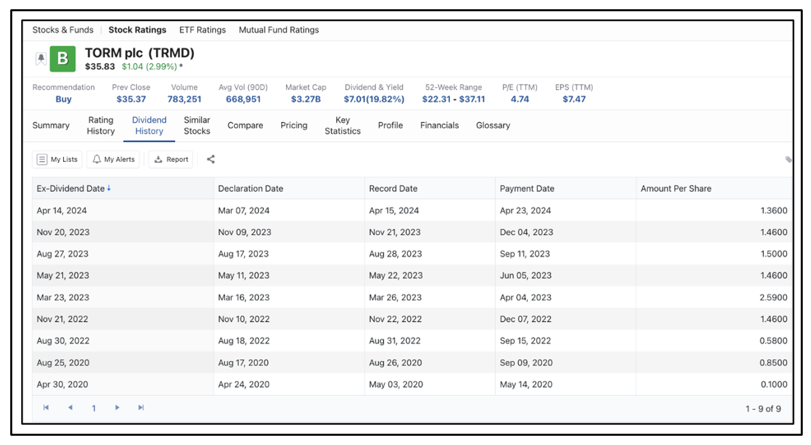

I especially want to look at the top name on this list: TORM plc (TRMD).

Now, you may be thinking, “Wow, that’s a very high yield. Is that payout sustainable, and how long has this company been paying that amount?”

Well, we conveniently have that information listed under the “Dividend History” tab.

Here’s what we have for TORM:

You can see that it has been paying a large dividend over the past few years on a quarterly basis.

And the company appears to be doing quite healthy, with shares up a very impressive 270% over the past two years.

Let’s take a look at its chart:

Perhaps I’m a little biased toward this name because it’s headquartered in the U.K., but it’s a shipping company that owns and operates a fleet of product tankers.

If you’d like to do additional research on this name, be sure to look at its Weiss Stock Ratings page.

Whatever your investing intentions are, we here at Weiss Ratings are quite confident that you can be assisted by visiting our site.

Whatever stock information you need, it can most likely be found with our research.

And don’t forget, it’s not just our Stock Ratings. That goes for everything including our banking ratings, insurance ratings and cryptocurrency ratings.

Cheers!

Gavin