|

| By Nilus Mattive |

If you’ve been following my work for any length of time, you know that I have typically focused on dividend-paying stocks and other income-generating investments and strategies.

However, over the last several years, I have also been making more recommendations related to alternative assets … including select cryptocurrencies.

That’s because I think having stakes in a wider range of investments actually makes the average portfolio safer, even if some of those assets are “riskier” on their own.

This is precisely what I told Safe Money Report readers back in February of 2023, when I officially recommended allocating some money to Bitcoin (BTC, “A”) in our model portfolio.

Although Bitcoin was largely being written off at the time, I had been out in the public eye for quite a while — saying the weakness was temporary, and it would eventually start a new climb as mainstream adoption followed the same basic curve we’ve seen in countless other technological innovations.

It didn’t take long for everything I said to get proven right.

As a new banking crisis hit, Bitcoin started jumping — demonstrating exactly how a completely different (and volatile!) asset could add a new dimension of safety to a conservative portfolio.

Within five months of the initial recommendation, I was already telling readers to grab a very solid 44% gain on half of their position.

That’s a terrific result.

But it was still just the beginning …

In October, I told Safe Money readers to switch their remaining Bitcoin into the Grayscale Bitcoin Trust (GBTC).

The idea was that the fund was trading at a discount compared to the value of the Bitcoin it was holding — a 19% discount at the time.

I said that discount would evaporate once the SEC finally approved a spot Bitcoin ETF, an event I predicted would happen in 2024.

I also told them it was the right time to buy the Grayscale Ethereum Trust (ETHE) under the same basic logic, plus other fundamental reasons to be bullish on Ethereum (ETH, “B+”) itself.

Specifically, I wrote:

“My personal take is that even if that ARK application is rejected, we will see an approval take place by the spring of 2024 when the next big wave of applications requires final decisions. And once a single approval happens, then pretty much all of them will start happening — for both Bitcoin and Ethereum.

Meanwhile, the discounts on Grayscale’s Trusts could continue to narrow leading up to the actual event. The minute any approval happens, I would expect the spreads to disappear almost completely.

That makes buying GBTC and ETHE lower-risk, higher-reward situations.”

To my pleasant surprise, it all started coming true within days of issuing that new batch of recommendations as more and more investors started waking up to the same arguments I was making.

Bitcoin and Ethereum started climbing, and the Grayscale Trusts began moving closer to the values of their underlying investments.

And as we now know, the SEC ended up approving a bunch of spot Bitcoin ETFs earlier this month — the most optimistic scenario I outlined.

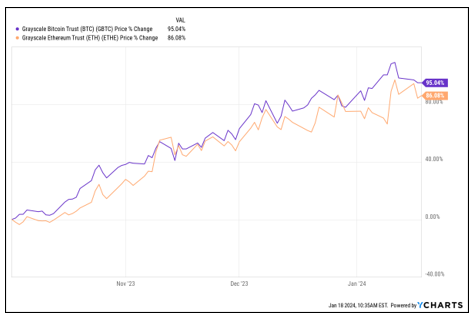

As a result, Safe Money readers are currently up as much as 89% on GBTC in just three short months … even after a “sell the news” pullback took place in the wake of the approval announcements.

Better yet, ETHE is up roughly the same amount!

These are already the biggest winners Safe Money Report has ever seen over any holding period — including all open and closed positions.

Which begs the question: Is now a good time to take profits?

I would say no for several reasons.

On the Bitcoin side of the equation, I believe this is still just the beginning of the big mainstream adoption phase I started predicting during the last crypto bear market.

Nobody should have expected it all to happen within a few days of the first ETF approval.

It’s going to take more time than that. Heck, a lot of people who don’t follow the markets very closely don’t even realize how easy it is for them to invest in Bitcoin now.

However, this is still a watershed moment.

Wall Street firms will begin telling their customers the same thing I told Safe Money readers a year ago. And they will begin putting real marketing dollars behind that message.

On top of that, Bitcoin will soon see its next halving — an event that reduces the supply of new Bitcoin coming into the marketplace.

Past halvings have pushed Bitcoin’s price up significantly. Couple that with the new ETFs, and you have the recipe for more gains ahead.

Meanwhile, on the Ethereum side … the discount to NAV on the Grayscale Ethereum Trust has narrowed considerably since I first made my recommendation, but it is still hovering around the 15% mark.

That alone argues for continuing to hold the trust. After all, now that spot Bitcoin ETFs have been approved, spot Ethereum ETFs shouldn’t be far behind. Applications are already on file!

Moreover, Ethereum itself is a crucial building block for many projects in the crypto ecosystem — including exciting projects related to Web3 and NFTs.

So, I believe Ethereum could post even bigger gains than Bitcoin this year.

This is precisely why I’m telling Safe Money readers to keep holding ETHE along with their GBTC.

And it’s also why I offered the Grayscale Ethereum Trust as my favorite “aggressive” pick for the MoneyShow’s recently released 2024 Top Picks Report: 90+ Stocks to Buy for 2024.

So, if you’ve been on the fence about crypto-related investments, I’d say now is the time to consider at least a small allocation to the space. A lot of money has already been made, but there are reasons to expect a lot more upside ahead.

Best wishes,

Nilus Mattive