|

| By Tony Sagami |

I was born in Fukushima.

Yeah, the same Fukushima that was hit by an earthquake and a tsunami in 2011. The same Fukushima that saw 154,000 of its residents forced to flee in the aftermath of the nuclear power plant's partial meltdown.

My uncle and his family still live there.

Fukushima is the latest — but not the only — nuclear disaster the world has dealt with.

Remember Chernobyl in 1986 and Three Mile Island in 1979?

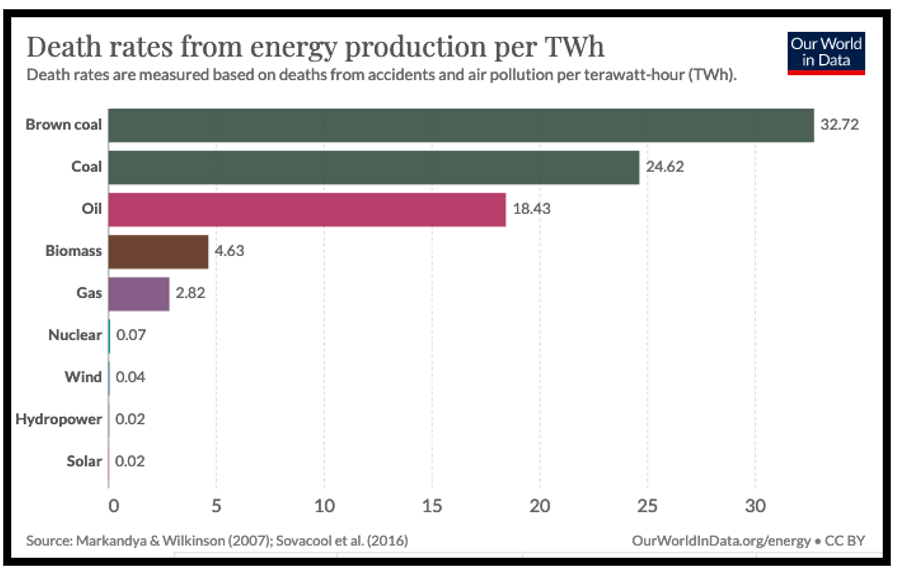

Construction, better engineering and safety protocols have improved so much that nuclear power is now statistically much safer than most other forms of power generation.

Today's nuclear reactors employ duplicate emergency cooling systems to prevent overheating and are built with core catchers that contain the reactor core in a worst-case meltdown event.

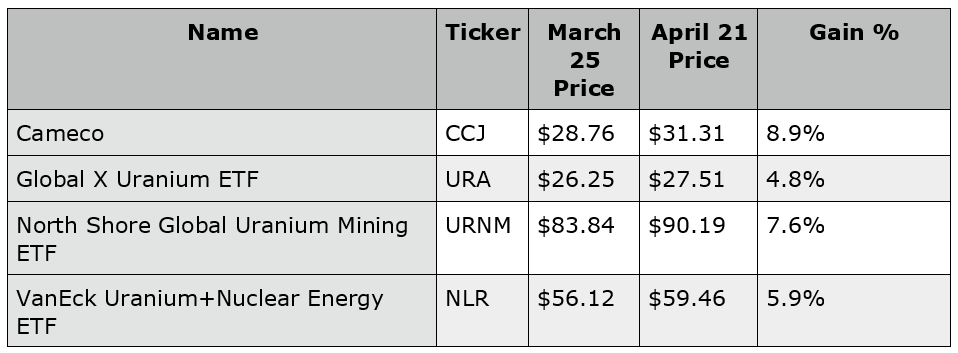

I wrote about nuclear power and uranium on March 25.

If you bought the stock or any of the exchange-traded funds (ETFs) I highlighted — Cameco (CCJ), Global X Uranium ETF (URA), North Shore Global Uranium Mining ETF (URNM) or VanEck Uranium+Nuclear Energy ETF (NLR) — you'd already be sitting on some sweet one-month gains:

Uranium's Price Propulsion

The price of uranium has jumped to $63.50 per pound this year, a +40% increase. That's just the tip of the iceberg.

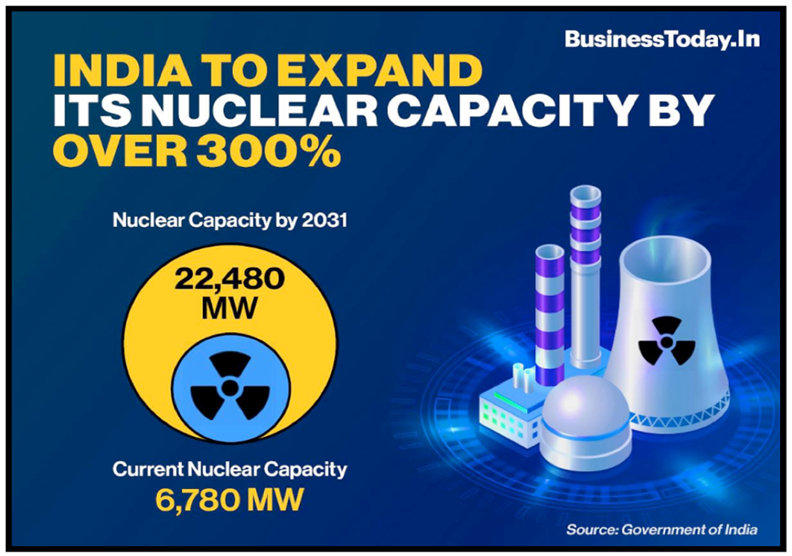

I was recently in New Delhi, India, and while reading the morning newspaper with my breakfast, I noticed the following front-page headline:

According to The Times of India:

"With the first pour of concrete for a 700 MW atomic power plant in Karnataka's Kaiga scheduled in 2023, India is set to put in motion construction activities for 10 'fleet mode' nuclear reactors over the next three years."

Fleet is more of a naval term. But the point: India is going full steam ahead for nuclear power.

To put those 10 new nuclear power plants in perspective, India currently has 22 operating nuclear power plants … so we're talking about a 44% increase.

But on a total power basis, those 10 new nuclear power plants will produce over 300% more electricity than all 22 of the existing plants combined.

Yes, fleet is an accurate description of the armada of nuclear plants to be built in India.

That also means that India will need to purchase 300% more enriched uranium every year.

The ongoing war between Russia and Ukraine has forced governments all around the world to reexamine their national energy policies. And countries are increasingly leaning toward nuclear energy as a solution:

- Earlier this month, the U.K. announced plans to build eight new reactors.

- France is planning 14 new reactors.

- And the U.S. Department of Defense is focusing on small-scale, mobile nuclear for remote bases.

Nuclear energy is the total package: low impact, high performance, zero emissions. It's the only form of clean energy that can supply power around the clock.

Nuclear power is about to enter a multidecade building spree … and if you haven't yet, you should jump on the uranium bandwagon.

To be fair, I want to disclose that my Disruptors & Dominators Members already own Cameco and are sitting on a huge open gain. At the time of writing, they're up 68% on that position.

But I'm still not currently recommending they sell. I think it's going to move much, much higher.

If you'd like to join them in receiving my best picks, click here now. They'll be getting my latest pick this afternoon in the monthly issue.

Best wishes,

Tony