Use the Weiss Ratings to Find More Than Just Big Names

|

| By Gavin Magor |

When you think of this year’s market rally, it’s easy to think about companies like Microsoft (MSFT) and Apple (AAPL).

And surely, those are fantastic companies that are responsible, with large weightings in major indices.

Equally weighted market indices show that a large majority of this rally is not broad and market breadth is narrow. But make no mistake: There are many other very strong and highly-rated names that have gone up considerably over the past few months, and the Weiss Ratings are here to prove it and are always ready to help you easily find them.

Simply go to the Weiss Ratings site, and check out our Stock Ratings. Today, I’m on the hunt for …

Highly Rated Names, Sorted by High Recent Performance

There are certainly many parameters you may want to search for, and on our stock screener, there are many. So, I’m very confident you will find what you are looking for.

For today, however, I want to focus on two specific aspects:

1) Stocks with a Weiss Ratings of “B+” and higher

2) And the highest 90-Day Total Return.

Having the screener of Weiss-rated stocks of “B+” or higher is extremely important for me, because it helps filter out the “high-flyer”-type stocks that may be unsoundly up for unjustified reasons.

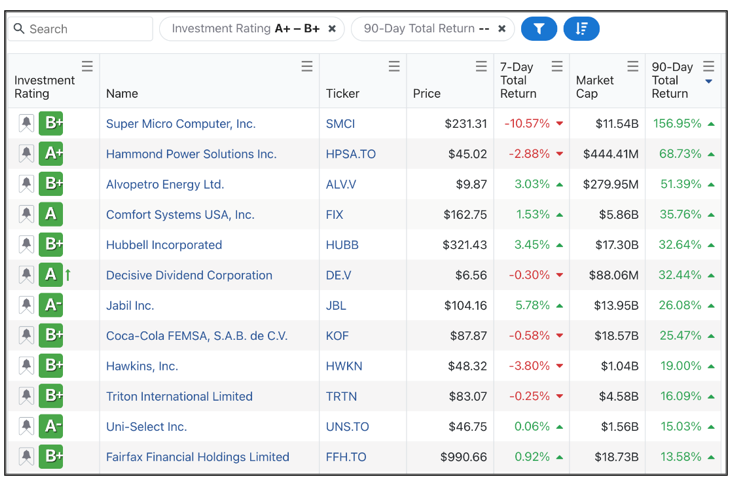

And after placing those two criteria into the screener and sorting by the highest 90-day return, here’s what populated:

Click here to see full-sized image.

And as you can see above, I also kept the 7-Day Total Return column in. This is also important because it allows you to see a stock’s most recent price action.

As in the case of Super Micro Computer (SMCI), even though it has been up a blistering 156% over the past 90 days, the past week has seen some down action, around 11%.

These are not your common household names, but they are stocks that are highly rated and have performed well over the past three months, and they should warrant some of your attention at the very least.

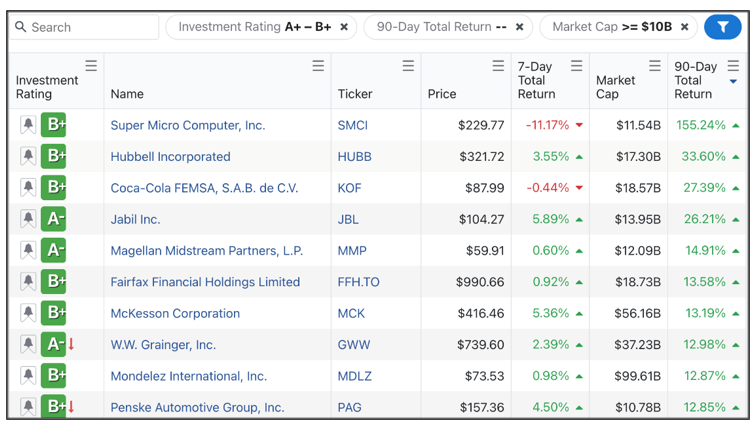

But I want to take it one step further. I want to only look at large-cap stocks or higher, meaning they have a market capitalization of $10 billion or more. (Large-cap stocks have a market cap between $10 billion to $100 billion).

The convenient market cap filter allows me to do just that by clicking on Market Cap “>= $10B”.

Here’s what populated, sorted by 90-Day Total Return:

Click here to see full-sized image.

Some benefits of larger stocks, such as large-caps, are more stability, lower volatility and more analyst coverage. With more information available, doing research is easier. They also tend to be better dividend payers, which I especially like.

In my list above, there are more companies that you are probably familiar with, such as W.W. Grainger (GWW) and Mondelez International (MDLZ), both of which sport high ratings of “A-” and “B+”, respectively.

You may like them for other reasons, but those names stand out to me for their stability, respectable dividend and the industries they operate in.

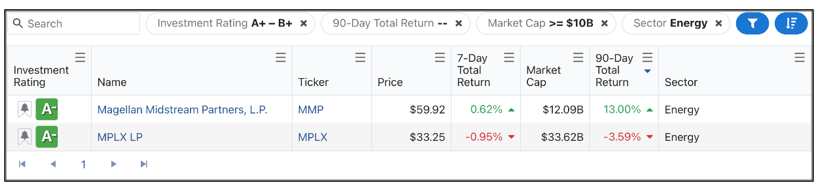

And say you wanted to take it a step further and really narrow down your list to just a particular sector, such as energy, you can easily do so:

Click here to see full-sized image.

In this case, two strong “A-”-rated names were left, Magellan Midstream Partners (MMP) and MPLX (MPLX).

The 90-Day filter is more of a “technical” tool looking at price, whilst the Weiss Rating is more of a “fundamental” tool taking a deep dive into the company's financials and overall safety.

If you’re not utilizing our incredibly easy-to-use and highly informative Weiss Ratings tools, you may be missing out on some great opportunities.

Finding quality names doesn’t have to be like finding a needle in a haystack … and it also doesn’t have to be the stereotypical names touted by the pundits on the television.

Here at Weiss, we try to do more of the heavy lifting so that every day investors have more sound judgement about what investment decisions they are making. Our ratings are (and have always been) 100% unbiased and free to use!

Use them! Your next great investment opportunity may be knocking.

Cheers!

Gavin Magor

P.S. If you’d like an even more personalized investing strategy, be sure to check out my service, All-Weather Portfolio. Members of that service are enjoying tailored picks driven by our ratings and our proprietary Bear Bull Model … and have enjoyed beating the major indices in doing so. Click here to learn more.