|

| By Nilus Mattive |

Today I’m writing to you from a remote island off the coast of Sumatra, Indonesia.

The weather is pleasantly tropical. The surfing is spectacular. And the food — chicken cooked in banana leaves … fresh fish and shrimp … and the occasional water buffalo curry — is all terrific.

The island is under Sharia law, which means there’s no drinking … no gambling … and a rather strict dress code.

However, the locals are all friendly. Indeed, many shout, “Hello, mister,” and wave as I whiz by on a scooter.

My daughter and I will be staying here for the next month. But I’m pretty sure I could spend an entire year here without much of an issue.

Especially since the internet service has been very reliable.

Which brings me to a rather interesting — and little-known — provision of the U.S. tax code that could essentially pay for me to stay here for free should I decide to extend my stay.

Better still, you might be able to use the same option to spend a year (or more) in just about any foreign locale you have your eye on.

Here’s how it works …

The United States is the only major country that taxes citizens on their worldwide income.

In other words, as long as you hold an American passport — or even a resident alien green card — you pretty much owe Uncle Sam a share of everything you make no matter where you make it or where you’re living when you make it.

Just about every other country only taxes income earned inside the country itself … if they tax income at all!

Really, when it comes to the U.S., there are only two ways to (legally) avoid the situation:

No. 1: Use the Foreign Tax Credit (FTC)

The foreign tax credit is pretty straightforward: If you pay taxes to another country, you can often use what you paid to offset what you would otherwise owe Uncle Sam.

But there’s another option that might be even more attractive, and in some cases, you can still use the FTC on top of it …

No. 2: Use the Foreign Earned Income Exclusion (FEIE)

Put simply, the Foreign Earned Income Exclusion (FEIE) makes it possible to exempt a large amount of money earned overseas from U.S. federal taxes.

Earned income includes things like wages, salaries and self-employment money but not things like dividends, interest or rental income.

For the most recent fiscal year, the cap was $126,500.

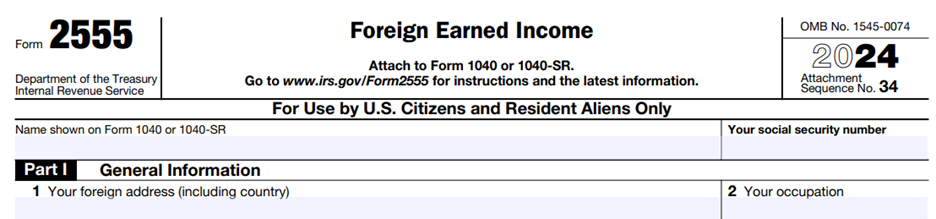

There are two main ways to qualify for this exclusion, which you claim by using IRS form 2555:

No. 1: You’re a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

No. 2: You are physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

For our purposes, let’s focus on the second avenue, as I consider it the more flexible test.

Let’s say you’re a graphic designer who does a lot of freelance work.

After paying things like Social Security taxes and factoring in your business expenses, you clear $150,000 a year.

If you live in the United States, you’re probably going to owe Uncle Sam something like $26,000 in federal income tax.

Instead, let’s say you decide to go on an around-the-world trip for that same year … staying for a month or two in a bunch of different countries throughout Europe and Latin America.

You leave on New Year’s Day and don’t come back until Christmas the same year.

Under the FEIE, you can exclude as much as $126,500 of your $150,000 in earnings for federal income tax purposes.

So, as long as you keep good records, you should be able to keep about $20,000 of the $26,000 you’d otherwise pay the U.S. government.

That’s almost $2,000 a month to help subsidize the trip itself. And frankly, $2,000 a month goes a long way in many places.

I’m sure I could stay where I am right now for that much. In fact, the average daily wage here is just $7.

While I haven’t investigated the possibility yet, I’m pretty sure I could buy a small house for $20,000. (While foreigners can’t own land in Indonesia, they are able to secure very long-term leases for the property that their structures are located on.)

Meanwhile, on a recent trip to El Salvador, I was eating lunch and dinner in various highly rated restaurants for somewhere between $20 and $30 a day …

My car rental was roughly the same, and I didn’t really NEED a car at all …

And my five-star-rated Airbnb right near the beach? About $90 a day all in, without any kind of monthly stay discount.

So, it might be entirely possible to live that type of life completely on Uncle Sam’s dime for a year or two.

I currently spend several months in various countries every year as a normal part of my life … and I work quite easily in every one of them without any complications at all.

Maybe this will be the trip where I decide to stay a lot longer!

Best wishes,

Nilus Mattive

P.S. As you can see, I don’t mind digging into the complicated U.S. Tax Code to find ways to lighten our burdens.

That’s why Dr. Martin Weiss and I teamed up to find six easy steps you can take to protect yourself in what we’re calling the “Age of Chaos.”