|

| By Jon Markman |

The most acclaimed investor in a generation spent Saturday dispensing folksy words of wisdom. Investors should ignore his advice about AI, though.

On Saturday, Warren Buffett, founder of Berkshire Hathaway (BRKB), claimed at his annual general meeting that AI might be as dangerous as the atom bomb, and that its hype is misplaced.

Investors should ignore Buffett and use weakness to buy AI leaders.

Buffett is widely regarded as one of the most successful investors of all time. His track record at Berkshire is stellar. The conglomerate has built major holdings over decades in a host of market-beating companies, including Coca-Cola (KO), American Express (AXP) and Apple (AAPL).

However, when it comes to AI and disruption, Buffett seems to be missing the point … and the opportunity. AI is not an atom bomb. It is the evolution of understanding.

Similarly, that’s how you can think about my colleague Chris Coney’s strategy for going after capital appreciation and yields in a sideways market, like we’ve been seeing for quite some time now. Chris has a method of routinely producing 18%+ yields when you want to add income to your portfolio. Click here to learn more.

Back to Buffett and AI …

Investors should think about AI as computer systems developed to supercharge human intelligence. These systems can learn and find patterns in huge amounts of data that we humans simply can’t fathom. The recognition is possible because the machines are running countless parallel simulations to draw inferences. It’s pure brute force.

The current excitement surrounding AI stems from efficiency. The machines are getting exponentially better at processing the data, due mostly to NVIDIA (NVDA).

The San Jose, California-based semiconductor company began in 1993 as a developer of graphics processing units for computers. GPUs happened to hit at a time when the computer gaming industry was taking off. Through the next two decades, Nvidia GPUs became the backbone of the parallel computing movement and AI.

Advances in AI have enabled new groundbreaking innovation in healthcare, robotics, education and entertainment, with more to come.

AlphaFold is an AI system that can predict the 3D structure of proteins based on their amino acid sequences with unprecedented accuracy and speed. This revolutionary development will speed up drug discovery and biotechnology advances.

MuZero is a reinforcement learning system that can master complex and previously unknown environments without any prior knowledge or rules. Robots can learn how to stack boxes at warehouses or even play soccer. AlphaFold and MuZero were developed by Alphabet (GOOGL).

OpenAI and its partner Microsoft (MSFT) pushed AI into the mainstream with full integration of two groundbreaking AI systems into the Bing web browser. DALL-E is a generative adversarial network capable of creating realistic and imaginative images from simple text descriptions, such as “a pentagonal green clock in the shape of a banana.”

And GPT-3 is the AI engine running under the hood of ChatGPT, a natural language processing chatbot. ChatGPT can generate coherent text and even computer code for any topic with no more than a few words or sentences as a prompt.

AI Isn’t a Destructive Force

That’ll Wipe Out Humanity

It is a powerful tool that can enhance productivity, creativity and efficiency. Developers are using the power of AI to solve some of the most pressing problems in the world, such as climate change, poverty and healthcare.

Investors should not fear AI. They should embrace it because disruptive forces create massive wealth.

In January, the Financial Times published an interesting story that showed the market capitalizations of the Ark Innovation (ARKK) ETF and Berkshire Hathaway. Both investment funds started Q1 2021 valued at approximately $100 billion, and through Q2 2022, each fund was valued near $145 billion.

However, in the interim, Ark soared to $310 billion, only to get more than cut in half. The implication of the Financial Times piece is that slow and steady is better than fast and volatile. This is not necessarily true.

Buffett is an outstanding investor. The accomplishments of the 92 year old have been legendary, yet he did completely miss the 2021 upswing in innovation shares. That event created generational wealth in a short time frame.

Another wave of innovation is coming, and AI will be the driving factor.

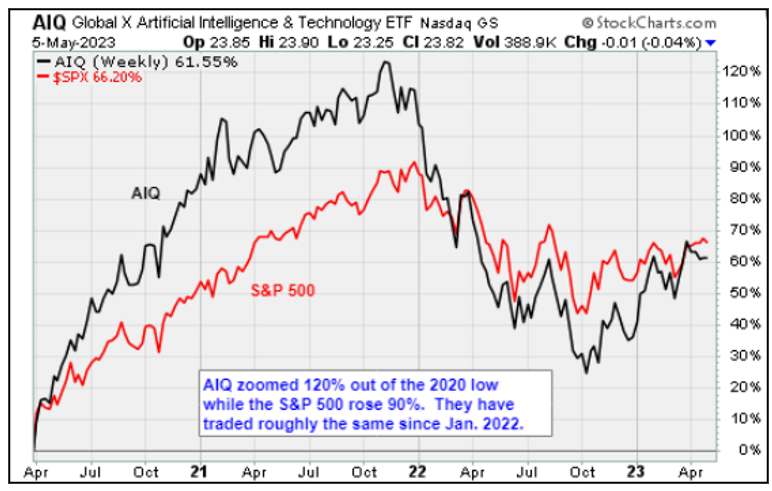

Click here to see full-sized image.

Longer-term investors should use weakness to add positions in Alphabet, Microsoft and Nvidia. These are AI leaders. Shareholders will be rewarded accordingly.

Investors who prefer exchange-traded funds for the sake of diversity should check out the Global X Artificial Intelligence & Technology ETF (AIQ), which appears to be one of the best performing and most heavily traded of the bunch.

That’s it for today. I’ll be back with more soon.

Thanks for reading,

Jon D. Markman