|

| By Jon Markman |

Wall Street analysts are finally coming around to the size of the digital transformation opportunity. Better late than never.

An analyst from Jefferies was interviewed last week to opine on the latest blowout report from Salesforce (CRM). He grudgingly admitted that he was surprised by the surge in the company order backlog.

Too many analysts don’t understand this moment in time. They’re thinking too small.

In the same way digital files changed the way we consume movies and music, digitization is transforming commerce at the enterprise level. Digital changes everything, from communication to better software to increase operational efficiency.

Bears often dismiss this idea as a variation of “it’s different this time” — a familiar refrain from bulls. This is lazy analysis and incredibly dangerous for most investors.

Innovation follows a time-tested path.

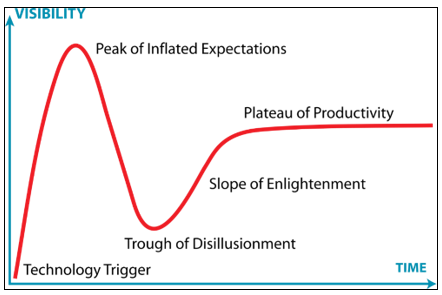

Gartner researchers termed this the hype cycle of emergent technologies.

The first is the innovation trigger, where the new tech is introduced, and hype builds.

The next phase, the peak of inflated expectations, sees the tech implemented on a limited scale … often without much early success.

As these failures mount, the trough of disillusionment begins. Early investors begin to exit, and startups fail.

The fourth phase, the slope of enlightenment, brings next-generation products, as the most determined entrepreneurs drill down to better use cases.

However, true success remains elusive until the fifth and final stage, the plateau of productivity. This is the path to mainstream adoption.

Digital transformation is now well into the fifth stage.

Brent Thill was interviewed Thursday on CNBC. The Jefferies analyst was asked about the surprisingly strong quarter results from Salesforce, the largest customer relationship management software company in the world.

After demurring about misunderstanding sales momentum at Salesforce, Thill was clear that large companies are stepping up CRM orders. He seemed surprised by the size of the backlog for existing orders.

Jefferies missed the bigger picture.

Large corporations are still early into their digital transformation strategies. CRM is the first stage of this process.

Salesforce helps companies digitize customer orders, plan marketing for new customers and get the analytics that have become so important to commerce in the digital era. More importantly, investment in software pays for itself with the boost it provides to productivity.

There is another, more niche opportunity here though. And if you don’t want to follow Jefferies’ lead, you should check it out.

Digital Governments Present a Huge Opportunity

Tyler Technologies (TYL) operates a vertically integrated software platform widely used by state and municipal governments to move necessary processes online.

The modular nature of Tyler’s software means parts of the overall portfolio can be added on a piecemeal basis. This appeals to counties large and small, everywhere from Los Angeles County, with a population of 12.9 million, to tiny towns in Texas of less than 100 citizens.

The Plano, Texas-based company is the largest player in public sector software — a deeply fragmented segment.

Modules include courts and justice, public safety, appraisal and taxes, civic services and K-12 schools. And company executives plan to accelerate growth by providing greater data analytics, a low code platform to help clients build bespoke applications.

The strategy is clearly working.

Tyler reported $1.85 billion in revenues during 2022, with up to $1.95 billion projected in 2023. Some 80% of those sales are recurring, with an operating margin of 23.6%.

In November, executives estimated that the total addressable market for state, local and educational software is $13 billion. The TAM for software devoted to the federal marketplace is $2 billion.

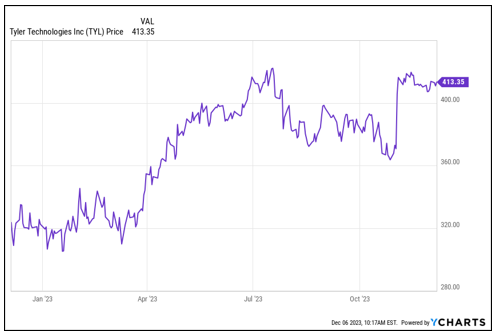

At a share price of $413, Tyler stock trades at 47.3 times forward earnings and nine times sales.

These metrics reflect investors’ continued confidence in Tyler’s sticky revenue stream and strong growth prospects.

If professional analysts like Thill can miss the bigger picture on a mega-cap company like Salesforce, imagine how much can be made on a smaller, faster-growing company like Tyler.

If you want to add some tech exposure that isn’t the trillion-dollar giants we hear about every day, consider this for your portfolio.

All the best,

Jon D. Markman

P.S. The Gartner Hype Cycle isn’t the only major cycle you should have on your radar. In fact, my colleagues just put together a presentation on an even bigger “millennial cycle” that could present a $13 trillion windfall opportunity for investors. Click here to RSVP your spot for when it goes live.