|

| By Chris Graebe |

Silicon has been the backbone of technology for over 60 years.

It’s in everything — from your smartphone to the vast data centers that power the internet you depend on.

You’ve probably never questioned its availability, abundance or reliability.

After all, it’s driven the exponential growth of technology for decades.

But there’s a problem on the horizon.

Silicon is hitting its limit.

The tech industry has long relied on Moore’s Law. It’s the principle that the number of transistors on a chip doubles roughly every two years.

This is why your devices keep getting faster, smaller and more efficient.

For decades, this theory held up, leading to an explosion of innovation.

But now, we’ve pushed silicon to its breaking point.

The more transistors we squeeze onto chips, the more heat we generate.

We’re producing so much heat that it’s becoming impossible to manage efficiently.

Data centers, electric vehicles and AI systems are all running into the same issue: They need more power.

But silicon is struggling to deliver.

The Race for Silicon’s Successor

Here’s where things get exciting.

If silicon can no longer meet the demands of modern technology, what comes next?

This question has sparked an arms race in the tech world.

Scientists and engineers have been searching for the next material to drive the future of innovation.

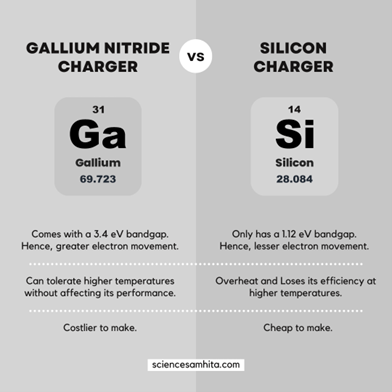

One contender is gallium nitride (GaN), a semiconductor material that’s already making waves.

Unlike silicon, GaN can handle higher voltages and temperatures. And it’s much more efficient, generating less heat.

This is critical as we look to power the future of AI, electric vehicles and renewable energy technologies — which are all demanding more from our electrical infrastructure.

GaN’s ability to switch on and off faster than silicon also makes it ideal for high-performance applications.

Essentially, GaN could be the key to unlocking more efficient, powerful and sustainable technology.

The Challenge

But there’s a catch.

While GaN is seen as the future, it’s difficult to manufacture at scale.

The methods that work for silicon don’t apply to GaN. And current production techniques are expensive, slow and environmentally unfriendly.

This is why there’s so much urgency in the race to figure out how to produce high-purity GaN quickly and efficiently.

The companies that solve this puzzle will have a massive advantage in the semiconductor market, which is poised to explode as the demand for GaN grows across industries.

My colleague, Sean Brodrick, pointed out a second problem just last week when he wrote: “China outright banned exports to the U.S. of gallium, germanium, antimony and other key high-tech materials with potential military applications.”

He has been all-in on antimony. But as I highlighted above, gallium supply is in danger now, too.

After all, China produces 98% of the world’s supply of this key material.

But make no mistake, the global GaN semiconductor market is expected to grow at an incredible pace over the next decade. And those working on the production end can also help solve the supply side of this equation, too.

Why This Matters to the Future of Technology

This transition from silicon to GaN isn’t just an incremental improvement. It’s a game-changing shift.

Silicon has taken us far. But to meet the growing demands of the globe, we need something better.

GaN offers the promise of faster, more efficient and more powerful technology without the energy losses that come with silicon.

But the race is just beginning. And the companies that can crack the code on GaN production will be the ones driving the next wave of technological advancement.

It’s a pivotal moment — one that will determine who gets to shape the future of the $15.7 trillion AI boom and beyond.

Happy hunting!

Chris Graebe

P.S. My Deal Hunters Alliance Members are positioned in a startup that seeks to solve this problem. That private offering just closed. But at least one publicly traded company is already on the case.

In fact, this is precisely the kind of problem Nvidia would like to be the first to solve. Two of its earliest problems with its next-gen Blackwell chip were power management and heating issues … exactly what GaN can solve.

Nvidia may be the world’s biggest and most important AI company. But it often solves these kinds of problems by relying on its silent partners. I urge you to check out this presentation on how that works.