|

| By Nilus Mattive |

It doesn’t get much more remote — or much more foreign — than Simeulue, where my daughter and I just spent the last month.

It’s the northernmost major island in Indonesia and part of Sumatra’s Aceh province …

An area that became famous as the epicenter of the 2004 Indian Ocean earthquake and subsequent tsunami that killed a couple hundred thousand people.

It is also the only province in Indonesia currently practicing Sharia law, a strict Islamic code of conduct that prohibits things like showing too much skin, drinking alcohol, gambling or public displays of affection between unmarried people.

Offenders are typically punished by caning — anywhere from 10 to 150 lashes doled out publicly.

You can see why, despite its unspoiled beauty and tropical climate — as well as its world-class waves — Simeulue isn’t an ideal spot for the typical tourist.

Heck, there are no bars, nightclubs or movie theatres …

There are no western shops or restaurants …

And the island’s hospital is only capable of performing basic medical procedures like stitching up surfers who collide with the island’s razor-sharp reef.

Should such a fate befall you, the cost is something like 10,000 Indonesian rupiah (IDR) per stitch.

While that sounds like a lot of money, it’s about sixty American cents.

Indeed, one of the most interesting things about spending time in Indonesia is performing mind-boggling currency translations because one U.S. dollar equals about 16,116 IDR.

That means one million Indonesian rupiah is about $62.

Even though things are generally dirt cheap in U.S. dollar terms, the numbers still get astronomically comical.

A return flight to the United States might cost you more than a billion rupiah!

To travelers more used to converting greenback to euros or even Mexican pesos, it’s a stark lesson in what can happen to a currency during periods of runaway inflation and/or inept government planning.

In Indonesia’s case, the first half of the 20th century saw a series of radical changes to the country’s monetary system as the Dutch, the Japanese and local governments all vied for control of the region’s economy.

The struggle wasn’t just academic.

At one point, after the Japanese had surrendered and the Dutch tried to impose a new version of money, local Indonesians outlawed its use.

Anyone caught carrying the new bills went to prison for five years.

In some cases, militants simply killed them … pinned the money to their dead bodies … and hung them in public as a warning to others.

Additional struggles ensued, including the British helping the Dutch try and confiscate Indonesia’s own printing presses and all the related money they were trying to create.

Indonesia finally managed to form a new central bank and create the Indonesian rupiah in 1946.

Still, there were competing currencies including dozens issued by various governments in Sumatra and Java.

Then, in 1953, Bank Indonesia was established. That new central bank issued its own brand-new rupiah that began circulating in several denominations.

But things didn’t go smoothly …

Massive inflation kicked in, with prices tripling over the following six years.

The president at that time wanted to devalue the IDR and the head of the central bank didn’t agree with that policy.

So, a more willing governor was put into power, and the IDR was subsequently devalued by 75%.

To put all of this into context …

In 1949, 3.8 IDR was equal to 1 U.S. dollar.

Before the devaluation, the rate was officially 11.4-to-1 …

And afterward, it was 45-to-1.

So, in ten years, the currency had lost most of its value.

Unfortunately, the trend didn’t just continue. It accelerated.

Inflation hit 27% in 1961 … 174% in 1962 … and 600% in 1965.

A communist upheaval followed and resulted in hundreds of thousands of Indonesian deaths.

Suharto, a major general who took control of the military during the conflict, served as the country’s president for the next two decades.

Despite allegations of corruption and authoritarianism, a period of relative calm ensued under Suharto … though the Rupiah continued to lose value.

Fast forward to 1992 and one Indonesian rupiah was worth less than one fifth the value it had when the 10,000-rupiah note was created in 1970.

Things got worse when the Asian Financial Crisis of 1997 hit.

The rupiah lost another 80% of its value in a matter of months, ultimately leading to the end of Suharto’s rule.

By June of 1998, it took 16,800 Indonesian rupiah to equal one U.S. dollar and Indonesia was forced to create a 100,000- rupiah note the following year.

The good news is things haven’t gotten worse since then, though that provides little consolation to many older Indonesians who experienced the events we just outlined.

It’s also easy to think that what has happened in Indonesia is unique, but nothing could be further from the truth.

You can find similar stories throughout history.

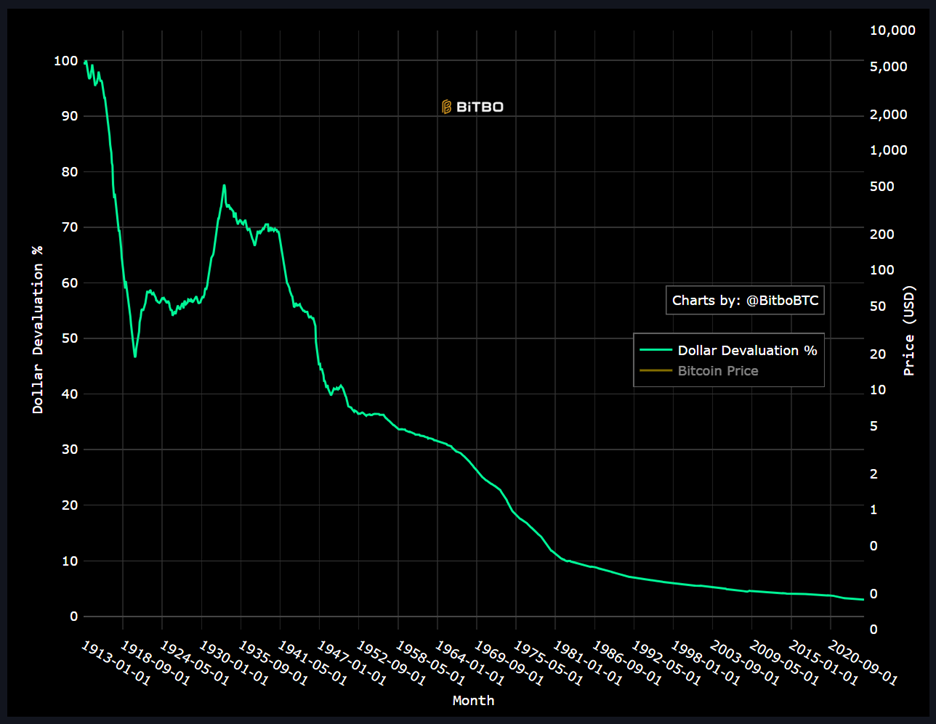

In fact, most people don’t realize just how much purchasing power the U.S. dollar has already lost over time.

Even using the government’s own manipulated numbers, something that cost $100 in 2000 now costs $191.

That means our money has lost about half of its value over the last 25 years.

If you go back to the start of the Federal Reserve in 1913, something that was $100 back then currently costs $3,296.

In other words, the U.S. dollar really hasn’t held up THAT much better than the Indonesian rupiah!

We just don’t see its decline printed on the face of our bills.

And given the U.S. government’s continually growing pile of debt, we can no longer rule out the possibility of an even bigger monetary crisis someday in the future.

Bottom line: Whether you live in Indonesia … the United States … or anywhere else in the world …

It’s crucial that you continue investing in a wide range of assets to protect your buying power and keep your relative wealth growing over time.

Whether it’s apparent or not, the reality is that EVERY government-backed monetary system in history has followed the same path over time.

Only the rates of the declines vary.

Best wishes,

Nilus Mattive

P.S. But the ever-creeping impact of inflation isn’t the only worry I have about the U.S. government’s fiat currency.

In fact, I recently worked with Dr. Martin Weiss on six steps you can take to protect yourself in times of chaos … like right now.