|

| By Sean Brodrick |

America’s economy is growing at a pretty good clip. The Atlanta Fed GDPNow model estimate for real gross domestic product growth in Q1 of 2023 is 2.8%.

Not too long ago, it was negative. Meanwhile, unemployment remains near five-decade lows. And workers are asking for — and getting — higher wages.

That’s all good news. So, why am I so worried?

I’ll tell you why: The Federal Reserve is creeping me out. This group of gray suits is fixated on inflation. Mind you, inflation is well off the 9.1% it hit last year, but the Consumer Price Index was still running at an annualized 6.4% in January.

This sent steam blowing out of the ears of Fed members, because they want inflation around 2%.

At the last meeting of the Fed’s Open Market Committee, which ended on Feb. 1, members voted unanimously to raise the federal funds rate by 25 basis points to a range of 4.5%–4.75%. But some argued for a 50 bps hike.

Then the latest core Personal Consumption Expenditures data came out last Friday. The Fed watches this very closely, and it also came out hot at 4.7%.

So, no matter which number you follow — CPI or PCE — inflation is too hot for the Fed. Now, some Fed watchers say the next move by the Fed could be a hike of 50 bps. And it won’t stop there.

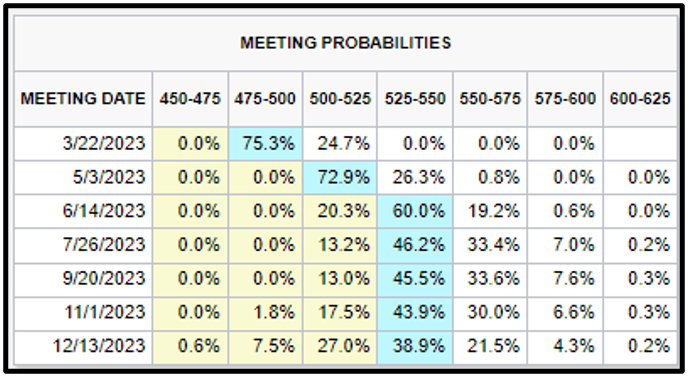

As a result, traders are moving their bets on how high the Fed will eventually raise rates. On the table below, most traders expect the Fed’s benchmark interest rate to be at least 75 bps higher by June.

Click here to see full-sized image.

What about the havoc higher rates are already causing in real estate? We’ve seen home sales plummet and new home starts crater because buyers are priced out by higher rates. The Fed does not care.

What about the car market, where consumers are getting slapped with high-interest car loans that keep climbing, thanks to commodity inflation? The Fed does not care.

What about the fact that inflation has many sources, and those the Fed can tamp down with higher rates are only part of the problem? The Fed does not care about that, either.

Here's a side note about inflation: While I believe the Fed has taken its inflation obsession a bit too far and at the cost of the economy, I also know that it’s still not behind us. Inflation comes in waves, and we've just seen the first swell. On March 9 at the MoneyShow Virtual Expo, I explain why inflation is going to heat up again and will give you my best picks in energy and metals to play the next wave. Click here to sign up now.

You see, in its monomaniacal focus on inflation, the Fed is willing to raise rates higher and higher! The scary part is the rising risk that the market hasn’t priced in just how high the Fed will go. That the 5.5% forecast for June might only be a signpost on the road to even higher interest rates.

I will be blunt: My biggest fear is that the Fed doesn’t care what damage it does to the economy as long as inflation comes down.

And that means three things:

1. Companies that need to roll over or refinance debt are going to be up the creek if interest rates rise and earnings come down. Plus, S&P 500 earnings are forecast to fall 4.3% this quarter. As rates go higher, we could see well-known names hit the rocks.

2. At some point, higher interest rates will gum up the works in the economy. The Fed is putting us on the path to a recession … or worse.

3. Put the first two together, and we could see a big sell-off in the broad market.

Now do you see why I’m worried? So, what to do?

First, you can protect your portfolio at least partially with put options and inverse ETFs — by that, I mean funds that are designed to go up as the market goes down.

And if you’re looking for a way to keep your money safe, I can tell you what I’m doing with mine. I’m buying U.S. Treasurys.

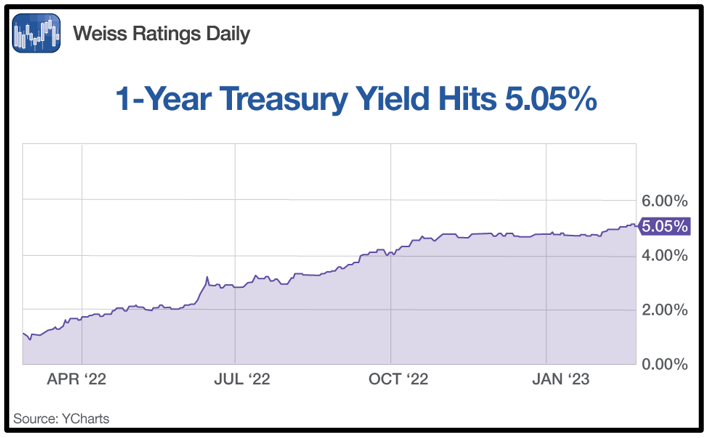

Yep, dull, boring Treasurys. Here’s the thing, though. Thanks to the Fed’s relentless rate hikes, there are now 1-year Treasuries that yield over 5%. That's higher than the long-term average of 2.87% and 4.5 times what it was a year ago.

Click here to see full-sized image.

I believe this is part of what is weighing on the market: Big investors are pulling money out of stocks and putting it in 1-year Treasurys, because a 5% yield over a year looks pretty darned good right now.

And yes, that’s lower than inflation. But you know what? Inflation is probably coming down, even if the Fed has to break the economy to do it.

Heck, under the circumstances, a 1-year Treasury looks very good to me. That’s why I just bought some.

I bought my 1-year Treasurys though my broker, Fidelity. Your broker probably offers pretty much the same thing.

Or you can buy Treasury bills — as well as notes and other government bonds — through TreasuryDirect.com. I set up an account on there in 10 minutes. But I’m not tech savvy, so you can probably do it in less time.

After weighing the options, I went with Fidelity because of the ease of keeping my investments in one place. But I may buy from TreasuryDirect in the future.

What about bond ETFs? Some look good. I like the U.S. Treasury 3 Month Bill ETF (TBIL). It’s liquid and it pays distributions monthly. I also like the iShares Short Maturity Bond ETF (NEAR), which also pays monthly distributions.

Finally, I like the iShares iBonds 2024 Term High Yield and Income ETF (IBHD). This fund is another monthly payer, and the interest rate on iBonds are adjusted for inflation every six months.

The bottom line is there is nothing written in stone that says the Fed must wreck the economy. But the odds of the Fed causing serious damage are rising with every rate hike.

Under the circumstances, you may want to get some protection and hedge your bets. And the high yields on Treasurys offer you a way to do it.

All the best,

Sean

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.