|

| By Gavin Magor |

The market sits just below its all-time highs.

But with the S&P 500 being a market-cap-weighted index, you have to take its performance with a grain of salt.

That’s because nearly half of the broad-market index’s run-up came courtesy of just seven “Magnificent” stocks.

That is, Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Alphabet (GOOGL), Meta Platforms (META) and Tesla (TSLA).

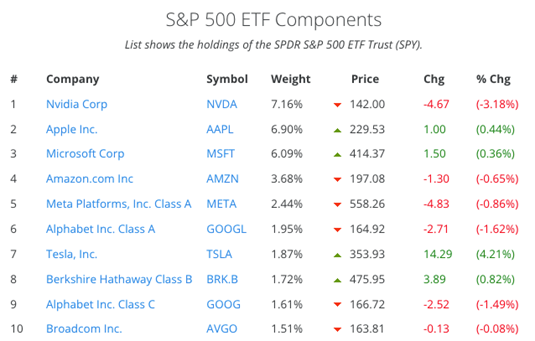

It’s pretty remarkable when you break it down and look at their recent weightings.

We’re talking about NVDA having a 7.2% weighting, Apple at 6.9% and MSFT at 6%.

So, it’s no wonder why all eyes were on Nvidia’s latest earnings announcement last week.

Ultimately, the company was able to further prove why it has the biggest market cap … and why it remains the behemoth among behemoths.

Both EPS and revenue handedly beat estimates. Yet, Wall Street was underwhelmed, with the stock gaining just 1.8% on the week.

In other words, analysts already expected the company to do well.

But is Nvidia — or any of the other behemoths — a buy right now?

After a few easy clicks, I was able to find that answer on the Weiss Stock Screener page.

‘B’ Stands for ‘Buy the Biggest Names’

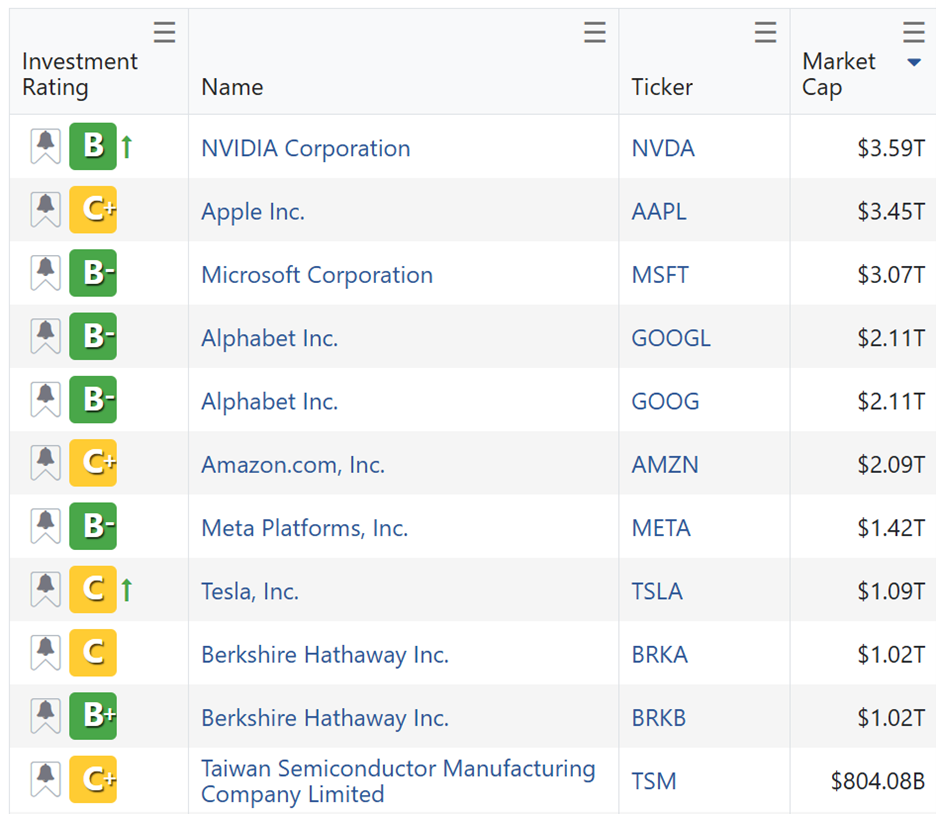

Here are the top 11 names that populated for me, in descending market-cap order:

As you can see, there are no “A”-rated names; only six of them are “Buy” rated, and the other five are all “C” or “Holds.”

You can also see a little green arrow next to two of the names, Nvidia and Tesla. The green arrow indicates that they recently received an upgrade in the Weiss Ratings universe.

This is what ultimately speaks volumes to me.

Upgrades are nice. Especially when that puts a stock into the “B,” or “Buy,” zone.

However, I am able to see that, despite their large sizes, five of these stocks are still just “Holds.”

I certainly would advocate for you to consider some of the market’s largest blue chips for your portfolio. But be sure to pick the right ones.

I also recommend exposure to the broader market through ETFs. You can do your own research on those here.

That’s your call depending on your own personal investing strategy. But for me, having broad exposure is important.

And in the process of doing my research, I always have the power of the Weiss Ratings on my side.

And you should too. I would also recommend you take …

A Look ‘Beyond AI’

My colleague Michael A. Robinson is a Silicon Valley insider who’s been on the boards of venture capital firms. If you look up “brilliant” in the dictionary, his picture should come up.

He has spearheaded a study on what comes next for AI. Sure, we’re all watching Nvidia and the rest of the Mag 7. But for them to have success, they need a lot of help.

Fortunately, Michael knows where that help will come from. He lays it all out in his new presentation “Beyond AI.” Check it out here.

Lastly, I hope you have a wonderful Thanksgiving holiday later this week. I’m thankful for my family, health and incredible Weiss Ratings readers like you.

What are you grateful for this year? I’d love to know. You can tell me here.

Cheers!

Gavin