|

| By Nilus Mattive |

I’ve been writing about the markets professionally for 25 years now, and I have consistently recommended a very simple first step before any other investment action is taken …

Establish a healthy cash cushion that remains readily available for emergencies or other unforeseen circumstances.

You might think this is common sense and that everyone does it, but you’d be wrong.

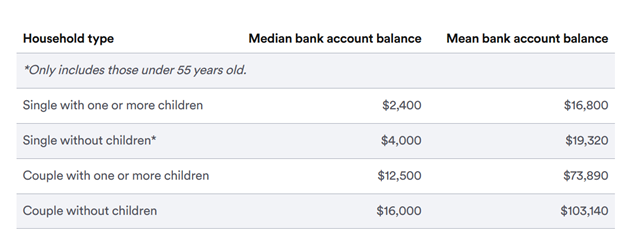

According to the latest data available from the Federal Reserve’s Survey of Consumer Finances, the median balance in “transaction accounts” — things like checking accounts designed for daily use — is $8,000.

That means half of these accounts have less than $8,000 and half have more.

That statistic is problematic enough because it means many Americans wouldn’t be able to cover even a month or two of their daily living expenses if something catastrophic happened.

When you dig deeper, things get even more dire.

According to Bankrate’s 2025 Emergency Savings report, roughly 59% of American households are uncomfortable with their emergency savings and say they wouldn’t be able to cover an unanticipated expense of $1,000.

About a third have more money in credit card debt than in emergency savings in the bank.

And 19% — almost one in five — have no emergency savings at all.

Hopefully you are already way ahead of the pack. If not, now is the time to start righting your financial ship.

Start with a list of all your regular expenses.

Look for any areas that are non-essential or that can be reduced through basic substitutions.

Take the difference and start socking it away.

Any step in the right direction — no matter how small — is a good one.

And frankly, this is an exercise that we should all take from time to time anyway, even if we already feel fairly secure in our finances.

Having a big cash cushion not only brings tremendous peace of mind. It also offers more opportunity and more freedom.

This is why I also recommend keeping a separate cash allocation inside an investing portfolio as well.

Of course, at today’s interest rates, it’s entirely possible to make a decent return for doing so.

That’s a luxury we haven’t had for most of the 2000s!

Which begs the question — where are the best places to park your cash now?

For liquid emergency funds outside of investment portfolios, I recommend both physical cash and standard savings accounts insured by either the FDIC or the NCUA.

The former won’t earn you any interest, and it carries some risk of loss or theft.

But it’s the only way to be truly prepared for a major emergency — an event that forces you to leave home in a hurry, closes local banks, disrupts the power grid, etc.

As far as the latter, make sure you park your money at an institution that isn’t gouging you with fees.

Also make sure it’s offering a competitive interest rate because plenty of banks and credit unions are still paying far less than they should be.

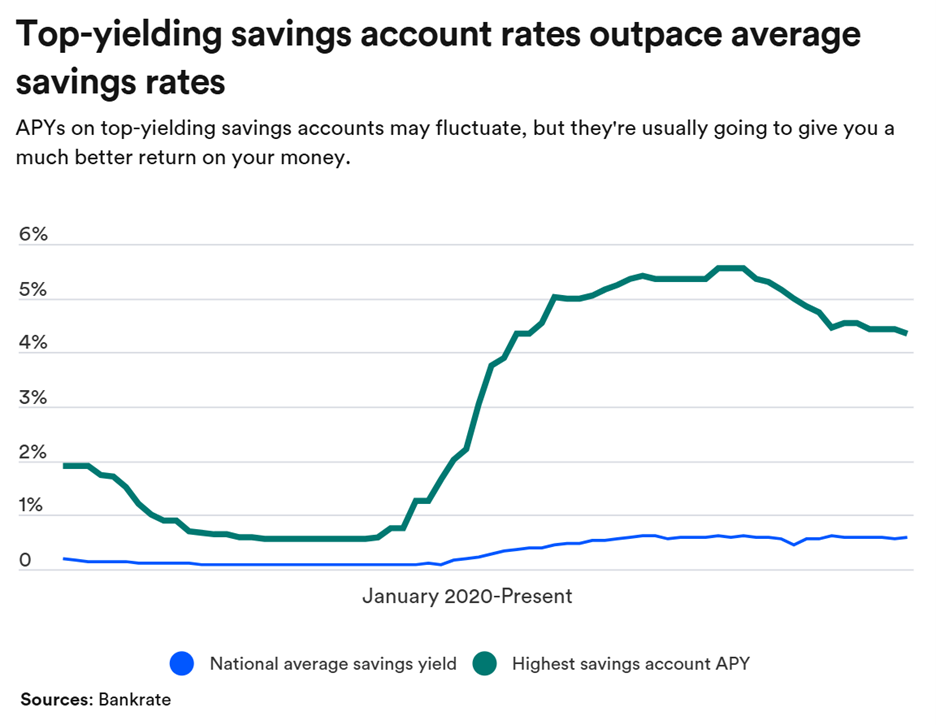

In fact, according to Bankrate’s latest survey, the average savings account in the United States is paying just 0.59% interest right now!

So, check to see if you can open a high-yield savings account.

When it comes to cash equivalents inside brokerage accounts, you have a few major choices.

While certificates of deposit, or CDs, are a valid component of a balanced investment portfolio, they’re probably not the best call for a true “cash” position.

That’s because many CDs impose early withdrawal penalties.

Money market funds are another option. Many are currently providing yields in the range of 4%.

What about a brokerage’s sweep account?

It depends …

In some cases, brokers are still providing extremely low returns to investors while pocketing the majority of the interest for themselves.

In other cases, they are offering competitive rates or seamlessly moving cash balances into accounts at partner banks — often getting you higher yields plus FDIC insurance in the process.

Last but certainly not least, there are now investment vehicles expressly designed to serve as short-term cash equivalents with generous yields.

For example, there are now ETFs focused on extremely short-term U.S. Treasury bills.

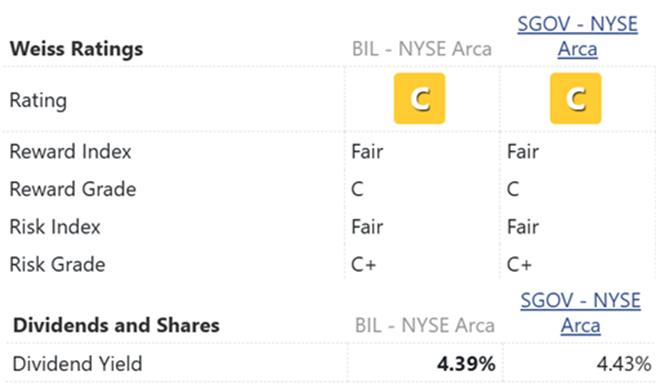

They include the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and one that I have been using extensively myself, the iShares 0-3 Month Treasury Bond ETF (SGOV).

A slightly more aggressive option is the JPMorgan Ultra-Short Income ETF (JPST).

It invests in things like short-term corporate securities, asset-backed securities, mortgage-backed and mortgage-related securities, as well as high-quality money market instruments such as commercial paper and certificates of deposit.

If you want to go just a bit farther out in terms of duration, you can also consider the iShares Short Treasury Bond ETF (SHV), which holds U.S. Treasury securities that have remaining maturities of up to one year.

From my perspective, the best overall approach is having a reasonable amount of cash on hand …

Another amount in a solid interest-bearing savings account …

And then one or more of the funds mentioned above in a brokerage account.

Of course, even if you have just one of those bases covered, you’ll be doing better than most Americans are right now.

Best wishes,

Nilus Mattive

P.S. Keeping some cash in your brokerage account — through short-duration Treasury ETFs, money market funds or just plain cash — is more important than ever.

We recently uncovered a 100-year-old investment secret that is signaling a radical shift in the stock market.

Where to get that cash? We can help there, too.

Along with this secret, you’ll get a full list of stocks you should dump immediately.

Plus, if you watch to the end, you’ll also get the ticker symbols of three little-known firms ready to surge as soon as this event hits.