|

| By Jon Markman |

Artificial intelligence is going to multiply corporate profits, yet not in the way most economists are currently predicting.

Executives at Amazon.com (AMZN) announced last week the demolition of nine Virginia office towers. The online retailer will ultimately use the space to build new, state-of-the-art data centers.

And it’s now time for investors to buy Amazon.com shares. Let me explain …

Blue-collar America has been under siege for decades. Automation, then offshoring gutted domestic manufacturing payrolls. At its peak in 1979, the manufacturing sector accounted for 22% of all American jobs, according to data from the Bureau of Labor Statistics.

In 2020, the National Association of Manufacturers noted that number shrank to only 8.6%.

It’s not all bad.

The average manufacturing worker in the 1960s produced approximately $40,000 of output annually. Yearly output per worker today is above $200,000 and rising. Operations that used to require teams of workers are now completed by two or three people with computers and robots.

This automation means:

- Lower prices.

- More consistent quality for consumers.

- Greater efficiency.

- And better profitability for corporations and their shareholders.

Doing more with less is what economists call productivity, the great wealth creator.

AI is now bringing the productivity to knowledge work. This is exactly what I’ve been stressing to members of my service, Disruptors & Dominators, which is now laser-focused on preparing investors for the looming gold rush in AI.

McKinsey, the global business consulting firm, studied 63 AI use cases across 16 business functions. Researchers concluded that AI’s total economic impact could be between 7.1 trillion and $26.5 trillion, and that the biggest beneficiaries would be sales, marketing and software engineering.

It makes sense. Intelligent AI chatbots are indistinguishable from humans. The software even seems to think like humans, drawing logical conclusions and solving problems rationally. This makes AI chatbots the perfect tool to streamline customer support operations.

Analysts at McKinsey believe the natural ebb and flow of interaction with these chatbots will lead to greater customer self-service and more resolutions during the initial contact. Productivity should grow 30%–45%.

AI software engineering will be a game-changer, too.

ChatGPT is best known for generating convincing responses to user prompts. However, the software platform, and a growing list of others, is capable of writing working software code from nothing more than a natural language prompt. Type what you want the code to do in plain English, and the chatbot spits out the code, ready to use.

Earlier this month, Matt Shumer, the founder of OthersideAI, told the Financial Times that AI has profoundly changed the role of software engineers. His team now focuses on defining the problem, designing structure and then directing AI to do all the heavy lifting. OthersideAI is capable of doing much more with far fewer coders.

Amazon.com demolishing office towers to build data centers makes so much sense. The future of the Seattle-based company is in data centers, not office towers.

Like many big technology companies, Amazon.com expanded during the pandemic at breakneck pace. Executives used soaring sales in 2020–2021 to drastically grow the business, often competing fiercely with Apple (AAPL), Alphabet (GOOGL) and Meta Platforms (META) for top engineering and managerial talent.

Big Tech companies began in January to reverse this trend.

All of the largest firms except Apple announced layoffs. Some firms put into place hiring freezes for the foreseeable future to cope with slower enterprise spending. This is likely a ruse, though.

Big Tech doesn’t need as many software engineers. Using generative AI, they can do more with less. The white-collar world is beginning a productivity boom not seen since the 1970s when so many blue-collar jobs were wiped out. Those jobs never came back.

Amazon.com is in a perfect position. Its mammoth online retail business is ripe for AI chatbot deployment. And its white-collar operations, including the AWS cloud services business will benefit from software generative AI.

This is especially pertinent given that CEO Andy Jassy has committed to cut costs and make the firm more profitable.

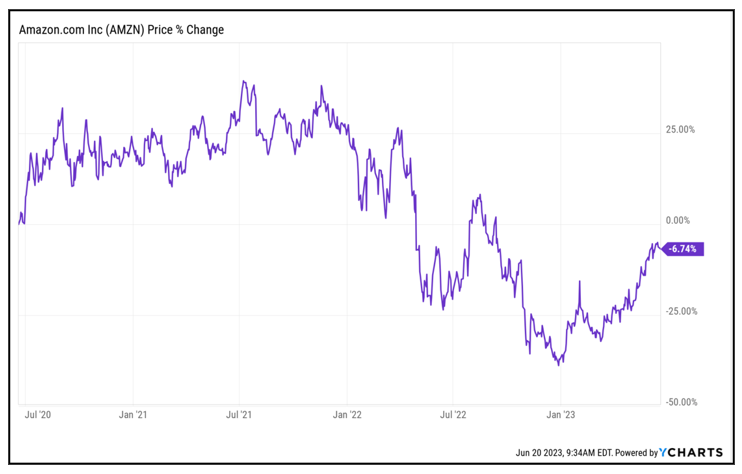

Click here to see full-sized image.

At a share price of $127.90 at the time of writing, Amazon trades at a very high 304.67 price to earnings ratio. More importantly, the stock price is badly lagging its big technology peers. Amazon.com shares traded near 90 as recently as December 2022.

Conduct your own due diligence, but investors should use weakness to buy Amazon.com.

Thanks for reading,

Jon D. Markman