|

| By Gavin Magor |

Are you following the big money?

By “big money,” I’m talking about institutional investing dollars.

Investors certainly don’t need to watch every move the markets make ... but keeping a close eye on institutional inflows and outflows can mean the difference between spotting or missing a trend.

Not to say that the retail investors of the world don’t influence the markets when we buy or sell a stock. We do.

It’s just that if you compare investments by institutions, we’re talking about the difference between mountains and molehills.

Average retail investors can only shovel a few mounds of dirt at a time. But the collective wealth and minds behind pension funds, retirement funds, mutual funds and insurance companies that comprise “big money” typically have a much stronger overall influence on the market.

They are the institutional investors, and we are the retail investors.

Obviously, the actual capital they’re sinking into stocks is the primary driver. However, it’s also very much about their access to technical resources, expertise and sophisticated strategies.

Because the people behind institutional investing use the fastest computers, in conjunction with the most sensitive algorithms, they hear about news before us and make trades quicker than us.

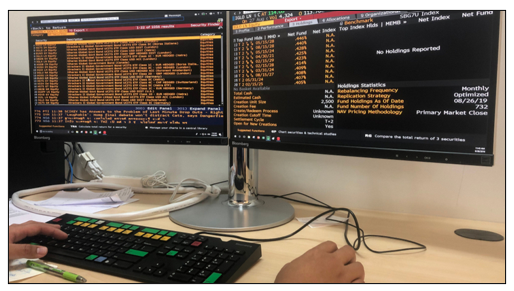

One example is the Bloomberg Terminal. It’s a software system that allows users to access pivotal real-time data. The kicker? It costs $20,000 to $25,000 per year per user.

That’s a hefty price tag that allows it to only be used by a select few. It is certainly one example of how much of a leg-up professional traders have.

Institutional investors have everything they need at their fingertips, including the influence-to-influence corporate decisions and trends, to facilitate even long-term shifts in the market.

These are the people who get laws passed, influence the waging of wars and spend big money to use the media to shape views.

Watch what they're doing, and you'll know the long-term picture … that is, the picture over months to years.

So, this group is a combination of those who know for certain what is going to happen in the future … and those who have a very good idea of it.

They don't have this knowledge because of their rare genius … or because they have PhDs in astrology. They know what they know because of who they know.

These are the guys who have the President of the New York Fed on speed dial. Scan pictures of White House ceremonies or the Met Gala, and you're likely to see their faces in the crowd.

They manage hundreds of billions or even trillions of dollars. And they pay many millions of dollars for their research. They work exclusively with the biggest, most intelligent players who know what’s going to happen next.

Most retail investors rely on personal research and financial guidance. Retail investors can impact market sentiment and trading volumes on a short-term basis ... but they lack the firepower to actually alter the landscape.

And that’s just fine because retail investors can watch what they’re doing.

From that perspective, they have a whole lot more to gain from the institutions than the other way around. Many retail investors tend to trade based on the news … or what analysts and the media say.

Institutions spend millions of dollars researching fundamental economic shifts that prompt them to move in and out of entire sectors. Because these moves are often done collectively, institutions can kickstart a trend … then buy stocks that ride in its tailwind.

So can retail investors.

Retail Investors Should Follow the Big Money

Since they’ve got their fingers on the market’s pulse 24/7/365, I say, “If you can’t beat ‘em, join ‘em.” And the Weiss Ratings are the perfect way for retail investors to do just that.

That just means knowing where to find the percentage of institutional ownership of a stock and the inflows and outflows over a given period of time.

Every investor’s first destination, in my eyes, should be the Weiss Stock Ratings. But a great source for checking inflows and outflows of cash in a stock is with MarketBeat.

When you are looking at the inflows and outflows, I recommend you look for established trends or the marks of a new one.

You want to see that over a 12-month period, the inflows into a stock exceed the outflows. Or, if inflows lagged over six months, you’ll want to see if there’s been a short-term uptick in buys and a decrease in sells that could signal a positive trend.

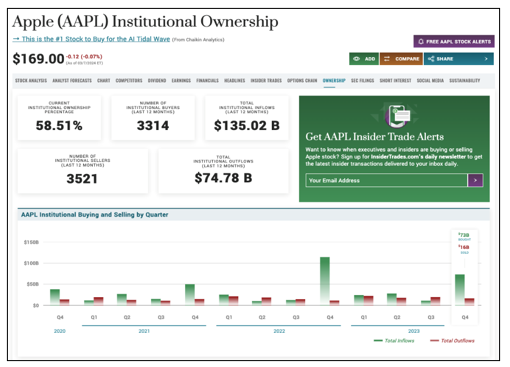

You can test this strategy by looking at the charts below on two of the largest stocks in the market in terms of market capitalization, Apple (AAPL) and Microsoft (MSFT).

As you can see in the above chart for Apple, total institutional inflows were $135.02 billion, versus the $74.78 billion in outflows over the past 12 months.

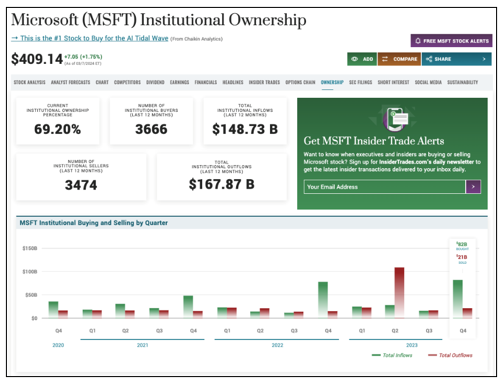

Now, let’s take a look at Microsoft:

Inflows for Microsoft are slightly below the amount of outflows. This is slightly bearish … and could be the signal of the stock being overbought. Typically, when you see far more inflows than outflows, it would be a bullish indicator. Not always, but typically that’s the case.

There’s clearly a link between institutional investing and the performance of stocks. Big money may move mountains, but retail investors can be smart enough to use their might to their advantage and spot trends early.

Smart Trends Spotted Very Early

And speaking of spotting trends early, my colleague Chris Graebe has made incredible strides in startup and pre-public company investing. This is one area where retail investors can make a huge difference.

Chris is an expert in this space. He recently presented his favorite tech-based startup that is about to open up a round of new funding. I highly urge you not to miss this opportunity. Click here now.

Cheers!

Gavin Magor