|

| By Sean Brodrick |

I believe gold is starting a run that should take it over $2,900 an ounce … and maybe higher.

But I also know it’s worth getting a second opinion. When I was at the New Orleans Investment Conference, I got that opinion from Rich Checkan, the president and COO of Asset Strategies International.

Rich has been in the gold business for a long time. He knows a LOT about how this business works … and what drives the metals.

In the interview video I’m sharing with you today, Rich goes over what he sees as the top drivers of precious metals, why he’s even more bullish on silver than gold and where he thinks the metals are headed.

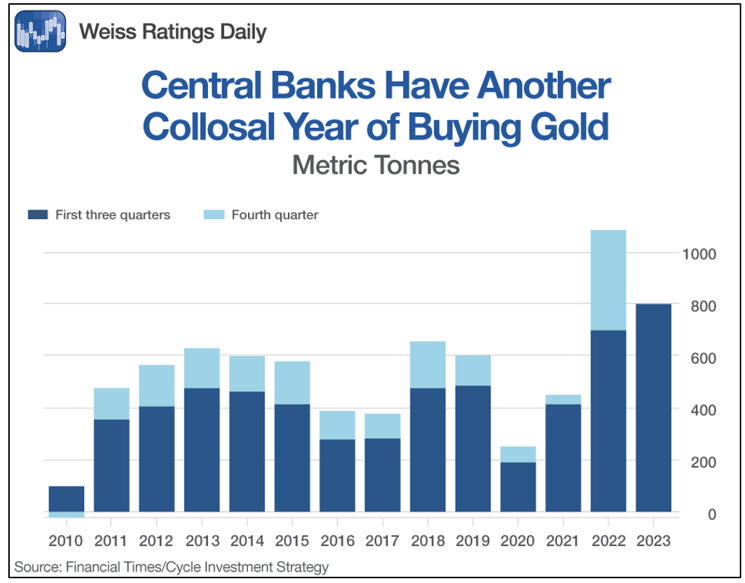

One of the first things that Rich mentioned was central bank gold buying. The year isn’t over yet, but we already know that central banks are buying the yellow metal hand over fist.

We won’t know until January, but central banks are on pace to buy even more gold than last year — and 2022 was a record year for central bank gold purchases. The largest increases have been in Turkey, China, Egypt and Qatar.

Turkey is buying more than China currently, but one thing to keep in mind is that China has a relatively low allocation to gold compared to other central banks. To me, this shows that China could buy a LOT more.

What’s driving this buying? Central banks around the world desperately want to diversify away from the U.S. dollar. That’s because Uncle Sam uses our currency like a cudgel to keep other countries in line, slapping sanctions on them when they break the rules we make.

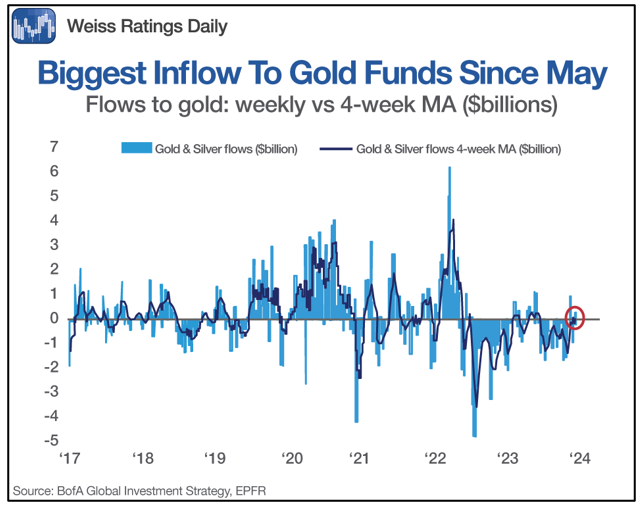

Rich also said that the big move in gold wasn’t here yet and that it would need a big influx of retail buyers. I have a chart on that, too …

Gold and silver funds like the SPDR Gold Shares ETF (GLD) and the iShares Silver Trust (SLV) just saw their biggest weekly inflow since May. This could be retail investors adding more gold exposure.

And that flow ain’t over. After all, there’s $5.76 TRILLION in cash held in money market funds right now. That’s because investors got scared by the recent pullback in stocks.

That pullback is over, and it’s likely some of that money will be put back to work. Much of it might go into stocks, but just a slice into gold and silver would send prices of those metals soaring.

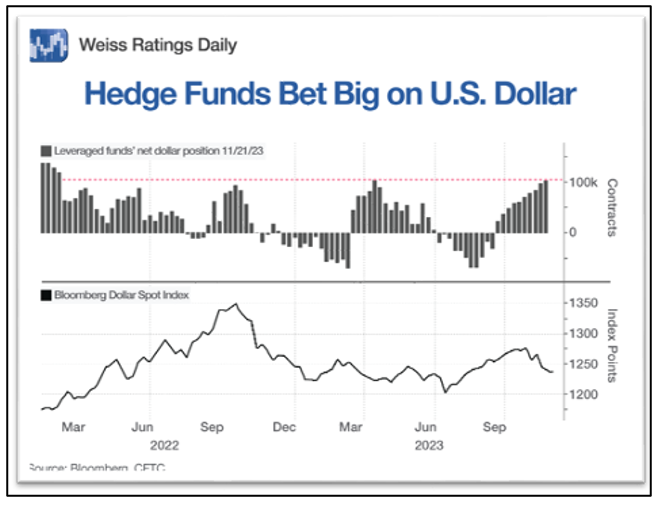

There is one more chart I want to share with you — something that didn’t come up in my conversation with Rich, but I believe it’s very important. Hedge funds have made historically high BULLISH bets on the U.S. dollar …

Hedge funds now have the largest long positions in the U.S. dollar since February 2022. When hedge funds get to an extreme position in something, that’s usually a sign that they’ve made too many one-way bets, and things will swing back the other way.

That’s important because gold and silver are priced in dollars. As the dollar goes down, the metals usually go up.

So, add it all up, and yes, I believe we’re going to $2,900 in gold. And we could go a lot higher.

All the best,

Sean

P.S. You might recall, I started pounding the drum on this gold trend about a month ago. In my Resource Trader, I’ve done more than that. I’ve shared several specific mining stocks in the best position to take advantage. You can join us and check them out by clicking here.